Paul Ho (iCompareLoan.com) 25 June 2017.

Credit cards can help you fulfill your dreams. But if you are not careful, when you wake up from your dream, you realize that the reality is very painful.

Credit card is like a steroid that can help you perform better for short periods of time, but if you overuse steroid, you can damage your liver, kidney and other organs. Or you could be caught out by drug testing.

We used to get all these good offers such as 12/24 months installment plan.

What is attractive is the “Spend Now and Pay 30 days later”.

Any credit card roll-over balance or installment plans have an “outsized” impact on your housing loan borrowing quantum.

Credit Cards

Image Credits: Wikimedia commons

Story of a Fictional character John (gathered from a number of true life stories and amalgamated into one character)

John frequents Thai pubs and joints where he chalks up tens of thousands of bills on his credit cards. John is considered a moderate case where he has only spent some $26,000 in Thai pub joints in Singapore.

In many cases, many men spent money to the tune of hundreds of thousands of dollars in a year in these joint merely by competing for the lady’s attention. They would buy the ladies “flowers”, in hokkien they call it “Diao Huay” or sashes. A bit like the Miss Universe where they wear these sashes. The only difference is that these sashes cost $50 upwards. Common denomination comes in $50, $100, $200, $500, $1,000, $5,000, $10,000, $20,000 and some as large as $50,000.

Men bid for the lady’s attention. And there is fierce competition. If you hang a “flower” of $300 on the girl, some rival may hang $500 and then you will top up another $300 to make it to $600 and so forth. Just one evening, you could burn easily $1,000 or more if you are silly or drunk. The waiter or waitress or the “flower” lady will come to you and say, “Sir, buy flower for your girl na…” You are drunk, you nod your head, they swipe your card, you could burn hundreds or thousands in one night.

Image Credits: iCompareloan Exhibition Models wearing a Sash. (The Diao Huay is similar to wearing a SASH, except that the SASH has money signs).

So John, like many men, loves beautiful women, in this case Thai women. (Can be any nationality). After spending some $26,000 on this favourite girl, they got along, he won her love. (He is lucky, most times these women would not easily fall in love).

He also won himself a divorce after his wife found out. He has a HDB flat with his wife and his wife will take the house and he will get proceeds from the house.

Estimated Proceeds from the house is $200,000 back to CPF and $90,000 cash.

Scenario: John 37 (Income $7,000) and New Spouse 23 (No income)

John earns $7,000 has 2 credit cards roll-over balance of $14,000 and $12,000 respectively. He rolls over this debt by paying the minimum 3% payment each month.

- 3% of $14,000 = $420

- 3% of $12,000 = $360

It’s very affordable as John earns $7,000 each month.

Now comes the crunch, john fell in love with a beautiful Thai lady he met at the club and is marrying her next month after settling his divorce. She is intelligent and educated, but alas, she has no income in Singapore and John must now buy a house as soon as possible as she is 3 months pregnant with his child.

John and his new wife, eyed a property for $1.1m.

Due to his credit card debt, instead of borrowing $880,000, he can only be approved for $731,000 using MAS TDSR rules.

