There are only 2 categories of mortgage loans in general. It is either the floating rate or the fixed rate mortgage loan.

Banks seldom offer very long tenure of fixed rates. Hence all fixed rate home loans are typically only fixed for a certain period of time, ranging from 1 year to 5 years and reverts back to floating rate after the fixed rate period.

Banks always face a challenge between offering fixed or floating rate packages. Floating rate packages are best for the bank as they can simply put a mark-up on their cost of funds, typically Sibor, Sor or cost of funds or internal reference and most recently pegging to fixed deposit rates.

Floating rates transfers the interest rate risks to the borrower. For example, if a bank charges Sibor + 1%, the bank can be assured to earn the spread of 1%, while the borrower takes on the risk of interest rate fluctuation of the Sibor.

Fixed rates are more costly for the bank, priced higher and hence harder to sell. But is there a middle ground between the fixed and floating rate packages?

Why are Fixed Rates more Expensive?

Fixed rate package are almost always more expensive than floating rate packages.

As banks are unsure of the future interest rate, they will need to enter into hedging contracts, which incur a fee, to guarantee you the future rates. It’s like buying an insurance policy against interest rates going crazy.

For example, if the current borrowing cost of the bank is 1.5%. The bank may then decide to create a fixed rate package that is 2% fixed for 3 years.

However, the bank does not know what will happen in year 2 and year 3. What if the cost of borrowing for the bank rises to 3% for year 2 and 3?

This would mean that the bank’s profit would be: –

- Year 1 = 2% – 1.5% (cost of funds) = 0.5%

- Year 2 = 2% – 3% (cost of funds) = -1%

- Year 3 = 2% – 3% (cost of funds) = -1%

- Total over 3 years = -1.5%

A bank is unlikely to create a product that has a risk of losing money. So banks typically pay a fee to go into a hedging contract.

The bank will buy a hedging product that would guarantee them 2% for year 2 and year 3 and maybe pay a fee of maybe 0.3% to do so. It is similar to insurance.

Hence the bank’s profit would be: –

- Year 1 = 2% – 5% (cost of funds) = 0.5%

- Year 2 = 2% – (1.5% Cost of funds + 0.3% Hedging cost) = 0.2%

- Year 3 = 2% – (1.5% Cost of funds + 0.3% Hedging cost) = 0.2%

- Total (over 3 years) = 0.9%

A guaranteed profit for each mortgage loan product is probably more important for the bank than the potential to make more money, but also open to the possibility to lose money.

The Birth of Innovative DBS FHR and OCBC FDMR packages

There are many types of floating rate structures. They are: –

- Pegged to bank’s internal board rate. (i.e. Board Rate – Discount)

- Pegged to Sibor Rate. (i.e. Sibor + 1%)

- Pegged to SOR Rate. (i.e. SOR + 1%)

- Pegged to Cost of Funds. (i.e. COF + 1%)

- Pegged to Fixed Home Rate (FHR)

- FHR12 – based on 12 months fixed deposit rates (i.e. FHR12 + 1%)

- FHR18 – based on 18 months fixed deposit rates (i.e. FHR18 + 1%)

- Pegged to Fixed Deposit Mortgage Rate (FDMR)

- FDMR36 – based on 36 months fixed deposit rates (i.e. FDMR36 + 1%)

As borrowers want the stability of the fixed rates and cheaper floating rates, in short they want cheap and stable, an almost impossible combination.

Credit should be given to DBS’ product team for innovation in creating the Fixed Home Rate (FHR) package which addresses the risks of rising interest rates and yet able to provide the lower cost of floating rate. OCBC soon followed with the Fixed Deposit Mortgage Rate (FDMR). These two products comes close to “Cheap and stable”, depending on a few conditions which we will explain later.

DBS’ Fixed Home Rate is pegged to the 12 months Fixed deposit rate and later versions of the FHR is pegged to 18 months Fixed deposit rate.

OCBC’ Fixed Deposit Mortgage Rate is pegged to their 36 months Fixed deposit rates.

