Decouple property Singapore, what does it mean?

When someone gets together, they become a couple. If they are famous or infamous, they become “the couple”. When they decide to leave each other, they de-couple, or divorce.

When a couple buys a house, they buy it together and pay for it by cash, and property is fully paid, the ownership is: –

· Owner: Husband + Wife (They hold the title deed)

When a couple buys a house, pay the down payment and then borrow the rest from either HDB or the banks: –

· Mortgagors: Husband + Wife (Also known as owner, except that the bank still holds the title deed when there is an outstanding loan).

· Borrowers: Husband + Wife (They owe the banks as borrowers.)

Here are some Professional tools Agents use to generate detailed Decoupling Report and analysis.

Video 1: De-coupling Report Generation and Explanation, Home Loan Report from https://consultant.iCompareLoan.com

Additional Buyer Stamp Duty (ABSD) causes many “divorces” (De-coupling)?

The problem comes when these couples have the ability to buy a second residential property.

They have to incur ABSD: –

· Buying 2nd residential property = 12% ABSD.

· Buying 3rd residential property = 15% ABSD.

If a couple owns a residential property (Fully paid up) and buy another property at $1m, they would incur: –

· Stamp Duty of 3% less $5400 = $ 24,600

· Additional buyer stamp duty of 12% = $ 120,000

· 25% down payment = $250,000

· Total Cash/CPF required = $394,600

This simply put them off buying another property. Let’s face it, Singaporeans love properties.

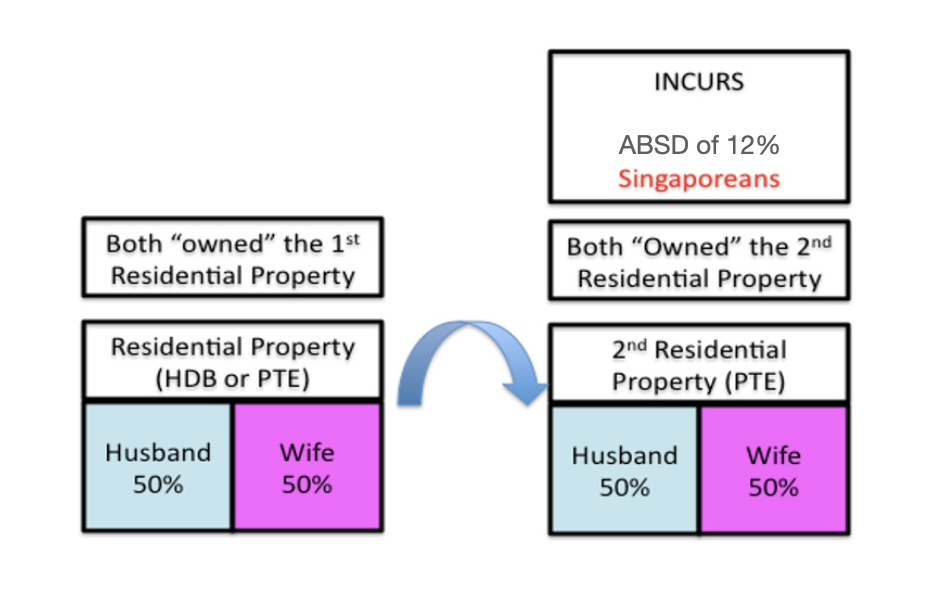

Diagram 1: Singaporean Husband and Wife buy 2nd Property

In the good old days, Husband and wife buy the 1st residential property and then the 2nd residential property together. They stayed together, not needing to decouple. But with ABSD, they have to pay 12% extra if they did it this way.

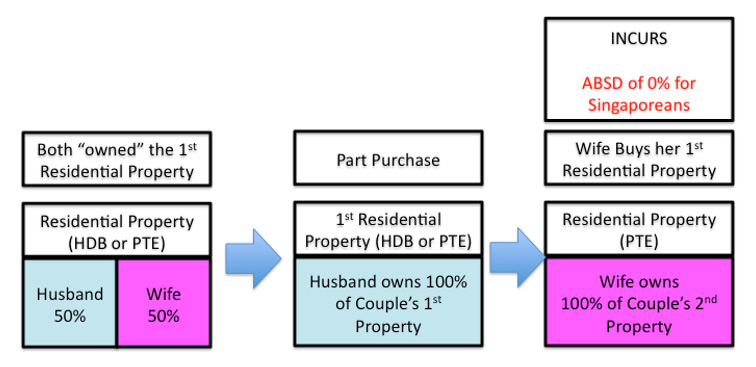

Diagram 2: Decouple property singapore – Husband buys Wife’s share and Wife buys her own property, saving on ABSD of 12%.

