Basics of Home Loans Jargon

By iCompareLoan Editorial Team

Sample DBS Sample HSBC Sample Maybank Sample Standard Chartered

In this article, we seek to offer a simple overview of the features in a housing mortgage Letter of Offer.

What is a Letter of Offer?

Table of Contents

After application of a loan, the financing institution will send you a Letter of Offer – a contract that states the terms of the loan offered by the lender – if it approves of it. Typically, the first page will indicate the loan amount and duration of the loan. The subsequent pages, will detail the conditions of the loan, such as the mode of repayment, interest chargeable, penalty for early repayment, etc. Finally, towards the end of the letter, appended is the Acceptance Form which must be returned, duly signed and filled in, to the financing institution for the loan to be processed.

Jargon used differ

“What’s in a name? That which we call a rose

By any other name would smell as sweet.”

(Romeo and Juliet)

These eternal lines of Shakespeare rings true even in today’s context. Quite often, the jargon used by financing institutions varies, but they may mean the same thing. For instance, even the term used to call the loan amount, or the principal, can differ. In the Letter of Offer for Maybank, it is termed as the“loan quantum”; whereas for HSBC it is known as the “facility limit”. Or it can simply be called the “loan amount”, as for Standard Chartered. See excerpts below.

Sample Maybank, page 1

Sample HSBC, page 1

Sample Standard Chartered, page 1

Common mortgage packages available

There are several types of loan packages in the market today. Most differ in the interest structure and interest rates used. Existing loan types include the “Fixed Interest Rate Mortgage”, “Floating (Variable) Interest Rate Mortgage” ,“Interest-offset Mortgage”, “Cash Back (Cash Incentive) Mortgage”, “Combo/Hybrid Mortgage”and “Interest-only Mortgage” [Do note that interest-only mortgages for residential properties has been disallowed by MAS (Monetary Authority of Singapore – Singapore’s central bank) since14 Sep 2009]. The first three are the more popular ones, so we will deal with them in turn in this article. To read more about the others, go here.

Are the interest rates on fixed rate loans fixed?

Fixed rates loans have interest rates fixed for a limited tenure of the loan, in Singapore usually the first 2 or 3 years only. There are no known perpetual fixed rates in the Singapore’s market. The closest you can get is the HDB (Housing Development Board) concessionary loan which interest rate [set at 0.1% above the interest rate of the CPF (Central Provident Fund) ordinary account] can remain constant for long periods, although it is revised quarterly.

At the end of the fixed-rate tenure, the loan becomes a floating (variable) interest rate loan as the interest rates will be pegged below the financing institution’s Board Rate or floating rate, which is based on SIBOR or SOR. The Board Rate is a non-transparent interest rate, that is the cost of fund for the institution and a margin. The Board Rate and floating rate cause the variation in the interest amount. In Sample Maybank, page 2, the Board Rate is the Singapore Residential Financing Rate (SRFR). Here, after the initial 3 years, the rates are pegged at 1.15% below SRFR in the 4th and 5th year , and 0.50% below thereafter.

Sample Maybank, page 2

Understanding spreads and floating (variable) interest rate loans

Before 2007, housing loan packages are pegged to the financing institution’s Board Rate, but after a series of complaints by borrowers about the fluctuations and non-transparency in the interest rates, MAS tightened the regulations pertaining to mortgage interest rates. In 2007, MAS ruled that these rates must be transparent. Consequently, financial institutions introduced packages which interest rates are pegged to SIBOR (Singapore Interbank Offered Rate) or SOR (Singapore Swap Offer Rate). Both these rates are set by the Association of Banks in Singapore and are publicly available in the media, like The Business Times, among others. SIBOR is the interbank lending rate; whereas SOR is the lending costs and the expected forward exchange rate between the US dollar and Singapore dollar. Both have different tenors: 1-month, 3-month, 6-month, 9-month and 12-month. The volatility of the rate is usually inversely related to the tenor. Most housing loans here follow the 1-month or 3-month tenor.

Thus today’s floating (variable) interest rate loans come in three flavours:

- Interest rates pegged at a discount below the Board Rate

- Interest rates pegged at a margin above SIBOR

- Interest rates pegged at a margin above SOR

Financial institutions may not offer all three types.

The margin that the financing institutions add to the loan is called the spread. For example, for an interest rate of SIBOR + 1%, the +1% is the spread.

After the first few years of the loan start-date, the spread is usually revised upward. For instance in Sample DBS page 1, Sample Standard Chartered page 2 and Sample HSBC page 4; the spread increases from the fourth year onwards. These packages are pegged to the same 1-month SIBOR, but the revision period for each bank may differ. For Sample DBS, Sample Standard Chartered and Sample HSBC, the revision period is 3-month, 1-month and 1-month, respectively.

