Condo maintenance fees is one of the unexpected expenses when a couple calculates their financial planning. A condo is also known as a strata titled property where the land belongs collectively to home owners with separate titles within the development and where there is sharing of common facilities such as security and lifts. Share value is used to calculate the amount of maintenance share each unit holder has to pay for maintenance. Share value is also used for voting on important strata titled management (MCST) matters, such as initiating an Enbloc collective sales program.

Angeline C and Paul Ho 7 Nov 2017

Image Credits: Biopolis Nucleus – centros vicinity Buona Vista, Paul Ho, iCompareLoan.com

For first time condo buyers, it is useful to understand some terminology like share value as it forms the basis for the amount of maintenance fees you pay and voting rights whenever there is a AGM and also in calculation of your payout in the event of an en-bloc.

What is Share value?

Official definition: Share value refers to the proportionate share entitlement assigned to each strata unit in the same development. (Source: https://www.bca.gov.sg/bmsm/others/strata_living.pdf)

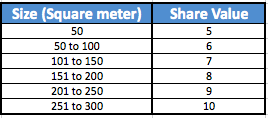

Table 1: Built up floor area (GFA) in Square Meters versus Share value allocation, Paul Ho, iCompareLoan.com

In other words, share value is used to represent the value of your home in relation to other owners. The condo comprises each individual’s home area as well as common facilities, shared among several homeowners. Thus, the share value of your unit has to take into account the size of your unit as well as the portion of common facilities. It does not vary directly with the size of your unit but rather “perceived usage of common facilities” and hence Condo maintenance fees are based on share value.

As shown in the table extracted from a publication on Strata Living in Singapore by the Building and Construction Authority, the share value starts at 5 for units measuring 50 sqm and below and rises by 1 for the next 50 sqm.

Enbloc sale will very much depend on collating enough share value and GFA to reach the mandated threshold to trigger the Collective Sales process. Perhaps the Share value may originally be developed for the sole use of condo maintenance fees allocation, but it is now also used for enbloc sale calculation for the the method of apportionment.

The shared value of your unit depends on factors like floor area, number of units in development and kind of common facilities provided in the development, etc.

Impact on fees

The share value is used to calculate the maintenance fees you need to pay each month. The higher the shared value, the higher the monthly maintenance fees. Maintenance fees are typically over S$200 and go up to over a thousand dollars for luxury condos and cluster landed housing.

For buyers of building under construction (BUC), this fee will only be charged after the development is completed and attained Temporary Occupation Permit (TOP).

The maintenance fee is collected by the management corporation (MC) or managing agent, whose role is to manage common property. The maintenance fee goes into the management fund and sinking fund.

While the management fund is for day to day maintenance of the development, the sinking fund is for future expenditure such as painting works or repairs to roof, which are typically not regular but once in a long while.

The amount of contribution for both funds depends on your share value.

The MC manages the funds and has to keep proper records and audit its accounts and records.

Voting rights

Share value is also used to determine your voting rights during the Annual General Meeting (AGM) and in the event of an enbloc sale (also knows as the “collective sale of a property”).

At AGMs, where you elect council members, or decide on fees, etc, the quorum for the meeting is met if at least 30% of the total share value of all lots are present.

With regards to enbloc, for property more than 10 years old, one criteria is that owners holding at least 80% of the share value have to agree before an enbloc proceeds.

Conclusion

Buying a condo is akin to joining a club in some ways. How often do you use the facilities? Do you really need to join a club and pay hundreds each month for the facilities that you may hardly use? Check out the Property buyer guide – Building-under-construction properties.

Do your homework and find out your rights and obligations. Knowing your share value and maintenance fee is useful before you buy a condo just as looking at other factors such as location and getting to know your neighbours.

Check with a mortgage broker for the latest BUC home loan rates.