FDMR example with OCBC (illustrative purposes only): –

36 months Fixed Deposit Mortgage Rate (FDMR36) for deposit sizes $5,000 to $20,000 = 0.65%

- FDMR36 + 0.98% = 1.63%

FHR example with DBS (illustrative purposes only): –

18 months Fixed Deposit Rate – “Fixed Home Rate” (FHR18) = 0.6%.

- FHR18 + 1.25% = 1.85%.

Many people are confused. They tell us they got a 36 months fixed rate mortgage very cheaply. Upon closer investigation and to their horror, it was not a Fixed Rate for 36 months, it’s a Floating Rate package pegged to the 36 months fixed deposit rate.

What is the Historical Trend of DBS FHR12/24 And FHR18?

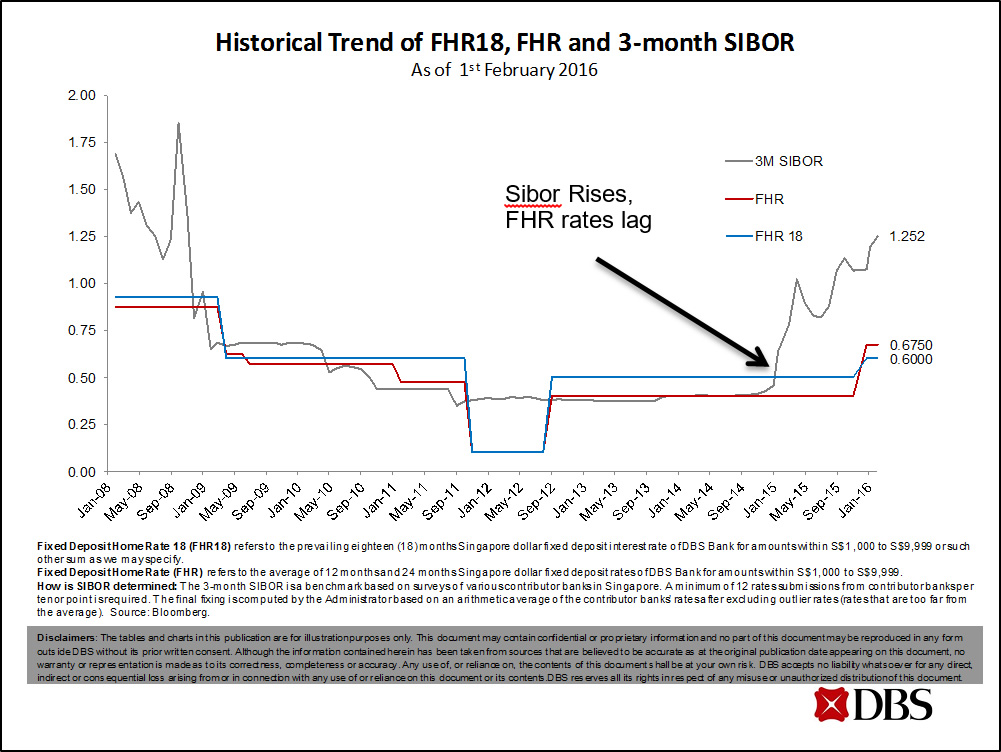

As we can see, from Jan 2008 to Sep 2008, FHR is lower than the Sibor. When Sibor is on an uptrend, from Jan 2015 to Feb 2016, FHR lags the Sibor, hence this gives the borrower a lower cost if they use a loan pegged to the FHR package. However DBS has also been adjusting the spread, so borrowers should look at the FHR + “Spread %” to figure out whether it is worth it.

Chart 1: Historical Trend of FHR18, Jan 2008 till Jan 2016, DBS

What is the Historical Trend for OCBC FDMR Fixed Deposit Mortgage Rate?

