On the 31st March 2020 MAS announces the Covid-19 relief scheme for individuals and SMEs affected by the Covid-19 pandemic. Individual Home owners can now defer repayment for residential mortgage loans till 31st Dec 2020 with their current banks. MAS has decided to waive the TDSR requirement.

Picture 1: MAS and Financial Industry Support Measures (header of Infographic), MAS

Infographic 1: MAS Support measures Infographic on Individuals and SMEs affected by Covid-19, MAS

A list of MAS defer of repayment for residential home loans for individuals as well as SME loans as seen in the MAS inforgraphic.

Listen to Paul Ho – Founder of iCompareLoan.com with CNA938 With Susan Ng and Ryan Ong.

Voice Recording: Paul Ho speaks on CNA938

ELIGIBILITY FOR DEFER REPAYMENT FOR RESIDENTIAL HOME LOAN

Table of Contents

There is no TSDR or MSR requirement for applying to defer your mortgage repayments for Residential, Industrial and Commercial properties. For those who wants to defer their personal loan (unsecured) payments and credit card payments, they can also speak with and apply with their banks.

Naturally at a time of financial strain, your incomes may be impacted, hence this measure will be designed to help those who suddenly find themselves cash strapped or soon to be cash strapped.

In case a home owner wants to extract money out of their private property (Layman = Cash out, Professional term = Equity Term Loan), they can do so without passing TDSR as long as their loan outstanding is less than 50% of the valuation of their home.

TDSR stands for Total Debt Servicing Ratio, it is a measure of a borrower’s monthly ability to service their loans.

- You are eligible if you have a residential mortgage or a mortgage with an equity loan, and your monthly instalments are not more than 90 days past due as at 6th April 2020.

What part of the Mortgage Repayment can I defer? Will interest still be charged on our home loans?

MAS allows the deferment up to 31st Dec 2020 of the: –

- Interest payment on the principle amount; or

- The entire instalment.

If you pay only the Interest Payment, the outstanding principal will remain. At the end of 31st Dec 2020, you will still have a modified repayment amount amortised over the remaining loan tenure. Alternatively you may ask your bank to extend the loan tenure by the amount of months deferred to work out the mortgage repayment.

If you defer the entire repayment. Interest charged per months multiplied by the number of months will be added onto the principal after the 31st Dec 2020. (There is no interest on interest for this period). The new principal will be amortised over the remaining loan tenure, your new repayment (instalment will be worked out). You may ask your bank to extend the loan tenure by the number of months deferred and work out your amortised mortgage repayment schedule.

What is the difference between Deferring the entire home loan instalment (repayment) or just the principal repayment?

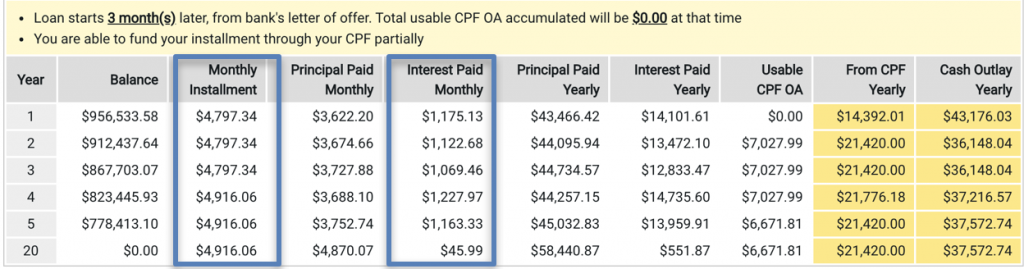

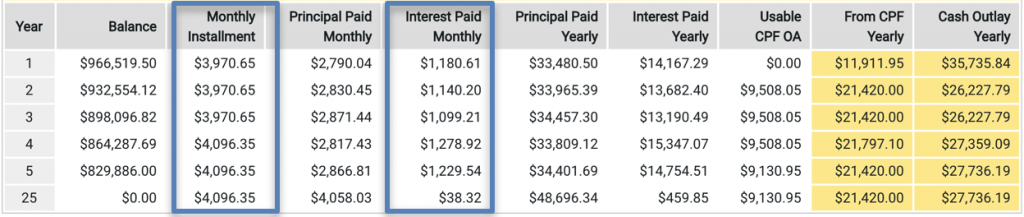

Table 1: A One million dollar outstanding loan with 20 years of tenure, Mortgage amortisation, iCompareLoan.com

