1Q 2020 real estate statistics released by URA shows price decrease compared to previous quarter

The Urban Redevelopment Authority (URA) released today the real estate statistics for 1st Quarter 2020. Private residential property prices in Singapore fell in Q1 2020, after rising for three straight quarters, due to the coronavirus (COVID-19) impact on the economy.

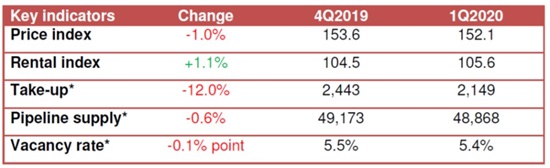

Final statistics from the Urban Redevelopment Authority of Singapore (URA) on Friday, 24 April, showed that private residential property prices fell by 1.0% quarter-on-quarter (QOQ) in Q1 2020, slightly better than the flash estimates of a 1.2% decline. This also compares to a 0.5% gain in the previous quarter and a 2.7% gain in full year 2019.

Prices of private residential properties have declined by 1.0% q-o-q, compared to the 0.5% increase in the previous quarter. This marks its first reversal after three consecutive quarters of growth. The decline in the overall price index was largely driven by both landed and non-landed properties which exhibited the same magnitude of decline.

PRIVATE RESIDENTIAL PROPERTIES

Private residential market 1Q 2020 real estate statistics at a glance:

Prices and Rentals in 1Q 2020 real estate statistics

Prices of private residential properties decreased by 1.0% in 1st Quarter 2020, compared with the 0.5% increase in the previous quarter.

Property Price Index of private residential properties

Prices of landed properties decreased by 0.9% in 1st Quarter 2020, compared with the 3.6% increase in the previous quarter. Prices of non-landed properties decreased by 1.0% in 1st Quarter 2020, compared with the 0.3% decrease in the previous quarter.

Prices of non-landed properties in Core Central Region (CCR) decreased by 2.2% in 1st Quarter 2020, compared with the 2.8% decrease in the previous quarter. Prices of non-landed properties in Rest of Central Region (RCR) decreased by 0.5%, compared with the 1.3% decrease in the previous quarter. Prices of non-landed properties in Outside Central Region (OCR) decreased by 0.4%, compared with the 2.8% increase in the previous quarter.

Rentals of private residential properties increased by 1.1% in 1st Quarter 2020, compared with the 1.0% decrease in the previous quarter.

Rental Index of private residential properties and 1Q 2020 real estate statistics

Rentals of landed properties decreased by 0.9% in 1st Quarter 2020, compared with the 1.6% decrease in the previous quarter. Rentals of non-landed properties increased by 1.3%, compared with the 0.9% decrease in the previous quarter.

Rentals of non-landed properties in CCR increased by 1.4%, compared with the 1.0% decrease in the previous quarter. Rentals in RCR increased by 0.6%, compared with the 0.7% decrease in the previous quarter. Rentals in OCR increased by 1.9%, compared with the 1.0% decrease in the previous quarter.

Launches and Take-up

Developers launched 2,093 uncompleted private residential units (excluding ECs) for sale in 1st Quarter 2020, compared with 2,226 units in the previous quarter.

Developers sold 2,149 private residential units (excluding ECs) in 1st Quarter 2020, compared with the 2,443 units sold in the previous quarter.

Number of private housing units launched and sold by developers (excluding ECs)

Developers launched 1,044 EC units for sale in 1st Quarter 2020, and sold 590 EC units in the quarter. In comparison, developers did not launch any EC units and sold 59 EC units in the previous quarter.

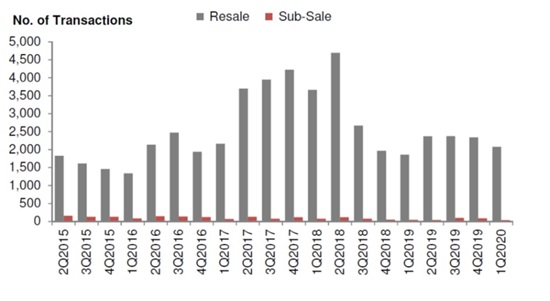

Resales and Sub-sales

There were 2,080 resale transactions in 1st Quarter 2020, compared with the 2,342 units transacted in the previous quarter. Resale transactions accounted for 48.7% of all sale transactions in 1st Quarter 2020, compared with 48.0% in the previous quarter.