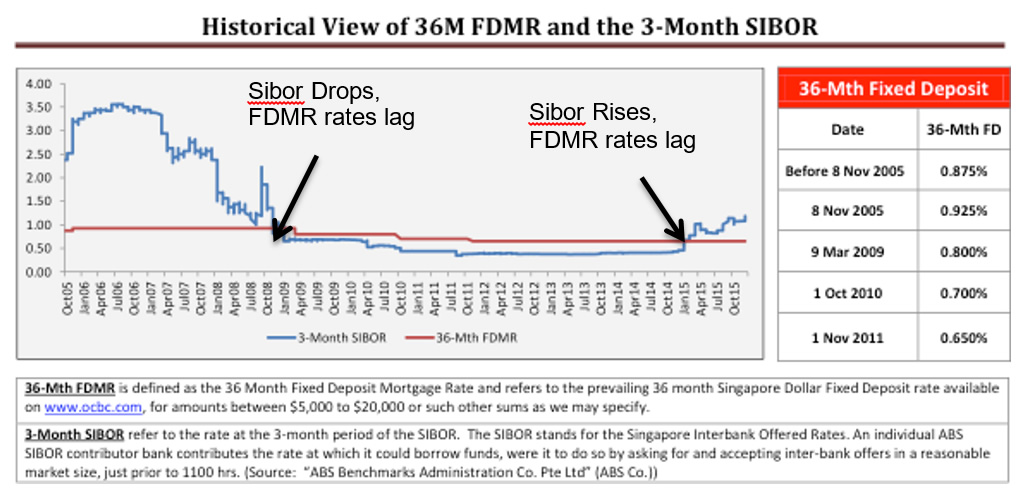

Ocbc bank followed suit with a mortgage loan package pegged to the 36 months Fixed Deposit rates. Hence it is important to know the historical trend of the FDMR36 as it has a direct bearing on the overall package interest rate.

Chart 2: Historical Trend of OCBC FDMR36, Oct 2005 to Oct 2015, OCBC

As we can see the FDMR36 has stayed flat during the period from Oct 2015 to April 2015, giving their depositors very little interest rate. Hence when the general interest rate environment is rising (i.e. Sibor is going up), the Fixed Deposit rates tends to lag in going up as well. When the Sibor is dropping, the deposit rates also lag in going down.

Hence there is some advantage to take FHR or FDMR packages when interest rates are rising, as the FHR and FDMR tends to lag the rises in Sibor. However if the interest rate environment is dropping, it is better to take Sibor or Sor based packages as FHR and FDMR tends to lag in reducing their rates.

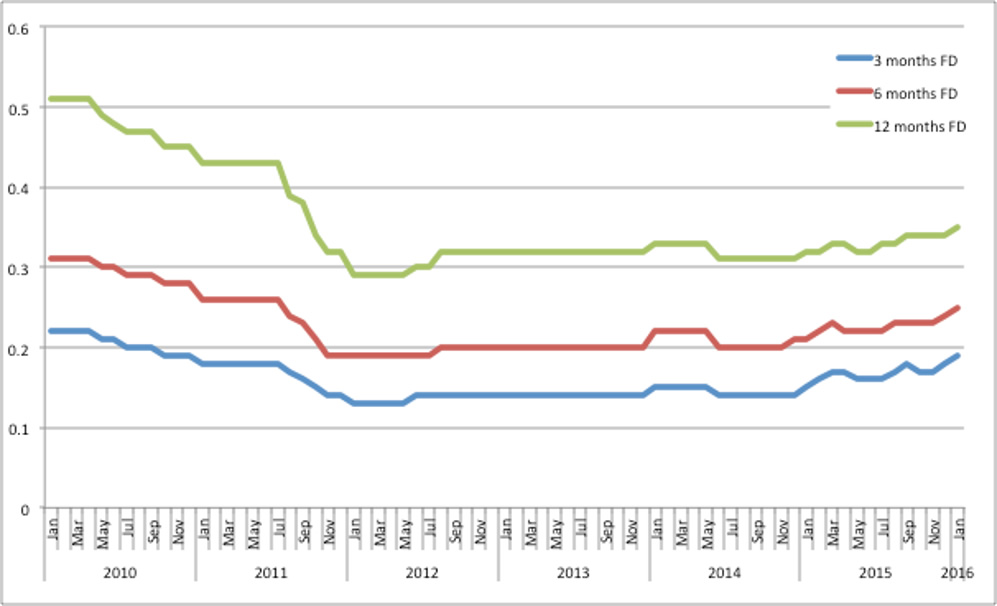

What is the Historical 3, 6, 12 months Fixed Deposit Trend?