Table 2: A One million dollar outstanding loan with 25 years of tenure, Mortgage amortisation, iCompareLoan.com

If you Defer Principal Payment

A monthly repayment of around $4,797 consists of $3,622 of Principal payment and $1,175 of Interest payment. Hence if you defer the principal portion of your instalment, then you would be paying $1,175 instead of $4,797.

- This frees up $3,622 for your monthly expenses. Based on table 1.

If you Defer the Entire Repayment

- A total deferment of instalment will free up $4,797 for your monthly expenses based on Table 1.

If you defer the entire loan entirely up to 31st Dec 2020. The interest will continue to accrue (in layman’s term, the interest will be added to the principal).

- The interest is $1,175.13 a month, let’s say you defer by 8 months, this is 8 x $1,175.13 = $9,401.04. This $9,401.04 will be added to your principal amount at the end of 31st Dec 2020 and a new mortgage amortisation table will be computed.

However there is no interest on interest charged during this deferment period. After the deferment period, the interest will be added onto the principal, a new repayment amount for mortgage amortisation will be calculated.

Do note that deferment costs you more overall interests over the duration of the loan.

Will my Credit Score be Affected with the Covid-19 Defer Repayment for residential home loan plan?

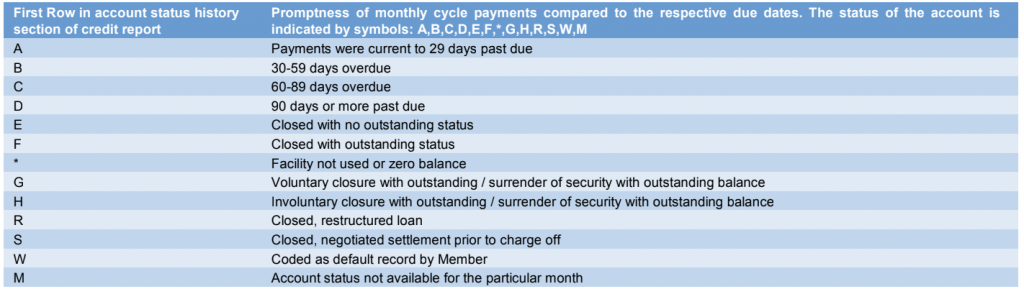

MAS commits that the deferment will not result in the loan being classified as a restructured loan for the purpose of credit bureau reporting.

A restructured loan is in layman’s term like a mini default, where the borrower is not able to fulfil repayment and asked the bank to restructure the loan. However private conversations with banks indicate that while the loan will not be classified as a restructured loan, it may still be classified as a Covid-19 Repayment deferment loan.

If you can survive this financial downturn caused by the pandemic, you should NOT opt for the Defer repayment for housing loan. Moreover, many banks have stepped up rates, for example if you took your loan in 2017 with a rate that is: –

Year 1 = 1.7%

Year 2 = 1.9%

Year 3 = 2.3%

By deferring, what you are still incurring is the higher third year interest rate. If you can afford it, or maybe even if it is slightly a bit challenging, but you still can make it, you can consider to refinance home loan instead, if refinancing can bring your interest rate to say 1.5%.

If you loan size is $1,000,000, a 0.8% savings (2.3% – 1.5%) is approximately $8,000 of annual savings.

Will Banks Log the Credit Report as “Deferred Repayment Scheme”?

The deferment of interest payment or instalment repayment may still be reflected on the credit bureau record, and if so, some bank’s credit department may still choose to classify this borrower as “Impaired”

The logic of banks is such that, for the fact that borrowers ask to defer their loans during the Covid-19, it means that they are reaching a near default. Their default was probably prevented by the MAS’ Residential Loan deferment plan.

