What are 5 of the most popular credit score myths?

Your credit score is a number used by banks and financial institutions as an indicator of how you are likely to repay your debts and the probability of going into default. Credit Bureau Singapore (CBS) credit score is based on the various types of information in the credit report to calculate a number that estimates your level of future credit risk.

Your credit score is a number used by banks and financial institutions as an indicator of how you are likely to repay your debts and the probability of going into default. Credit Bureau Singapore (CBS) credit score is based on the various types of information in the credit report to calculate a number that estimates your level of future credit risk.

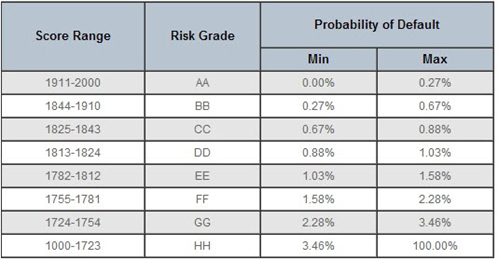

The score ranges from 1000 to 2000, where individuals scoring 1000 have the highest likelihood of defaulting on a repayment, whereas those scoring 2000 have the lowest chance of reaching a delinquency status.

Your credit score is guaranteed to influence the cost of the big ticket items you have to prepare for such as taking out a mortgage loan, planning a wedding, qualifying for a car loan and building up for retirement. A good credit score is crucial for these financial successes.

Improving your credit score should be a priority. The higher your score, the better your chances of getting the credit you need. So do you know your credit score? And more importantly, do you know how these credit scores can affect your finances?

Here are 5 of the most popular credit score myths that could give you a better idea of what you are in for.

Table of Contents

Credit Score Myths #1: My credit score determines whether or not I get credit.

Fact: Lenders may use your credit score as a tool to assess your credit worthiness to decide if a loan should be granted. If your credit score is in good standing, your loan may be approved faster, with higher line assignment and lower pricing. Lenders will also take into consideration other factors such as the individual’s income, application documentations, existing banking relationship with the lender, the lender’s risk appetite, etc before extending credit to the individual. One thing to note on is, CBS does not play a part in the lender’s lending decision.

Credit Score Myths #2: A poor score will haunt me forever.

Fact: Credit repair is possible. A score is a “snapshot” of your risk at a particular point in time. The bureau score is dynamic and it changes as new information is added to your credit file such as taking up a new HDB loan with the bank. Your score is a reflective behaviour of your repayment history and it changes gradually as you change the way you handle credit. For example, a good credit score is derived from paying your credit card bills on time, all the time.

Credit Score Myths #3: My credit score will drop drastically if I apply for new credit.

Fact: If you apply for multiple credit applications within a short period of time, it may have a negative impact on your credit score. Looking for new credit can equate with higher risk. Always approach credit in moderation.

Credit Score Myths #4: My credit score will impact supplementary card holders.

Fact: Although primary card holders are primarily responsible for the usage and payments due on the supplementary cards, the credit report will only show the factual credit data available of the principal cardholders. The credit history and repayment behaviour of supplementary card holders will not affect the principal cardholders.

Credit Score Myths #5: My bad credit will affect my spouse’s credit score.

Fact: If you have a joint credit account, these items could affect a score if they appear on your credit report. It is important that joint account holders understand that his or her repayment behaviour impacts the other joint account holder’s credit score. A credit account held solely in the name of your spouse cannot impact your credit score if it is not a joint account.

A credit Score is a number used by lenders as an indicator of how likely an individual is to repay his debts and the probability of going into default. It is an independent assessment of the individual’s risk as a credit applicant.

CBS’s Credit Score:

- A CBS Credit Score is a four-digit number based on your past payment history on your loan accounts.

- The score range from 1000 to 2000, where individuals scoring 1000 have the highest likelihood of defaulting on a payment, whereas those scoring 2000 have the lowest chance of reaching a delinquency status. Together with the score, the risk grade and risk grade description are provided.

- Your credit score is just one factor used in the application process. Other factors apart from your credit report, such as your annual salary, length of employment, bankruptcy/litigation information, number of credit facilities may also be taken into consideration by lenders during a loan application.

- CBS neither “blacklist” nor play a part in the lending approval decision which is fully undertaken by lenders and its lending policies. CBS instead, only provides specific factual credit-related information about consumers who have credit or loan facilities to the lenders.

Description of Credit Score

Factors that Affect Your Credit Score?

1. Utilization Pattern

- This refers to the amount of credit amount owed/used on accounts by individuals.

2. Recent Credit

- Lenders may perceive that you are over-extending yourself if you have newly booked credit facilities within a short period of time.

- Consumers are advised to apply for new credit in moderation.

3. Account Delinquency Data

- Presence of delinquency (late payment) on your loan accounts will reduce your credit score.

4. Credit Account History

- A consumer with long established credit history is deemed to be more favorable or a reliable borrower when compared to one who has limited or no credit history.

- Accounts with history of prompt payments will help to boost your credit rating.

- 12 months of account repayment conduct (closed and defaulted accounts are also included) as displayed under the Account Status History in your credit report is used for score calculation.

5. Available Credit

- This refers to the number of accounts available (open or active) for credit.

6. Enquiry Activity

- This refers to the number of new application enquiries found in your credit

- Each time a potential bank/financial institution pulls your credit report in response to a new loan application, an enquiry is placed on your file. Having too many enquiries in your credit report indicate to lenders that you are trying to take on more debt, therefore increasing your credit exposure.

- To keep your enquiries to a minimum, try to limit the number of loan facilities and credit cards which you apply for.

- Review enquiries on existing loan facilities do not affect your score.

A credit report is especially important for homebuyers and those that want to invest in real estate. Finding home loans in Singapore, let alone finding one with a reasonable interest rate can be a challenge if you have defaulted on any loan repayments before.