From the chart 3, we can see that between the 3 months and the 6 months Fixed Deposits, there is a gap of 0.1%. Between 6 months and 12 months Fixed deposit, there is a 0.15 to 0.2% gap.

Chart 3: Average of 12 bank’s 3 Months, 6 months and 12 months Fixed Deposit rates, Jan 2010 till Jan 2016, MAS

The 12 months FD rate is about 0.35%. The difference between the 24 months and 12 months FD is perhaps +0.2% (i.e. 24 months FD should be around 0.35% + 0.2% ~ 0.55%). The difference between the 36 months and 12 months FD is perhaps + 0.4%, hence an estimated relative fair value is 0.35% + 0.4% = 0.75%.

Pricing the 36 months FD at 0.65% is about right.

This is so as to get a feel of how much these different duration Fixed Deposit rates is likely to be priced.

However it is not sure how MAS calculates these average fixed deposits from 12 banks, is it based on deposit volume weighted fixed deposit rates or simply based on published rates averages.

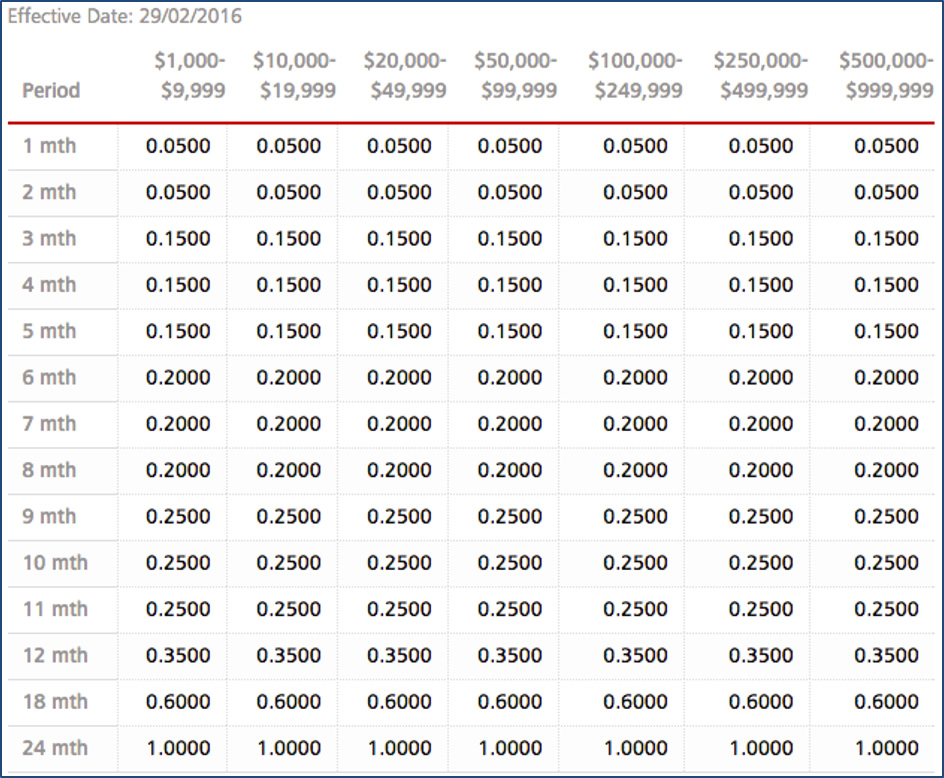

What are banks typically offering for their Fixed Deposits?