Sample Standard Chartered page 2

Features of interest-offset loans

Interest-offset loans are ideal for borrowers with substantial idle cash that can be left in a bank account. For this type of loan, a proportion of the deposit in the account will enjoy the same interest rate as that chargeable for the loan. Borrowers will then have the option of using the interest earned to pay for the interest of the loan. A case in point is for Sample Standard Chartered page 1-2, under the MortgageOne Facility, 2/3 of the deposit earns this special interest, with the rest earning the normal interest.

Sample Standard Chartered page 1-2

What is a Commitment Period or Lock-in Period?

The period in which full or partial repayment, that exceeds the agreed monthly amount, of the loan is subjected to a repayment fee (usually at most 1.5% of the redeemed amount) is known as the Commitment Period or Lock-in Period. The former can be found in Sample DBS page 2 and Sample Maybank page 2, while the latter can be found in Sample Standard Chartered page 5. This period commonly varies between 2 to 5 years.

Sample Maybank page 2

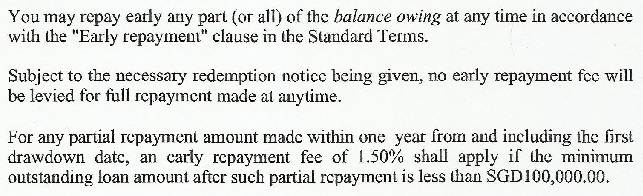

The repayment fee can be called a commitment fee, redemption fee, partial redemption fee or prepayment fee. In some cases, full or partial redemption may incur zero penalty. This is also termed an open term mortgage. See Sample Standard Chartered, for one such example:

Sample Standard Chartered page 5

In some instances, no terminology will be given to the commitment period. The Letter of Offer simply states that any early full or partial repayment may or may not incur a repayment fee. As seen in Sample HSBC page 4:

Sample HSBC page 4

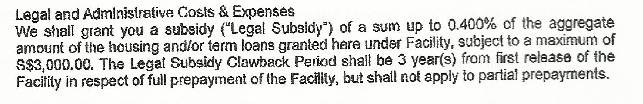

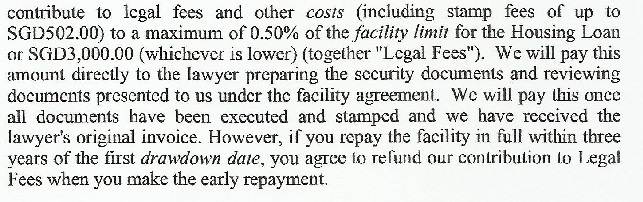

What is a Clawback Period or Reimbursement Period?

The Clawback Period or Reimbursement Period is the period (typically the first 3 years) when full redemption of the loan is subjected to a refund of $2,000 to $3,000 worth of freebies given; such as legal and administrative expenses, valuation and insurance premiums. See Sample DBS page 4 for an example of the Clawback Period and Sample Standard Chartered page 5 for the Reimbursement Period.

Sample DBS page 4

In some instances, no terminology will be given to this period. The financing institution simply explains that an early repayment will incur a refund of perks. As seen in Sample HSBC page 2.

Sample HSBC page 2

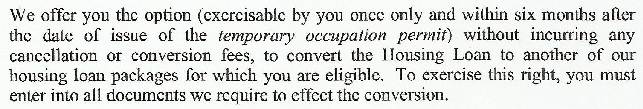

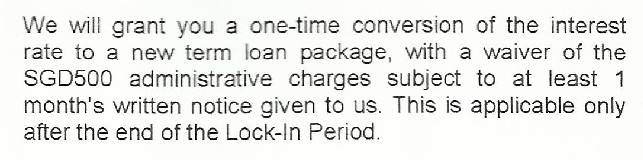

What is a Conversion?

Some loan packages offer the borrower a free one-time option of converting their package into another, or a new term package. See the following examples:

Sample HSBC page 3

Sample Standard Charted page 8

To wrap things up, …

If you are confused by the myriad of jargon and conditions, our consultants will be most happy to help you examine the Letter of Offer, using a layman approach, as part of our added service. (Disclaimer: If in doubt, you should always check with a lawyer and NOT hold our consultants accountable for any loss whatsoever, arising from our advice.)

For advice on a new home loan.

For refinancing advice.

Download this article here.

References

1. BTINVEST, “Understanding Housing Loans and Mortgages”, Web

< http://www.btinvest.com.sg/personal_finance/home-loan/understanding-housing-loans-and-mortgages/ >

2. HDB, “What To Note”, Web

<http://www.hdb.gov.sg/fi10/fi10321p.nsf/w/HLHDBWhat?OpenDocument>

3. Maybank, “ONE Home Loan Board Rate”, Web

< http://info.maybank2u.com.sg/personal/loans/property-loans/single-board-rate.aspx >