There were 40 sub-sale transactions in 1st Quarter 2020, compared with the 93 units transacted in the previous quarter. Sub-sales accounted for 0.9% of all sale transactions in 1st Quarter 2020, compared with 1.9% in the previous quarter.

Number of resale and sub-sale transactions for private residential units (excluding ECs)

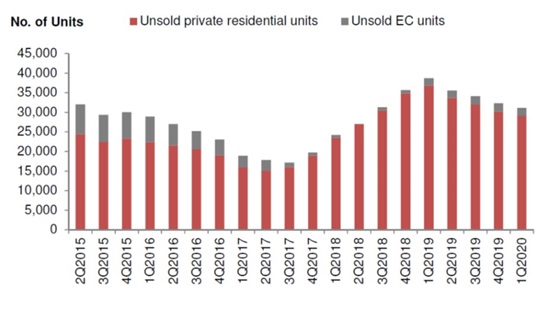

Supply in the Pipeline

As at the end of 1st Quarter 2020, there was a total supply of 48,868 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals3, compared with the 49,173 units in the previous quarter. Of this number, 29,149 units remained unsold as at the end of 1st Quarter 2020, compared with the 30,162 units in the previous quarter.

After adding the supply of 3,613 EC units in the pipeline, there were 52,481 units in the pipeline with planning approvals. Of the EC units in the pipeline, 1,950 units remained unsold. In total, 31,099 units with planning approvals (including ECs) remained unsold, down from 32,272 units in the previous quarter.

Total number of unsold private residential units in the pipeline

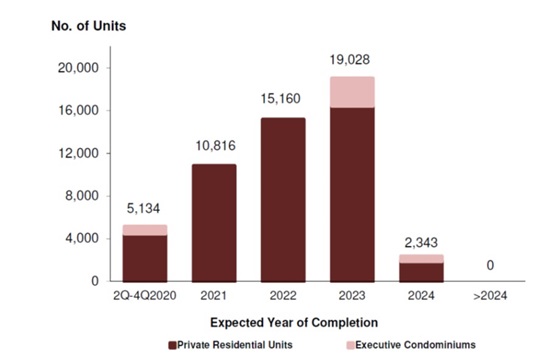

Based on the expected completion dates reported by developers, 5,134 units (including ECs) will be completed in the remaining 3 quarters of 2020. Another 10,816 units (including ECs) will be completed in 2021.

Pipeline supply of private residential units and ECs (with planning approvals) by expected year of completion

Apart from the 31,099 unsold units (including ECs) with planning approval as at the end of 1st Quarter 2020, there is a potential supply of around 4,100 units (including ECs) from Government Land Sales (GLS) sites that have not been granted planning approval yet.

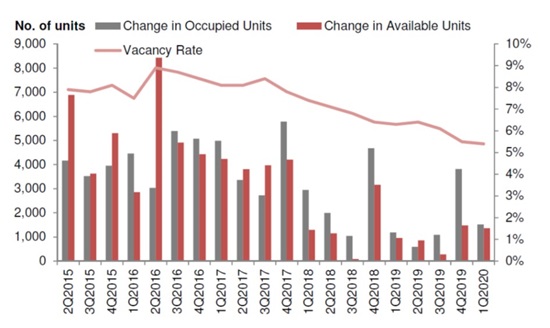

Stock and Vacancy

The stock of completed private residential units (excluding ECs) increased by 1,364 units in 1st Quarter 2020, compared with the increase of 1,476 units in the previous quarter. The stock of occupied private residential units (excluding ECs) increased by 1,521 units in 1st Quarter 2020, compared with the increase of 3,816 units in the previous quarter. As a result, the vacancy rate of completed private residential units (excluding ECs) decreased to 5.4% as at the end of 1st Quarter 2020, from 5.5% in the previous quarter.

Stock and vacancy of private residential units (excluding ECs)

Vacancy rates of completed private residential properties as at the end of 1st Quarter 2020 in CCR, RCR and OCR were 7.4%, 6.2% and 4.1% respectively, compared with the 6.9%, 5.8% and 4.7% in the previous quarter.