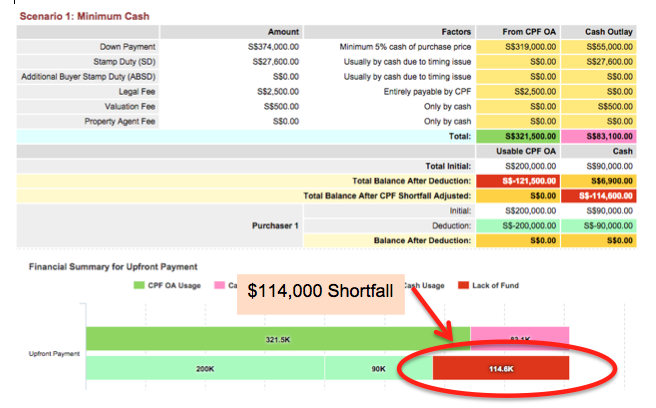

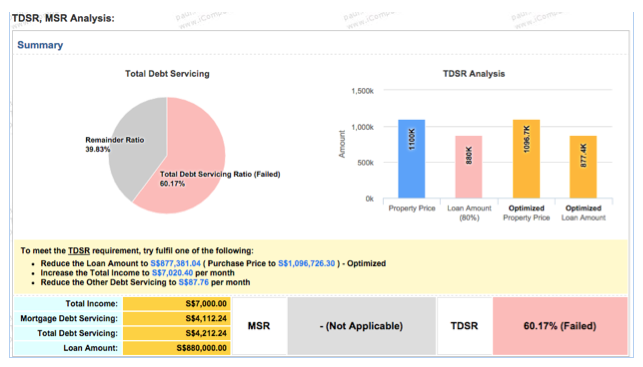

Figure 1: TDSR with $26,000 Outstanding Credit card debt, iCompareLoan.com

The estimated loan John can get is $731,000 with an outstanding $26,000 credit card debt.

Figure 2: Minimum Cash Down-payment for buying a property, with $26,000 Outstanding Credit Card Debt, iCompareLoan.com

Click here to download a copy of the John – With Credit Card Roll-over – Property Buyer Report – 20170626.

Due to the lower loan, his down-payment shortfall becomes higher.

He has a shortfall of $114,600 for the down-payment.

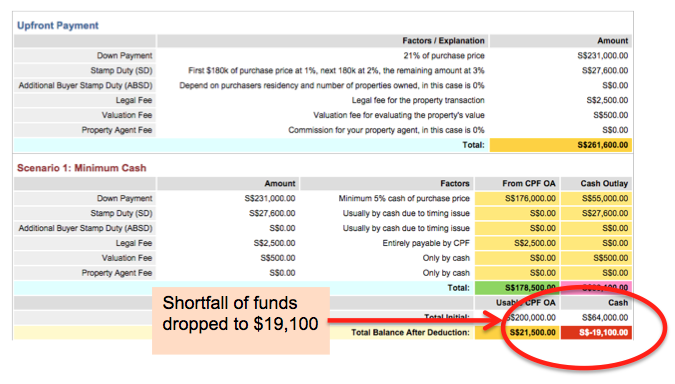

Alternatively, John can use his $90,000 to pay off the $26,000 Credit card loan. He is left with $64,000 for down-payment after paying his credit card outstanding balance.

Just by paying off a $26,000 debt, you will see that the housing loan approved amount will likely be much higher.

Figure 3: TDSR without Credit Card Outstanding debt, iCompareLoan

John’s Optimised TDSR loan quantum improves a lot as can be seen from Figure 3, optimized loan amount increases to $877,000.

Table 1: Total Debt Possible, Down-payment shortfall, With Credit Card and Without Credit Card Debt, iCompareLoan.com

As you can clearly see here, with the credit card debt of $26,000 it created a Down-payment shortfall of $146,000. This means that, if there was no credit card roll-over debt, the loan would have been $877,000 instead of $731,000.

Figure 4: Down-payment without Credit Card Debt, iCompareLoan.com

Click here to Download a copy of the John – With NO Credit Card Debt – Property Buyer Report – 20170626 here.

John’s down-payment shortfall (After paying off the credit card debt) would have gone from $114,600 to just $19,100. A small loan from John’s father would easily cover that $19,100.

Therefore it is very important to not rack up too much credit card debt no matter what promotions there are. And do not get drunk and do not nod your head especially at expensive joints. Outstanding debt on the credit cards or long term installment plan hurts your home loan borrowing quantum.

Remember, credit cards, apart from being a very expensive loan option at 24% to 30% per annum, a $26,000 credit card debt easily hits you with a reduced loan quantum from your housing loan to the tune of $146,000.

Personal loans or balance transfer loans are cheaper than credit card loans despite hitting you equally hard when it comes to buying a home.

It could be even worse if you are renting a house, missing out on a “Cheaper rental” as buying a property for own stay is usually way cheaper than renting. There is no best time to buy a Singapore property, but whenever you can afford the down-payment and pass the total debt servicing ratio (TDSR) for monthly repayment.

This could be the difference between having a roof over your head and not having one.

And please do not ask me why John cannot buy a cheaper house instead of the $1,100,000 house as he is a fictional character.

If you are unsure, you can call a Mortgage broker for a discussion or do your own Singapore Property market research.