Digital Realty, a leading global provider of data center, colocation and interconnection solutions, announced today it has closed the previously announced joint venture with Mapletree Investments and Mapletree Industrial Trust (together “Mapletree”) on three existing Turn-Key Flex® data centers located in Ashburn, Virginia.

The transaction values the three fully stabilized hyper-scale facilities at approximately $1.0 billion. The three facilities are fully leased and are expected to generate 2020 cash net operating income of approximately $61 million, representing a 6.0% cap rate. Digital Realty is retaining a 20% ownership interest in the joint venture, and Mapletree has closed on the acquisition of the remaining 80% stake for approximately $811 million. Digital Realty will continue to operate and manage these facilities, and the joint venture transaction will be completely seamless from a customer perspective.

The second tranche of the Mapletree transaction, the outright sale of 10 fully-leased Powered Base Building® properties for $557 million, is expected to close in early 2020.

Citigroup served as lead financial advisor to Digital Realty, along with CBRE and Park Hill who served as co-advisors. Latham & Watkins and Mayer Brown served as Digital Realty’s legal advisors.

About Digital Realty

Digital Realty supports the data center, colocation and interconnection strategies of customers across the Americas, EMEA and APAC, ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, healthcare and consumer products.

About Mapletree Investments Pte Ltd

Mapletree Investments Pte Ltd (“MIPL”) is a leading real estate development, investment, capital and property management company headquartered in Singapore. Its strategic focus is to invest in markets and real estate sectors with good growth potential. By combining its key strengths, MIPL has established a track record of award-winning projects, and delivers consistent and high returns across real estate asset classes.

MIPL currently manages four Singapore-listed REIT and six private equity real estate funds, which hold a diverse portfolio of assets in Asia Pacific, Europe, the United Kingdom and the United States.

As at 31 March 2019, MIPL owns and manages S$55.7 billion of office, retail, logistics, industrial, residential and lodging properties.

MIPL’s assets are located across 12 markets globally, namely Singapore, Australia, China, Europe, Hong Kong SAR, India, Japan, Malaysia, South Korea, the United Kingdom, the United States and Vietnam. To support its global operations, MIPL has established an extensive network of offices in these countries.

About Mapletree Industrial Trust

Mapletree Industrial Trust is a real estate investment trust (“REIT”) listed on the Main Board of Singapore Exchange. Its principal investment strategy is to invest in a diversified portfolio of income-producing real estate used primarily for industrial purposes in Singapore and income-producing real estate used primarily as data centres worldwide beyond Singapore, as well as real estate-related assets.

MIT’s property portfolio comprises 87 industrial properties in Singapore and 14 data centres in the United States (40% interest through the joint venture with Mapletree Investments Pte Ltd). The properties in Singapore include Hi-Tech Buildings, Flatted Factories, Business Park Buildings, Stack-up/Ramp-up Buildings and Light Industrial Buildings. As at 30 September 2019, MIT’s total assets under management was S$4.8 billion.

MIT is managed by Mapletree Industrial Trust Management Ltd. and sponsored by Mapletree Investments Pte Ltd.

Mr Paul Ho, chief mortgage consultant at iCompareLoan, said: “the joint venture agreement for the data centre in the US makes good business sense. The infrastructure in the US market is fully developed, which poses little challenges for data centre providers.”

A recent research by Cushman & Wakefield (C&W) said that North America is the largest co-location data centre by market size at US$17.2 billion currently but the Asia Pacific region is expected to take over the top position by as early as 2021. The total market size for Asia Pacific co-location data centres is forecast to be around US$28 billion by 2024, 20 per cent higher than the US$23.4 billion market size of North America.

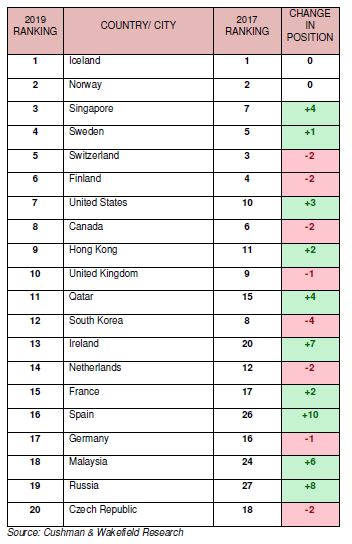

A detailed analysis of success factors across 38 countries and cities globally also shows the strength of Singapore’s data centre market. Singapore is ranked the third most robust data centre growth market, the only data centre market in Southeast Asia to have featured in the global ranking. Its ranking jumped four spots from seventh to third and retained the top spot in the Asia Pacific region since two years ago when the study was conducted.

The index identifies the top competitive factors such as connectivity, ease of doing business, political stability, corporate tax rate, natural disaster, energy and security that are likely to affect the successful operation of a data centre. Countries and cities are assigned scores based on the weightage allocated to each of the factors.

Singapore’s rise in the global index comes on the back of its improved high-speed connectivity, political stability and low risk of natural disasters relative to other countries. Being sheltered from natural disasters and robust infrastructure, many content operators continue to take advantage of Singapore’s prime geographical location to service their regional clients in Malaysia, Indonesia and Thailand. Taking these factors together, Singapore ranks top in the data centre competitive index in the Asia Pacific region.

Singapore has attracted a number of tech companies to set up data centres. Facebook set up its US$1 billion data centre in the city state. It would be its first in Asia, and 15th in the world, a strong testament to Singapore’s continued strength as a global data centre powerhouse. Apart from Facebook, we also saw Equinix, Digital Realty, ST Telemedia and at least two other operators having successfully tendered for land plots from Jurong Town Corporation to build data centres.

Although the rest of the SEA countries such as Malaysia, Indonesia, Thailand and Vietnam rank relatively lower in the risk index, the potential commercial upside for data centre players is significant.