Budget 2020 initiatives should help the property sector says Colliers International’s new research

Colliers International on Feb 26 published a new research report that assesses the impact of the COVID-19 outbreak on the Singapore real estate market and outlines key recommendations for various property sectors drawing references from the market performance during the SARS (Severe Acute Respiratory Syndrome) outbreak in 2003.

Since the announcement of the first case of novel coronavirus (officially known as COVID-19) case in Singapore on 23 January, more cases have been detected due in part to the government’s robust containment efforts and contact tracing capability. The Disease Outbreak Response System Condition (DORSCON) alert level was raised to Orange on 7 February following the detection of a few local cases without any links to previous cases or travel history to China.

Of note, Singapore did not have a large number of infections (91 as at Feb 25) by comparison, and more than half of the patients (58 as at Feb 25) have been discharged from the hospital, according to the Ministry of Health.

Tricia Song, Head of Research for Singapore at Colliers International, said, “On top of its efficient containment measures, the Singapore government has also announced a SGD4 billion package in the recent Budget 2020 to help sectors most affected by the COVID-19 outbreak to tide over this difficult period. While there are near-term risks on the property sector, we believe the strong response to the outbreak will support market confidence and help pave the way for the eventual rebound in market performance. Assuming the COVID-19 outbreak runs its course by June this year, we estimate that certain property sectors, such as investment sales and office leasing, could see rapid recovery in the second half of 2020.”

Budget 2020 initiatives and COVID-19 measures

Table of Contents

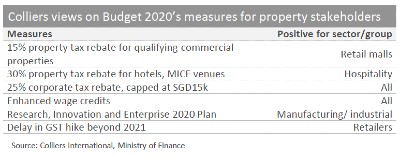

The Singapore government has on 18 February 2020 unveiled a slew of measures that will help the country deal with the COVID-19 outbreak, as well as address longer-term global challenges and structural shifts. Among the measures, a SGD4 billion Stabilisation and Support Package was introduced to provide assurance and support to workers and enterprises in this time of economic uncertainty. The sectors that are more directly affected by the outbreak will receive additional support.

Apart from the COVID-19 targeted measures, Colliers Research believes that initiatives to support research and innovation, as well as the postponing the increase in Goods and Services Tax (GST) beyond 2021 should help the property sector.

Budget 2020 initiatives and COVID-19 Measures vs Impact of SARS on real estate market in 2003

Singapore’s economy also took a beating from the SARS outbreak in 2003, with a 0.3% year-on-year (YOY) contraction in Q2, at the height of the epidemic. However, the economy rebounded in Q3 and Q4 of the same year, with respective growths of 5.3% and 8.9% YOY, bringing full year GDP growth to 4.5% in 2003. The growth momentum continued in 2004 where Singapore’s GDP grew by 9.9%.

Meanwhile, Singapore’s property market – which was already declining prior to the SARS outbreak, having been hit by the dot-com buble in 2001, Iraq War in 2003 and an office supply boom between 2002 and 2003 – continued to bottom out in 2003. In particular, rents and prices of the office, retail, and industrial properties eased in the first half of 2003. However, they all recovered by the end of 2004: office rents were up by 3.5%; retail rents recovered by 3.7%; and industrial rents climbed by 1.5%.

Budget 2020 initiatives especially helpful because of Chinese economy’s impact

“As the Chinese economy accounts for a much larger proportion of the global economy than in 2003, the impact on Singapore’s economy is likely to be more severe this time. Comparing COVID-19 with SARS in 2003, we assume the COVID-19 crisis will peak in H1 2020. However, with the recent spread of the virus beyond East Asia, there is an increased possibility of a negative scenario in which disruption persists into H2 2020. The Singaporean government announced a SGD4 billion stimulus package in 2020, compared to the SGD230 million off-budget SARS relief package in April 2003. Offbudget measures could be implemented should the current rebates be Office, Retail and Industrial Price Index deemed insufficient given the uncertain impact of the virus outbreak.”

Real estate investment sales registered quarter-on-quarter declines of 63% in Q1 and 5% in Q2 2003, as the SARS outbreak dampened investors’ confidence. However, transactions mounted a strong comeback across most sectors in the second half of 2003, taking overall real estate investment sales to SGD3.2 billion, up by 29% YOY.

Ms. Song added, “Drawing parallels to SARS in 2003, we expect some negative impact on occupancy and rents in the first half of the year, but most could recover in the latter part of 2020. We believe this crisis presents both threats and opportunities: retailers should take this downtime to accelerate technology adoption and offline-to-online strategies; industrial landlords could upgrade assets and improve processes; and investors should hunt for opportunities that may emerge from this crisis.”

Forecasts and recommendations for 2020

Colliers Research is monitoring the evolving situation closely and is maintaining its forecasts for the various property sectors for now. It has made the following recommendations:

- Office: Occupiers to rationalise their real space requirements and accelerate technology adoption. Colliers recommends that they consider a Flex-and-CoreTM strategy or split office locations, and wellness certified buildings.

- Retailers: To take this opportunity to work with landlords to bridge the offline-to-online gap, and landlords, as well as lining up marketing campaigns to recapture shoppers, post-epidemic.

- Industrialists and landlords: To use this downtime to upgrade assets to align with Industry 4.0. The crisis clearly highlighted the importance of efficient inventory and last-mile management process for warehouses.

- Investment: Sales could be weak in H1 2020, but could see a rapid recovery in H2, going by SARS experience in 2003. Investors should focus on long term drivers, which remain most attractive for hotels and office assets.