Paul Ho (iCompareLoan.com) 18 March 2017.

The desire to own a car in Singapore is so strong that it causes many Singaporeans to go into unnecessary debt.

Buying a car is serious commitment in Singapore. Cars are extraordinarily expensive in Singapore. You may wish to use a Car Affordability Calculator to verify your affordability.

Take for instance a car at $100,000 with 7 years loan with OMV below $20,000. Loan = $70,000 @ 2.78% for 7 years. But there are a lot of other costs. You may want to read up on why are cars so expensive.

Downpayment = $30,000

Monthly Cost

· Installment = $ 995.50

· Petrol = $ 500

· Parking (Home) = $ 100

· Parking (Office) = $ 200

· Parking (Others) = $ 100

· ERP = $ 100

· Road Tax = $ 100

· Insurance = $ 120

· Maintenance & repairs = $ 200

· Tyres = $ 40

· Traffic and Parking Fines = $ 30

· Total = $ 2,485.50

You think you know the TRUE COST of owning a car?

Info-graphic 1: Owning a Car and its myriad costs and surprises

Although the Installment is $995.50, the Petrol cost of $500 and Parking of $400 adds up quickly to $1898.50 per month of car ownership costs. There is also the dreaded Electronic Road Pricing (ERP) that springs up everywhere, Road Tax and Insurance, maintenance and Repairs and the occasional traffic and parking fine from the sometimes sneaky LTA traffic police that hide behind some bushes or the “Summon” aunty that hide behind pillars to give you tickets.

In this example, the true cash outlay per month of owning a car comes to about $2485.50 a month or about $29,826 a year. This is about the median salary of a Singaporean worker.

Often people who buy cars are emotionally attached to getting a car. Therefore they only tend to calculate the installment amount and not the other associated costs and hence severely underestimated the cost of owning a car. Sometimes it felt almost like they were trying to make all sorts of calculations to justify buying a car. If one method of calculation did not turn up a good number to justify buying a car, they would using another car affordability calculator.

If you have to spend $2,485.50 a month on just a car, how much money is left for your housing loan (Cash top up portion) and your living expenses?

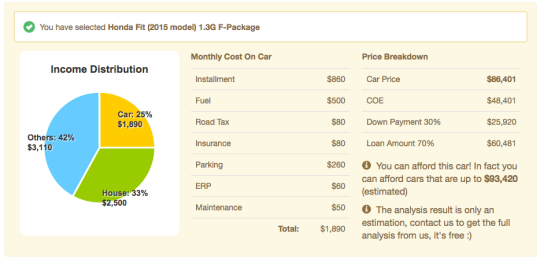

Figure 1: Car Affordability Calculator – Can you afford to buy a Car?, iCompareLoan.com/car-affordability

In the figure, we have included estimated running cost of a car per month. It is a crime, a Honda Fit has an approximate running cost of $1,890 per month.

Most of the time, beside the downpayment, monthly repayment of the car loan installment, you will still have to contend with Fuel costs, repairs and maintenance, Car insurance, Road tax, many ERPs on the road, Car parking fees at home and at work, traffic and parking fines, these costs all add up.

It is not worth it to explore 90% car loan financing as those are meant for private hire car scheme.

What are the 3 major areas of expenses of a person’s income?

The 3 major demands on a person’s income are: –

· Housing Loan repayment (Cash top up portion)

· Car Related Expenses

· Living expenses

o Food, entertainment, savings, insurance, education, childcare, Electricity, Conservancy charges, property taxes, income taxes in arrears, and of course Water.

So Housing loan, car expenses and Living Expenses make up all your monthly commitment. If you spend $2,485,50 a month on a Car, and you will need at least $1,500 for Living expenses. For example, if you have a housing loan repayment of $3,500 a month, your CPF OA is about $1,000, you will need to pay cash of $2,500 a month on top of CPF OA for your housing loan.

Can you imagine this scenario where you are spending $2,485.5 on a car, $1,500 on living expenses and $2,500 on your housing repayment, this comes to $6,485.50.

Your cash take home pay will need to be more than $6,485.50. Therefore if I use a simple calculation, your gross salary will need to be about $8,106 just to meet your expenses living on a measly LIVING Expenses budget of $1,500 a month.

But generally we recommend that you will need to reserve 40% for your Living expenses of which Savings, Education and other household expenses and food are all included. Hence your car and housing payment should not exceed 60% of your take home pay.

So can you really afford to buy that glossy new car? Check out the latest

car affordability tool to find a car that you can afford and work within your budget, based on your income and expenses.