While we recognise that banks can and should be able to determine who is of good credit and who is of inferior credit, however Covid-19 is a pandemic of historical proportions, this probably has nothing to do with repayment credit and habits. Hence we have started a petition to collect signatures to appeal to banks and MAS for leniency not to treat the deferment as inferior credit standing after the pandemic is over.

Table 3: Credit bureau report status History and grading, screenshot from credit bureau report, Credit Report

MAS will not treat it as “R” (see Table 3) because it is not a “restructured loan”, but what will they treat is as? Will they introduce a “N” in this Defer Repayment of residential property loan scheme?

This is probably going to hurt individual salaried employees and even more so the SME bosses cum home owners the most. SMEs create the most employment, hence to encourage a culture of entrepreneurship, I think we can and should help people reduce the burden of making mistakes, moreover this is a crisis of historic proportion that nobody anticipated.

While we are very grateful to MAS for the fast response, we still would like to appeal to MAS to consider not having the credit standing degraded, this would then free up more cash for entrepreneurs who could take the added time and opportunity given to restructure their businesses and prepare for the upturn.

Sign this petition here to appeal to MAS to keep credit record clean for Defer repayment for residential housing loan:

Is there a difference between HDB loans and private bank loans, when it comes to defer repayment for residential loans?

This notice is from the MAS who is the authority for banks and financial institutions, there is no mention of HDB loans here. The relevant authority for HDB loans is Ministry of National Development. As mortgage brokers, we do not handle HDB property loans, so I cannot tell you the difference. This is a good question, I will reach out to HDB to ask.

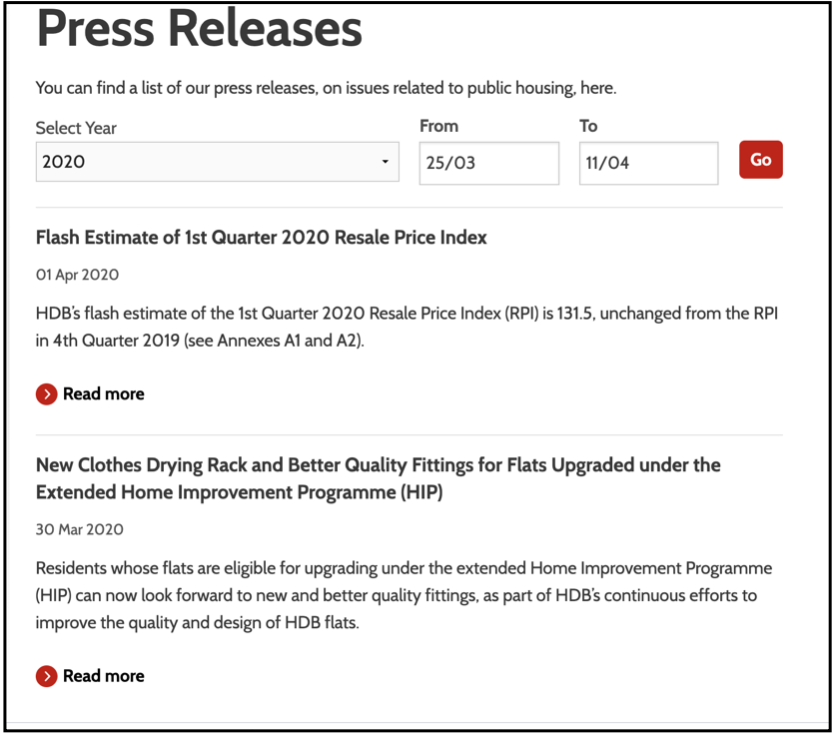

A search on HDB’s press releases from 25th March 2020 to 11th April 2020 reflects only 2 releases, there is no mention of any deferment of residential property loan repayment program.

Picture 1: Screenshot of HDB’s Press Release between 25th March to 11th April 2020, HDB

Who should defer repayment for residential home loans? Does the added interest cost makes it worth deferring the loan.

Yes, if you are thirsty in the desert, a bottle of water that normally cost $2 is now selling for $10, should you take it?

Of course you should take it, if you do not, you will not survive this thirst, all the potential future bottles at $2 counts for nothing when you are dead.

https://www.icompareloan.com/resources/relief-measures-mas/