Buying a condominium is a very big commitment. How do you feel less financially stretched with buying a new home? How to make buying a condominium a less stretched exercise?

There are several reasons why people buying their first home feels financial stretched.

- They have high aspirations and are aiming for a property that is too expensive.

- The property prices have really gone crazy, they are being squeezed out of the market place.

- They are fairly junior in their careers and have insufficient savings and income yet.

Image Credits: Paul Ho, iCompareLoan.com

Government policies and micro levers favour higher private property per square feet prices. Such as when MSR is set at 30% of monthly income for HDB flats, impeding HDB flat purchases whilst young people buying condominiums due to TDSR at 60% can get a bigger loan, driving up prices of smaller units. It is all for land price appreciation.

If you are unsure, you can always check with a mortgage broker such as iCompareLoan.com who will give you the low down on the housing affordability. If you are ready to buy click on this to find the best home loans in Singapore.

https://www.icompareloan.com/resources/property-prices/

How much does it take to save for buying a condominium property?

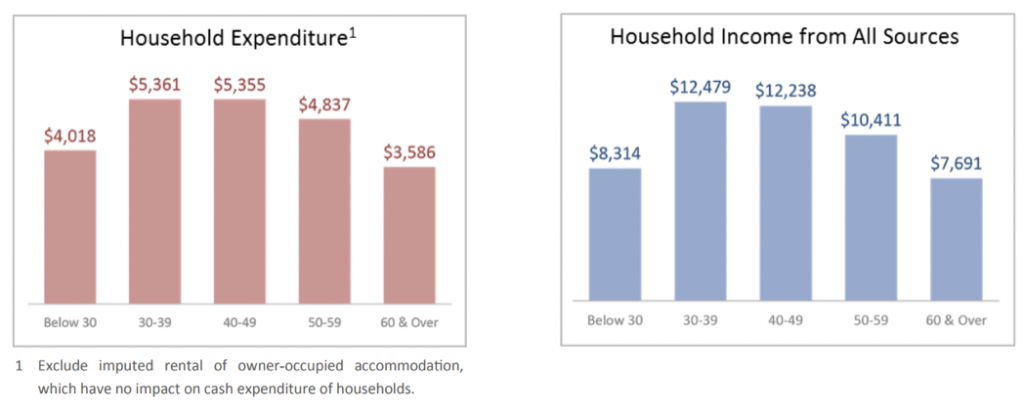

According to a Singstat survey (Household spending by age group) in 2012/2013, households below 30 spends around $4,018 per month, while they have an income of $8,314.

https://www.singstat.gov.sg/-/media/files/publications/households/ssnsep16-pg10-13.pdf

Based on Singstat definition, households does not mean that they already own a house. As long as a couple is married, even if they stay in the same house with their parents, and as long as they have “Separate meal arrangements with their parents”, there can be one house and 2 households. (Father and Mother = 1 household, Son and Daughter-in-law = 2nd Household)

So these spending patterns from Singstats are blended between those that already own a property and those that do not.

Hence it would make sense to say that the average couple below 30 years old and who have not yet bought any property could be spending less than $4,018 a month and accumulate savings.

Saving for buying a Condominium property

For people who have yet to find a girlfriend or a boyfriend, you may want to start an endowment plan that is shorter in tenure, say 3 to 5 years. Don’t start to save when you find that perfect one, do it earlier as you could always fall in love in an instant. The purpose of an endowment plan is really not so much about the returns as the returns are tiny, but rather it is the discipline of saving. For those who lack discipline in saving, they can choose a 3 year or a 5 year endowment plan.

- $1,000 per month for 36 month = $36,000 (one person)

- Or $72,000 (if both saves up for it)

I would strongly encourage you to do this as far as your finances allow. This is rather easy when you still eat, sleep and snore in your parent’s home.

If both people do the same and stay away from Luis Vuitton, Hermés, Birkin, Rolex and the countless overseas holidays (you can come back to these when you are more established), and guys, and self congratulatory indulgence that the credit card companies are so happily encouraging you to do. And guys, stay away from too many entertainment joints, especially those that require you to support the dancers and performers by “hanging flower”. As each one is $50 to $100 and some could be even more. A single night like that can cost you $200 to $300 or the low thousands.

And some things are really very simple to do. Just cut down on your 2 Starbucks a day, that is around $12 to $15 a day, that is $300 to $400 a month. And if you are a smoker, just quit smoking, that is easily another $200 to $300 a month. And the thing about Food courts are, they are really costly and due to rentals they are now charging you $6 to 7 for a meal. If you can, walk over to the hawker centres (where available), you could eat good food that are tastier and cheaper.

How much CPF do I have to Buy a Condominium

If you have been working for 5 years and assume that you each earn $3500 on average over the 5 years.

“Age 35 and below

At the start of your career, your CPF contributions will amount to 37% your monthly salary, with 17% contributed by your employer and 20% contributed by yourself. A large portion of this, 23% of your salary to be specific, goes towards your Ordinary Account (OA), which can also be used for your first home purchase in future.”(Source: areyouready.sg)

Employee Ordinary Account (OA) Savings per person

- $3500 x 23% x 12months x 5 years = $48,300

(Note: CPF interest earned has been ignored for simplicity)

Buying a condominium – How much does it cost?

