Singaporean households are buying residential property and remain the key buyer of new homes in 2018, says a research report by DBS.

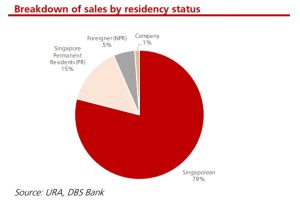

The report said that based on data compiled by Realis as at 27 November 2018, out of the 22,000 units transacted in the 11-months of 2018 (9,300 in the primary sales, 12,700 in the secondary market), a majority of the buyers in 2018 were Singaporean households, accounting for close to 79% of total sales with Singapore permanent residents (PRs) accounting for another 15% and the remaining 6% from foreigners.

Foreigners and PRs who are buying residential property and are active in the property market come mainly from China (6.1% of total PR and foreigner transactions), followed by Malaysia (3.8%), India (1.8%) and Indonesia (1.8%).

Foreigners and PRs who are buying residential property and are active in the property market come mainly from China (6.1% of total PR and foreigner transactions), followed by Malaysia (3.8%), India (1.8%) and Indonesia (1.8%).

Table of Contents

Close to 34% (or potentially more) of sales are made to upgraders (denoted as buyers with public housing addresses

[HDB]) looking to purchase a private home, which implies that there is strong underlying demand from Singaporean households to upgrade to a new home. The report said that robust upgrader demand will yield another 6,000 units per annum.

https://www.icompareloan.com/resources/private-residential-property-buyers-checklist/

DBS research finds that the “upgraders” (home owners who have already bought their first HDB homes) who are looking to buy a bigger home due to a growing family or aspirational reasons are a big source of demand. It said that in its analysis, the number of HDB flats that would have achieved the minimum occupation period (MOP) is estimated to increase to 17,000 – 19,000 per annum over the next 10 years.

While there is a significant number of households that are interested in buying residential property and upgrade to the private market, the timing of these households opting to enter the market remains uncertain for now, said the report. Developers will likely cater their projects to attract this market who are buying residential property.

The report added that developers have been relatively successful in their project launches over 2018. Based on Realis

data extracted as of 27 November 2018, the bank that the 15 best-selling projects sold close to 5,653 units, capturing almost 61% of the total sales in the primary market over the same period. These projects collectively sold close to 75% of the units launched during the period.

When compared against the total number of units in these projects, developers have achieved a sell-through rate of 44%. The top 5 selling projects in terms of units sold include the likes of Riverfront Residences, Rivercove Residences, Park Colonial, Stirling Residences and The Tapestry, which are launched before the introduction of the property measures in Jul’18.

DBS noted that these projects achieved between 64-100% sell-through rates for units launched for sale and it believes that given the good sales momentum in the initial phase of the project, may continue to achieve strong sell-through rates going into 2019. It further notedthat Riverfront Residences and Stirling Residences have only sold 47% and 37% of the total number of units respectively, implying that there is still some way to go before the projects are sold out.

The report said:

“Selected launches are fully sold; past projects also saw strong take-ups as developers took advantage of positive buyer sentiment. Projects that sold well include the likes of Rivercove Residences, an executive condominium and The Verandah Residences which were sold out within a year of launch.

Park Colonnial by a Chip Eng Seng-led consortium sold c.65% of the total project within four months of launch, which is commendable given supply build-up in the vicinity. Twin Vew (the first project by China Construction in Singapore), located in West Coast, has also reportedly sold 88% of its 520 units launched for sale.

Past property launches in 2017 also leveraged on the positive market sentiment to launch their remaining phases – Park Place Residences at PLQ by Landlease (429 units, 95% sold) and Seaside Residences (841 units, 86% sold) are substantially sold ahead of completion.”

In noting that Oxley, CDL and Chip Eng Seng launched the most number of units, DBS Research said:

“Developers have launched close to 10,000 units (estimated from new projects and new phases of existing projects) as of 27 November 18, higher than a year ago. This comes on the back of active land-banking activities in the enbloc market since late 2016.

In terms of market share, we note that the Oxley-led consortium came out tops at close to 19%, meaning that nearly one out of five new units launched in the market comes from the company. Meanwhile, CDL was second with a market share of 9%. Other developers that have been active in launching their suite of projects include the likes of Chip Eng Seng (9%) and Qingjian (9% market share from existing project Le Quest and the most recent launch Jadescape).”

The research report said that while the Singapore residential market is expected to remain weak, the commercial real estate prospects remain bright given positive demand-supply dynamics.

https://www.icompareloan.com/resources/first-time-home-buyers-3/

How to Secure a Home Loan Quickly

Are you planning on buying residential property but ensure of funds availability for purchase?

Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.