CPF usage rules and HDB housing loans have been updated to provide more flexibility for Singaporeans to buy a home for life, while safeguarding their retirement adequacy, said the Ministry of National Development and the Ministry of Manpower in a joint statement.

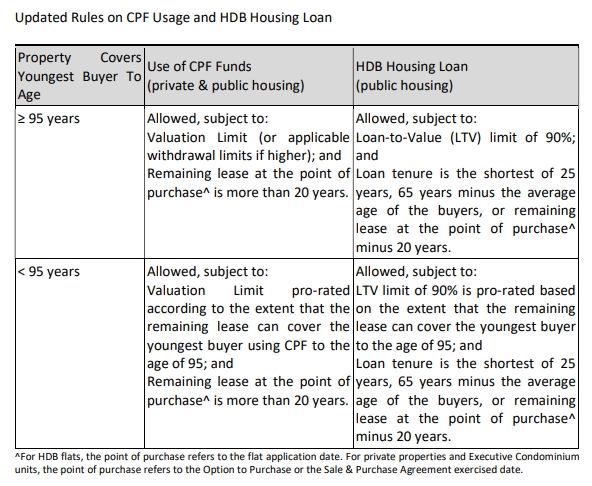

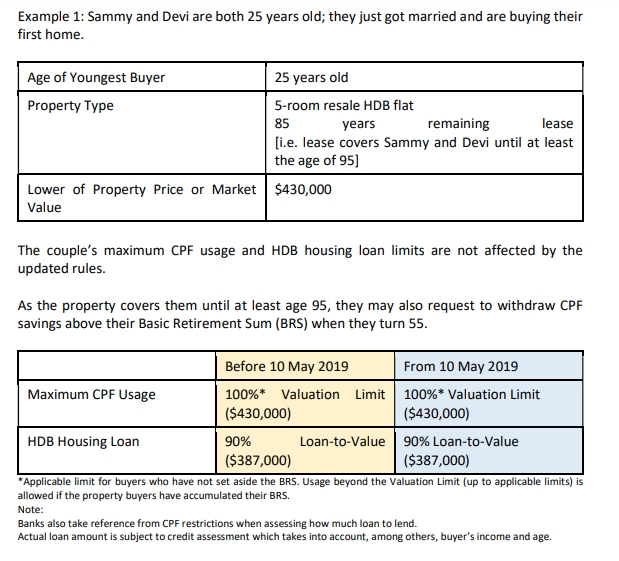

The new CPF usage rules will now focus on whether the remaining lease of the home can cover the youngest buyer until at least the age of 95. If so, home buyers will be allowed to obtain maximum CPF usage and HDB housing loan (for HDB flat buyers). Those who do not meet this criteria will still be able to use CPF and take up an HDB housing loan, but the amount will be pro-rated.

The updated CPF usage rules will take effect from 10 May 2019.

Table of Contents

In their announcement on the new CPF usage rules and HDB housing loans criteria, the Ministry of National Development and the Ministry of Manpower assured that the majority of home buyers will not be affected as they are already purchasing a property which lasts them to the age of 95.

Updates to CPF rules for all properties

Use of CPF for property purchase

Previously, the use of CPF to buy properties focused on the remaining lease of the property:

| Remaining lease of property | Previous rules on total use of CPF |

| 60 years or more | Buyer can use CPF to pay for the property up to the Valuation Limit (VL) (The VL is the lower of the purchase price or the property value at the point of purchase. Usage beyond the VL (up to applicable limits) is allowed if the property buyers have accumulated their Basic Retirement Sum.) |

| 30 years to less than 60 years | Buyer can use CPF if the remaining lease of the property covers the youngest buyer until at least the age of 80

Total amount of CPF that can be used is capped at pro-rated VL |

The Government Ministries said the rules have to be updated to take into account the changing needs and higher life expectancy of Singaporeans.

