Buying a commercial property vs residential property

Angeline C and Paul HO (iCompareLoan.com)

Commercial properties rose in popularity following the cooling measures imposed on the residential segment in 2011 and 2013.

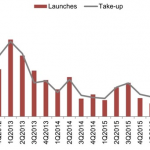

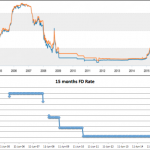

The charts below show the office, retail space price index was on an uptrend from 2009 to 2013 though it has tapered in recent years with general weakness in the property market. For the private residential properties price index, the downtrend is more pronounced after 2013.

http://www.singstat.gov.sg/statistics/visualising-data/charts/private-residential-properties-price-index

In this article, we explore some of the key areas that a potential buyer should take note of when deciding between purchasing a commercial and residential property.

First, we define commercial property to cover retail, office, HDB shophouse, strata title shops, conservation shophouses, hotels, commercial buildings and mixed development.

Unlike residential property, commercial property is typically not an option considered by most Singaporeans unless you are an investor or business owner. Thus, the pool of local buyers is smaller. Further, buying a commercial property is more complex and varied. It is also less speculative compared with residential segment.

Let’s consider the main factors that differentiate a commercial property with a residential property.

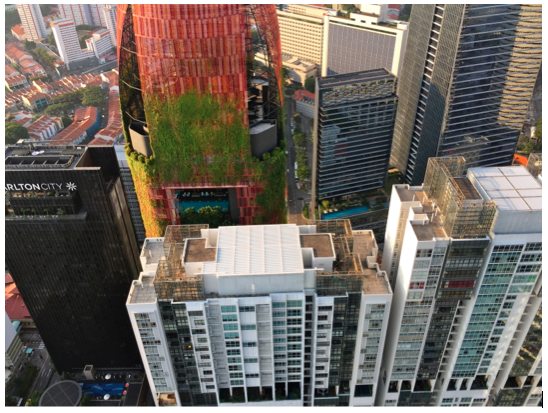

Image credits: Tanjong Pagar CBD taken at 61th floor at Altez, Paul Ho, www.iCompareLoan.com

No ABSD

An important differentiator is that additional buyer’s stamp duty (ABSD) does not apply for buyers of commercial property. This could prove to be significant in swaying a potential buyer towards commercial property.

Unique price determinants

As with all properties, location is key e.g. whether it is near MRT. But unlike residential, it could be a plus for a commercial property to be located in an area with heavy traffic if the space is to be used as a showroom so you would want passerby to notice your products and brand.

Prices of commercial property are also tied to performance of the industry. If the industry is doing well, this will attract more tenants vying for the space, and rental and property price will go up.

When buying a commercial property, it is important to look out for the condition of the amenities and facilities such as lift, toilets, maintenance of air conditioning, security, lighting, fire safety as you/your tenant/customer/staff will probably have to bear with the overall condition of such facilities unlike for residential where you only have to take into consideration your family’s preferences and the fact that you will have some of these basic amenities in your own home.

Yield

Rental yield for commercial property is higher at about 5% vs residential’s 2-3% though the landlord is usually expected to furnish and enhance the space from time to time.

No utilisation of Central Provident Fund (CPF)

Another key difference to note is that you can’t use your CPF to fund your purchase of the commercial property unlike for a residential property probably because it is deemed non-essential unlike a home.

This means you should have enough cash to pay the downpayment.

Property tax

The tax is a flat 10% of the annual value of the commercial property compared with 0-20% for residential property, which varies according to annual value and whether it is owner or non-owner occupied.

Goods and services tax (GST)

Purchase of commercial property is subject to 7% GST unlike nil for residential property.

Do note that GST cannot be financed by the property loan so be prepared to pay in cash.

Leasehold and freehold

Commercial property in Singapore are typically leasehold e.g. 30-, 60-, 99-, or 999-year lease. Freehold commercial property command a premium and are mostly in suburb areas. For residential property, they usually come with at least 99 year lease.

Loan terms

The maximum loan tenure will depend on remaining lease and typically stands at 30 years compared to up to 35 years for home loan. Generally they would be lower if the lease of the property becomes less.

The loan to value (LTV) is typically up to 80% for commercial property loan. Generally, banks offer a lower LTV for commercial property and are more stringent, taking into account whether the property is for own use or investment, with the latter subjected to stricter criteria by some banks.

Buying Under Company name or Personal Name

To buy a commercial or industrial property under personal name, total debt servicing TDSR applies on the individual income.

To buy a commercial or industrial property under company name, total debt servicing ratio TDSR also applies on the individual director’s income if the company is an investment holding company or an operating company that is loss-making or does not have sufficient cash flow to servicing the repayment.

To buy a commercial or Industrial property under company name where the company is well established with an existing operating business with strong financials, TDSR may be waived on the individual. However director is usually required to become personal guarantors of the loan the company undertakes. Hence this may affect the director’s other purchases, such as for buying a residential property, due to the loading from the TDSR for guaranteeing a loan.

Some banks even advertise 100 to 120% loan. This is due to a combination of working capital as well as commercial/industrial property loan, but this only applies to company with strong cash flow position.

In conclusion, commercial property is different from residential property and the considerations are more complex and varied though the payoff may be worthwhile for you.

Our mortgage brokers can help you. Contact us here.

To read more on commercial property, click here.

To find the latest and best loan package to refinance your commercial property, click here.