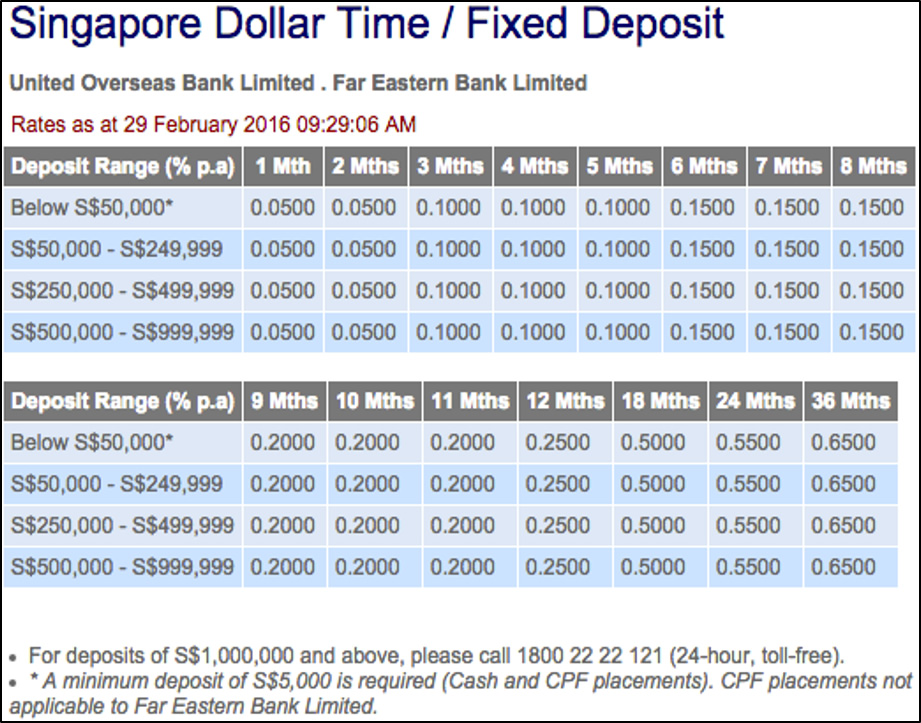

And by looking at OCBC’s website, as at 29 Feb 2016, (Reference 1)

- 12 months FD is 0.25%

(Promo 12 mths from $20,000 to $999,000 = 1.7%)

- 18 months FD is 0.5%

- 24 months FD is 0.55%

- 36 months FD is 0.65%

It seems that DBS offers better rates for their 24 months Fixed Deposit rate at 1% compared to OCBC’s 36 months Fixed Deposit rate at 0.65%.

Chart 4: DBS Singapore dollar Term Deposit rates, DBS, 29 Feb 2016, (Reference 2)

Chart 5: UOB Fixed Deposit Interest Rate, 29 Feb 2016, (Reference 3)

A look at UOB reveals that it pays almost similar fixed deposit rates to DBS and OCBC.

Chart 6: Maybank Promotional Singapore Dollar Time Deposit, 29 Feb 2016, (Reference 4)

Maybank pays more Fixed Deposit interest rates than all DBS, OCBC and UOB.

Is Fixed Deposit Mortgage Rate (FDMR) or Fixed Home Rate (FHR) safe?

Depositors in Singapore are very loyal and risk-averse. Many have the mistaken belief that Singapore banks are safer than foreign banks in Singapore.

In Singapore, depositor’s funds are insured up to $50,000, what this means is, if you are depositing only $5,000 to $50,000, even if a foreign bank goes bankrupt, you will not lose your deposit. (Reference 5)

All Qualifying Full Banks (QFB) and Finance companies are members of the Deposit Insurance scheme (DI scheme), except those exempted by the Monetary Authority of Singapore. (Reference 5)

A list of banks and financial institutions covered under the deposit insurance scheme are found in (Reference 6).

Maybank’s website (Reference 4) indicates 2% for their 24 months fixed deposit while CIMB (Reference 7) is paying 1.95% (for $20,000 and above) for their 24 months fixed deposit (13 Feb 2016), while OCBC’s 36 month fixed deposit rate ($5,000 to $20,000) pays only 0.65%.