Under the new CPF usage rules, the total amount of CPF that can be used for property purchase will depend on the extent the remaining lease of the property can cover the youngest buyer to the age of 95.

| Remaining lease of property is at least 20 years and can cover youngest buyer until at least the age of 95 | New rules on total use of CPF (with effect from 10 May 2019) |

| Yes | Buyer can use CPF to pay for the property up to the VL |

| No | Use of CPF will be pro-rated based on the extent the remaining lease of the property can cover the youngest buyer to the age of 95. This will help buyers set aside CPF savings for their housing needs during retirement (e.g. a replacement property). |

The authorities said to ensure prudent use of CPF monies, there will still be a minimum lease requirement for the use of CPF for property purchases. This will be lowered to 20 years (from the existing 30 years), in line with the existing criteria for HDB loans.

CPF withdrawal rules after age 55 with a property

Previously, CPF members above the age of 55 could withdraw their CPF savings above the Basic Retirement Sum (BRS) if they owned a property with a remaining lease of at least 30 years. This was to ensure that they have secured a home in retirement and a basic level of retirement income.

The authorities said that to encourage CPF members to have a home for life and to secure at least a basic level of retirement income, CPF members will now need to have a property with sufficient remaining lease to cover them until at least the age of 95, before they can withdraw their CPF savings above the BRS. This change is not expected to affect most CPF members, as all HDB flats and the vast majority of private properties have leases that can last a 55-year old member until the age of 95.

https://www.icompareloan.com/resources/revising-cpf-use/

Updates to HDB housing loan rules for flat buyers

Previously, buyers of HDB flats faced restrictions on the amount of HDB housing loan they could get to purchase flats with remaining leases of less than 60 years. With this update, buyers will now be able to take an HDB housing loan of up to the full 90% Loan-to-Value (LTV) limit , if the remaining lease of the flat can cover the youngest buyer to the age of 95.

If the remaining lease of the flat cannot cover the youngest buyer to the age of 95, they can still take an HDB loan but the LTV limit will be pro-rated from 90%, based on the extent that the remaining lease can cover the youngest buyer to the age of 95.

The LTV limit refers to the maximum amount of loan a flat buyer can take up, expressed as a percentage of the lower of the purchase price or flat value. The actual loan amount is subject to credit assessment which takes into account, among others, buyers’ income and age.

The Government agencies said put together, these changes will give buyers more flexibility when buying a home for life while safeguarding their retirement adequacy.

Further Information on the changes to the CPF usage rules:

Consequential changes to purchase of multiple properties using CPF: Previously, CPF members needed to set aside the Basic Retirement Sum (BRS) before excess Ordinary Account (OA) monies could be used to purchase second or subsequent properties. From 10 May 2019, members who do not have any property bought using CPF monies that covers them until at least the age of 95 will need to set aside the Full Retirement Sum before using excess OA monies to purchase second or subsequent properties. Members who have a property with remaining lease that covers them until at least the age of 95 will not be affected (i.e. previous rules apply). Members in a buy-first-sell-later situation are not affected if they dispose of their previous property within the six-month grace period.

Consequential changes to CPF usage rules after age 55: For purchases from 10 May 2019, the remaining lease of the property needs to cover the buyer until at least the age of 95 for the buyer to use Retirement Account (RA) savings above the BRS to pay for the property.

The Government agencies said that members approaching age 55 can ask CPF Board to reserve their OA savings so that they may continue servicing their mortgage payments after the age of 55, and that those facing difficulty servicing their housing loans can approach HDB or CPF Board for assistance.

https://www.icompareloan.com/resources/explaining-the-advantages-of-hdb-loans-versus-bank-loans/

Implementation

The updated rules will apply to:

- HDB flats: Flat applications received on or after 10 May 2019.

- Private properties and Executive Condominium units: Option to Purchase or Sales & Purchase Agreement signed on or after 10 May 2019.

- CPF withdrawals: Applications received on or after 10 May 2019.

Buyers who bought properties before 10 May 2019 and are still servicing their housing loans will not be affected by these changes. The Ministries assured members who bought their property and turned 55 years old before 10 May 2019 that they can continue to apply to CPF Board to withdraw their CPF savings above their BRS under the previous rules. Those who are mid-way through a property purchase can approach CPF Board or HDB for clarifications and assistance.

How to Secure a Home Loan Quickly

Are you planning to invest in properties during this period of private home price decline but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.