How much it would save with Decoupling property.

Video 2: Decouple property Singapore, savings, Home Loan Report.

Decouple property Singapore – Does it work for HDB flats

HDB does not allow part sale between couples, unless in case of divorce. Banks on the other hand does not accept “Gifting” of ownership between HDB couples with outstanding loan.

Hence decoupling for HDB is only possible on a case by case basis when the HDB flat is fully paid up via the Gifting method, subjected to approval by HDB. (Transfer of flat ownership, HDB) One of the couples is the full owner while the other is an occupier. The family nucleus must still be valid.

Very complicate rules, which you have to keep up to date all the time.

So decoupling for HDB flat is basically out.

Decouple property singapore – Mainly for Private Property

Decoupling for Private Flats is still possible through the following methods: –

· Gifting (subject to property being Fully paid) – IRAS tax is still payable based on arm’s length transaction. That means you cannot under-declare your GIFT and an independent valuation need to be sought.

· Part purchase (Fully paid) – Also need to be an arm’s length transaction, where the valuation is independent. CPF monies from the acquired shares will need to be returned with accrued interests into member’s CPF account.

· Part purchase (With bank loan outstanding) – Arm’s length transaction where the valuation will need to be independent.

Usually part purchase with existing bank loan is the most common. But the existing bank usually do not like to do part purchase as there is no new loan dispersed and hence this is extra work without revenue points for the bankers. As bankers have high targets to meet, they will tend to ignore this request.

The best situation is usually to refinance home loan to a new bank while doing part purchase. This will involve 2 sets of lawyers: –

· Seller’s lawyers for Sale and Purchase.

· Buyer’s lawyers for Buyer conveyance.

· Seller pays for Seller Stamp Duty (If sold within 4 years – if they fall under the period SSD is applicable)

· Buyer pays for Buyer Stamp Duty; 1st $180,000 at 1%, 2nd $180,000 at 2% and 3% (between $360k to $1m, 4% thereafter.)

Why stop Singaporeans who can afford to buy their 2nd or 3rd properties from buying?

Why stop Singaporean couples from buying their 2nd and 3rd properties and impose punitive taxes such as Additional Buyer Stamp Duty (ABSD)?

For financial prudence, Total Debt Servicing Ratio (TDSR) would more than suffice to make sure that whoever is buying their 2nd and 3rd properties are able to finance it.

There is also the added protection of reduced loan-to-value borrowing, such that if you have an outstanding 1st residential property loan, your 2nd property loan is capped at 50% of property valuation or price (whichever is lower).

If a Singaporean couple can afford a second property, is it necessary to make Singaporeans jump through all the hoops and pay Additional Buyer Stamp Duty?

Why Singaporeans should come first?

While we welcome foreign talents, we should first take care of our citizens. In an unintended consequence, If Singaporeans are hindered (by ABSD) to buy the second property, PR can buy their 1st property more easily, this simply deprives the Singaporean from being able to buy and rent to foreigners, including PR. Perhaps the work around would be to decouple property.

In this case we may have foreigners who buys his/her own property instead of renting from a Singaporean. This represents loss of potential rental revenue for Singaporeans who would otherwise own a 2nd properties.

Of course, due diligence, must still be exercised by the Singaporean couple in deciding whether property investing is the right asset class or not.

Summary

HDB has about 76% of Singapore residents staying in it, has too much rules, It is like some legal textbook. Since HDB is becoming more and more like private properties, approaching the price points of S$500 to S$700 per square feet in some mature estates. Perhaps it is time to bring HDB policies in line with those of private properties? There are too many pages to read.

For those who still want to buy a 2nd property, they can still de-couple and spend thousands of legal fees to get around the additional buyer stamp duty (ABSD). Moreover, there is already Total Debt Servicing Ratio (TDSR), and a reduction in Loan-to-value for 2nd residential property purchase with outstanding loan, capped at 50%. Hence the incremental benefit of Additional Buyer Stamp Duty (ABSD) on 2nd property purchase is limited. ABSD should be abolished for Singaporean buyers.

Some of these hurdles may have the unintended consequences of disadvantaging Singaporeans. Since some Singaporeans can afford to buy a 2nd private condominium, they are not competing with 1st time home buyer who are most likely to buy HDB, why stop them from earning rent from foreigners?

Click here to receive a sample Property Buyer Report.

Sample Decouple Property Report Singapore for Download:

Reference

1. Transfer of flat ownership, HDB, http://www.hdb.gov.sg/cs/infoweb/residential/living-in-an-hdb-flat/changing-owners/-occupiers/change-in-ownership/transfer-of-flat-ownership)