In short, depositors in OCBC, DBS, UOB are being underpaid by more than 1% in fixed deposit rates.

When the depositors finally realized that there is a big difference in deposit interest rates between local banks and other banks, such as Maybank or CIMB, local banks may have to raise deposit rates or lose some of their Fixed Deposit funds to other banks that are paying much more interests to depositors.

A few reasons why people are willing to accept less deposit rates with local banks: –

- Brand premium of local banks (people knowingly and willing accept less)

- Fear, Ignorance and inefficient market (people do not know they have a choice and are fearful of new encounters)

- Convenience factors (people knowingly and willingly accept less due to convenience) – Such as ease of banking, consolidating their banking with one bank, number of branches, etc.

However further study may be needed to determine the dominant reasons for the interest rate gap between local and foreign banks.

It is possible that depositors will continue to put money in local banks and accept less fixed deposit interest rate. Hence mortgage loan borrowers pegged to FHR and FDMR loan structures may be able to have attractive savings when the interest rate trends upwards, gradually.

REFERENCES

- OCBC Fixed Deposit Rates, http://www.ocbc.com/personal-banking/accounts/sgd-fixed-deposit.html)

- DBS Singapore dollar Term Deposit rates, DBS, 29 Feb 2016, Reference 2, http://www.dbs.com.sg/personal/rates-online/singapore-dollar-fixed-deposits.page

- UOB Fixed Deposit Interest Rate, 29 Feb 2016,

http://www.uob.com.sg/personal/deposits/fixed/singapore_fixed_deposit.html

- Maybank Promotional Singapore Dollar Time Deposit, 29 Feb 2016, http://info.maybank2u.com.sg/promotion/deposits-banking/singapore-dollar-time-deposit.aspx

- Singapore Deposit Insurance Corporation Ltd, https://www.sdic.org.sg

Excerpts:

“All full banks and finance companies in Singapore are required to be members of the Deposit Insurance Scheme.” “So a foreign bank which has a full-banking license would be included under the Deposit Insurance Scheme.”

“all insured deposits placed with that member, except for deposits under the CPF Investment Scheme and CPF Minimum Sum Scheme, are aggregated and insured up to S$50,000. If you are a sole proprietor, your personal eligible accounts will be aggregated with the eligible accounts of your sole proprietorship(s). Trust and client accounts held by non-bank depositors are insured up to S$50,000 per account, without aggregation.”

- List of banks covered under Singapore Deposit Insurance Corporate Ltd, https://www.sdic.org.sg/di_scheme_members.php

Banks

- Australia And New Zealand Banking Group Limited

- Bangkok Bank Public Company Limited

- Bank of America, National Association

- Bank of China Limited

- Bank of East Asia Ltd

- Bank of India

- Bank of Singapore Limited

- Bank of Tokyo-Mitsubishi UFJ, Ltd

- BNP Paribas

- CIMB Bank Berhad

- Citibank NA

- Citibank Singapore Limited

- Credit Agricole Corporate and Investment Bank

- DBS Bank Ltd

- Far Eastern Bank Ltd

- HL Bank

- Hongkong and Shanghai Banking Corporation Limited

- Industrial and Commercial Bank of China Limited

- ICICI bank Limited

- Indian Bank

- Indian Overseas Bank

- JPMorgan Chas Bank, NA

- Malayan Banking BHD

- Mizuho Bank, Ltd

- Oversea-Chinese Banking Corpn Ltd

- PT Bank Negara Indonesia (Persoro) TBK

- RHB Bank Berhad

- Standard Chartered Bank

- Standard Chartered Bank (Singapore) Limited

- State Bank of India

- Sumitomo Mitsui Banking Corporation

- UCO Bank

- United Overseas Bank Ltd

Finance Companies

- Hong Leong Finance Limited

- Sing Investments & Finance Limited

- Singapura Finance Ltd

- CIMB SGD Fixed Deposit Promotion, http://www.cimbbank.com.sg/en/personal/news-and-promotions/promotions/accounts/cimb-sgd-fixed-deposit-promotion.html