Owners of Gilstead Mansion have relaunched the 24-unit development for collective sale at a reduced price of $65 million. Exclusive marketing agent Teakhwa Real Estate which announced the relaunch of the development for collective sale said the revised price is $3 million down from its guide price in June.

The revised price for the collective sale works out to $1,524.70 per square feet per plot ratio (psf ppr) with no development charge payable.

Table of Contents

The collective sale relaunch of Gilstead Mansion comes after the Government’s new property cooling measures introduced in July and the new unit-size restrictions which was announced in early October to raise the average unit size and lower the maximum number of houses at new non-landed projects outside Singapore’s Central region.

The Urban Redevelopment Authority’s (URA) new guidelines to restrict development of excessive shoebox units mandate the maximum permissible number of housing units for a development outside the central area by dividing the development’s proposed building gross floor area by 85 sq m. The new rules will take effect for development applications submitted from 17 January 2019. This new requirement which aims to “safeguard the liveability” of residential estates by stemming the reduction in unit sizes, also requires a higher average unit size of 100 sq m to apply to nine specific areas.

Nestled on a 35,751 sq ft site, the collective sale site has an existing gross floor area of 42,632 sq ft. It is part of the Stevens-Chancery area, in which the increased average unit size of 100 sq m rule would apply for development applications submitted on or after 17 January 2019. Teakhwa Real Estate said the site could yield about 56 new units under the current 70 sq m rule. Also, the site requires no pre-application feasibility study for traffic impact.

The marketing agent added: “The expected land rate is undemanding in view of the high price transacted for the surrounding Dunearn Gardens at $1,962 psf and the 99-year leasehold Chancery Court at $1,610 psf This is an opportunity for developers who target good smallish prime sites at reasonable pricing in this en bloc cycle. The potential buyer may possibly make it on time to develop the site under the current Urban Redevelopment Authority planning guidelines.”

The tender for the collective sale of Gilstead Mansion closes on 22 November.

Mr Paul Ho, chief mortgage consultant of iCompareLoan said owners of Gilstead Mansion have to act quickly and decisively. Whatever decision owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

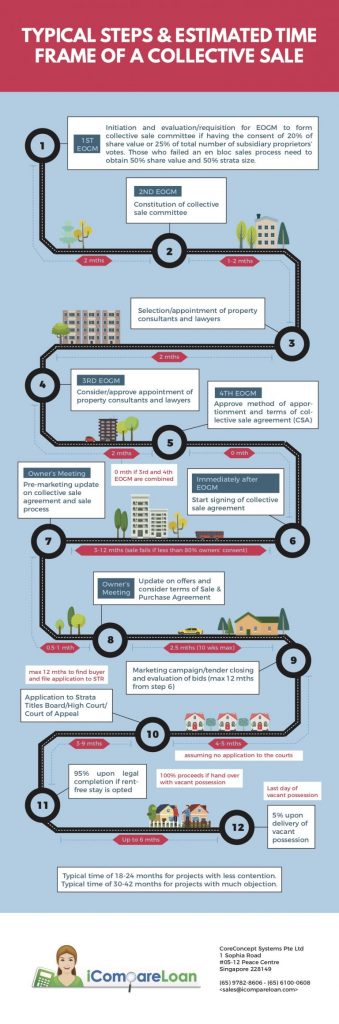

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

How to Secure a Home Loan Quickly

Are you planning to invest in properties like Gilstead Mansion but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.