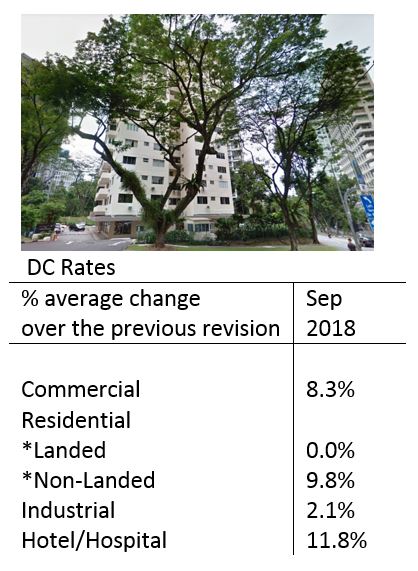

The Ministry of National Development on 31 August, revised the development charge rates for the period 1 September 2018 to 28 February 2019. The review is carried out on a half-yearly basis in consultation with the Chief Valuer.

The development charge (DC) rates for four Use Groups, namely Groups A (Commercial), B2 {Residential, (non-landed)}, C (Hotel/Hospital) and D (Industry) have increased. The DC rates remain unchanged for Use Groups B1 {Residential, (landed)}, E (Place of Worship / Civic and Community Institution), and 3 other Use Groups F, G and H (open space, nature reserve, agriculture, drain, road, railway, cemetery, mass Rapid Transit Route, Light Rail Transit Route).

The development charge rates for Use Group A (Commercial) have increased by 8.3% on average.

Table of Contents

116 out of the 118 sectors have increases in DC rates ranging from 3% to 17%. There is no change to the DC rates for the remaining 2 sectors. The largest increase of 17% applies to sector 110 (Commonwealth Avenue West / North Buona Vista Road / Holland Road / Ulu Pandan Road / Clementi Road Area)

The development charge rates for Use Group B2 {Residential, (non-landed)} have increased by 9.8% on average. 75 out of 118 sectors have increases in DC rates ranging from 3% to 33%. There is no change to the DC rates for the remaining 43 sectors. The largest increase of 33% applies to the following sectors:

• Sector 43 (Tanglin Road / Cuscaden Road / Orchard Blvd / Grange Road)

• Sector 67 (Dalvey Road / Stevens Road / Anderson Road / Orange Grove Road / Tanglin Road / Napier Road / Cluny Road)

https://www.icompareloan.com/resources/private-properties/

The DC rates for Use Group C (Hotel/Hospital) have increased by 11.8% on average. 116 out of the 118 sectors have increases in DC rates ranging from 8% to 23%. Rates are unchanged for the remaining 2 sectors. The largest increase of 23% applies to the following sectors:

• Sectors 3 & 5 (Stamford Road / Bras Basah Road / North Bridge Road / Beach Road / Nicoll Highway / Temasek Boulevard / Temasek Avenue / Raffles Avenue / Raffles Boulevard)

• Sector 6 (Collyer Quay)

• Sector 11 (Shenton Way / Raffles Quay / Marina Bay Financial Centre)

The DC rates for Use Group D (Industry) have increased by 2.1% on average. 26 out of the 118 sectors have increases in DC rates ranging from 6% to 11%. Rates are unchanged for the remaining 92 sectors. The largest increase of 11% applies to the following sectors:

• Sector 101 (Paya Lebar Road / Ubi Area / Macpherson Road / Eunos Link / Aljunied Road / Sims Avenue / Jalan Eunos Area)

• Sector 102 (Macpherson Road / Aljunied Road / Geylang Road / Guillemard Road / Mountbatten Road / Sims Way / KPE / Jalan Kolam Ayer)

• Sector 103 (Thomson Road / Marymount Road / Braddell Road / Bartley Road / Upper Paya Lebar Road / Lorong Ah Soo / Hougang Avenue 3 / Kim Chuan Road / Airport Road / Macpherson Road / Jalan Toa Payoh / PIE)

The revised development charge rates will be effective from 1 September 2018. The new rates will apply to cases which are granted Provisional Permission (PP) or 2nd and subsequent extensions to the PP on or after the effective date. If there is any disagreement over the DC payable for any development proposal calculated based on the rates under the respective Use Groups, developers and owners can opt for a case-by-case valuation by the Chief Valuer, as provided for in the Planning Act.

https://www.icompareloan.com/resources/land-bank/

Property market observers said the increase in Sector 43 was due to the collective sale of Park House in June at $2,910 per sq ft per plot ratio (psf ppr) and the Cuscaden Road government land sale (GLS) site sold in May for $2,377 psf ppr. These land sales were a record for any residential land and for residential Government Land Sales respectively.

Ms Tricia Song, Colliers International’s head of research for Singapore, said the current figures which tracked market developments in the March to August period, may not fully reflect the present cautious sentiment, noted that the latest numbers. Others said there have not been many land transactions since the new measures in July.

JLL senior consultant Karamjit Singh said: “The impact of the measures was not seen in this latest set of DC rates. But the full extent of the measures will be seen in the next round of revisions in rates starting March 1, 2019.”

Suggesting that this is because developers buying residential property for development now have to fork out another 5 per cent non-remittable additional buyer’s stamp duty, Mr Singh added: “For non-landed residential use, we may see DC rates flatten or even drop because land prices may drop following the new measures.”

Observers said the development charge rates increases across the commercial, non-landed residential, hotel/hospital and industrial use land reflect their attractiveness to investors in the past 2 quarters.

Mr Paul Ho, chief mortgage consultant of icompareloan.com, said: “the 0% development rate charge for ‘landed’ may mean that landed properties will hot up.”

He added: “Buyers of landed properties stand to potentially save tens (if not hundreds) of thousands of dollars if they engage the services of a mortgage broker for their purchase of the high end property.”

How to Secure a Home Loan Quickly

If you are searching for a landed property, but are ensure of funds availability for purchase, our mortgage consultants at iCompareLoan can set you up on a path that can get you a home loan in a quick and seamless manner.

Our consultants have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.