Canberra Drive land sites awarded to highest bidders on 99-year lease terms

The Urban Redevelopment Authority (URA) has awarded the tenders for the Canberra Drive land sites (Parcels A & B) to Oasis Development Pte. Ltd. and United Venture Development (2020) Pte. Ltd. respectively.

The companies submitted the highest bids in the tenders for the two Canberra Drive land sites.

Table of Contents

The Canberra Drive land sites (Parcel A & B) were launched for tender on 28 November 2019. The tenders for these Canberra Drive land sites closed on 3 March 2020. The land parcels were offered for sale on 99-year lease terms.

Details of the awarded Canberra Drive land sites and the successful tenderers are provided below:

| LOCATION | ALLOWABLE DEVELOPMENT | SITE AREA | MAXIMUM PERMISSIBLE GROSS FLOOR AREA (GFA) | SUCCESSFUL TENDERER | TENDERED PRICE

($PSM of GFA) |

| Canberra Drive

(Parcel A) |

Residential | 13,315.3 m2 | 18,642 m2 | Oasis Development Pte. Ltd. | $129,196,000

($6,930.37) |

| Canberra Drive

(Parcel B) |

27,566.1 m2 | 38,593 m2 | United Venture Development (2020) Pte. Ltd. | $270,200,000

($7,001.27) |

Colliers International earlier commented on the bids for the Canberra Drive land sites saying:

“Developers continue to exercise discretion and prudence in the latest Government Land Sales tenders as reflected by the bids tabled for the three residential sites – Canberra Drive Parcels A & B, Fernvale Lane Executive Condo (EC).

“Since the introduction of fresh property cooling measures in July 2018, developers have by and large taken a cautious approach to site acquisition, and we expect this to continue for some time – particularly in view of the COVID-19 curveball which is expected to weigh on the economy. Having said that, we have observed that the virus outbreak has yet to impact home sales thus far, supported by pent-up demand, low interest rates, and attractive projects with competitive pricing. However, should the outbreak become protracted and stretch into the second half of 2020, there may be some pressure on housing demand, especially if there are widespread job losses and poor market sentiment.”

Against a backdrop of uncertainty, the bids for Canberra Drive residential sites are generally within market expectations. Colliers believes developers probably took some comfort from the decent home sales in recent months and healthy buying interest in certain upcoming projects.

Ms Tricia Song, Head of Research for Singapore at Colliers International commented on the Canberra Drive residential sites saying:

“The two adjoining residential sites in Canberra Drive (Parcels A and B) were previously put on the Reserve List H1 2019 as a single 4.09-ha plot, which was subsequently split into two parcels for sale on the Confirmed List in the Government Land Sales programme for H2 2019.

“We had expected developers to bid for both sites, with a potential outcome of a single developer submitting the top bid both parcels. However, it appears that developers were not over exuberant in their bids, and the tender for the two sites were topped by different developers.

“While the number of bids were in line with expectations, top bid prices were marginally lower than our expectations. The per square foot per plot ratio (psf ppr) price for both parcels were SGD644 and 650 psf ppr, within 1% of each other. We expect this would still put potential average selling price of either project at SGD1,250-1,300 psf.

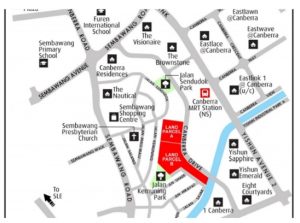

“Nearby comparable private condominium projects such as Eight Courtyards (completed in 2014), The Nautical (2015) and Canberra Residences (2013) traded at SGD900-1,000 psf over the past 12 months. In February, newly-launched 496-unit Parc Canberra EC achieved sales of 64% (316 units) at an average price of SGD1,085 psf.

“These two sites should benefit from the Canberra MRT which turned operational since 2 November 2019, and Bukit Canberra, an upcoming sports and community hub in Sembawang set to open progressively from 2020.”

Colliers International assessed the Canberra Drive residential sites individually as such:

“Canberra Drive Parcel A

All four developers who pitched for Parcel B, the larger site, also submitted bids for Parcel A. Incidentally, the top bid for Parcel A was tabled by the only developer who did not bid for Parcel B – Oasis Development.

Parcel A attracted five bidders, in line with our expectations of 4-6 bidders given its smaller quantum. The top bid of SGD129.2 million or SGD644 psf ppr was 3.4% higher than the next highest bidder – MCC Land and Greatview, and slightly lower than our earlier expectation of SGD670 psf.

Canberra Drive Parcel B

Meanwhile, Parcel B – being a larger site – garnered slightly fewer bids of four, also in line with expectations. The top bid of SGD270.2 million or SGD650 psf ppr by United Venture Development was 4.8% higher than the next highest bidder – MCC Land and Greatview, and slightly below our earlier expectation of SGD670 psf.

For Parcel B, there is also a requirement to build an Early Childhood Development Centre1 (ECDC) for infant care and childcare services within the proposed development for a minimum of 10 years from the date of issuance of ECDC licence.”

Mr Desmond Sim CBRE’s Head of Research for Southeast Asia commenting on the URA residential site tenders said:

“Canberra Drive (Parcels A and B)

These two sites were launched for sale under the Confirmed List of the GLS programme for the second half of 2019. They were initially put on the Reserve List of the first half of the 2019 GLS programme as a single plot, but are now split into two parcels on the confirmed list. This will ensure that the sites are more digestible and will appeal to more developers.

Parcel B is almost twice as large as Parcel A, yielding up to 455 units while Parcel A can yield 220 units. The sites are attractive considering their proximity to Canberra MRT station, Sembawang Shopping Centre and Sun Plaza.

Recent transactions include Kandis Residence which was sold at a median price of S$1,254 psf in Q1 2020, with a relatively well take-up of about 75%. The most recent GLS sites awarded in the area were two EC sites at Canberra Link awarded at $558 psf ppr to Hoi Hup/Sunway, and $566 to MCC Land.”