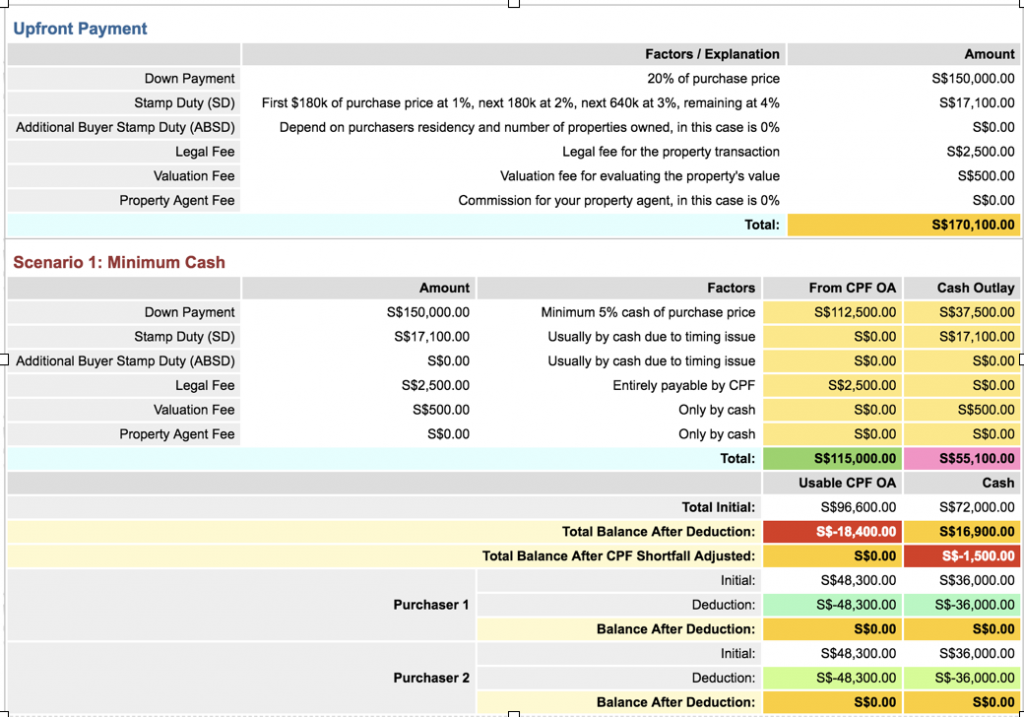

Let’s say a condominium is priced at $750,000, this couple will pass Total Debt Servicing Ratio (TDSR) based on their income, but the downpayment is just about right. A slight shortfall of $1500.

Image: Property Buyer Home Loan Report of a young couple buying a $750,000 property, Paul ho, iCompareLoan.com

We will see that the couple have a shortfall of $1500 after paying tax (bottom right of image), downpayment and wiping out their ordinary account.

Wedding can Wait

Being the practical person, I would say wedding can wait. Most wedding cost is around $1,000 per table at least. The cost for 30 tables would be $30,000. For Chinese family, the groom will donate half of these tables to the bride’s family and any collections of red packets will be kept by the girl’s family. Hence the total cost could come to around $20,000 upwards for the groom and I have not even mentioned honeymoon or that expensive piece of stone on one’s fingers. For Indian families the bride’s family is likely to pay. For Malay families their void deck weddings is also not cheap.

But usually some or most of these expenses are sponsored by the parents. And many newer fashioned couples share this cost. Of course there will be women that want the groom to pay for everything and some grooms that wants the bride’s family to pay everything.

Every women wants a perfect wedding. But you can choose a perfect wedding and no marriage when money quarrels spoil the marriage.

Let’s face it, there is no marriage if you spend all your money and future money on a wedding. A marriage will not be happy if one side insists the other side takes care of everything.

Renovation Cost for buying a condominium

The cost of renovation can escalate if you are too fussy. Interior design firms are good and professional, but their cost are exorbitant in many cases as they tend to specify too many carpentry and customised work. They cater to the more fussy and probably deep pocketed families.

When buying a condominium – Avoid Fixtures and carpentry

Avoid fixtures as much as you can. Try not to install this cabinet, that cabinet. Avoid Built-in furniture and carpentry whenever possible. Carpentry and fixtures are sunk cost, as good as down the drain when you move house.

Buy Valuable Furniture that is portable – Not just Cheap furniture

Couples should instead opt for furniture that fits in nicely and that is movable. Do not buy fashion items unless you are very rich. Ultra modern lines such as glass, white, black, gloss, this and that, they are nice to look at for a while, they will become out of fashioned later.

So focus on buying good and valuable furniture that is portable from house to house.

If you want a certain look and feel, maybe contemporary look or modern look or a certain theme, make sure that the furnitures that goes with it is time-less.

I still have my Spanish Alabaster chandeliers that cost me a few thousand of dollars a piece, very expensive. But I move them from house to house and (after more than 10 years), it is now more rare and has appreciated in value.

Work with a renovation contractor that knows how to use reasonable material to achieve the look and feel of a million dollar home.

Last but not least, obtaining a renovation loan of say $30,000 and spread it over 36 months, that will be quite manageable and ease your load. Remember, don’t go crazy with your design cost.

You can read more about avoiding some of the key mistakes a novice property buyer makes or Connect with Paul on Linkedin.

https://www.icompareloan.com/resources/first-time-home-buyers/