Edmund Tie & Company (ET&Co) announced that a freehold redevelopment site in District 9 up for sale by tender on 28 May 2018. ET&Co said that the property’s ownership is held under a single family, which provided for certainty in completion timeline. The tender exercise for the site will close on Tuesday, 3 July 2018 at noon.

Located in exclusive District 9 along St Thomas Walk, the property has a land area of approximately 1,190 square metres (sq m) or 12,809 square feet (sq ft) and is zoned for Residential use at gross plot ratio (GPR) of 2.8 under Master Plan 2014. Subject to relevant authorities’ approvals, the site can be redeveloped into a high-rise boutique project of a maximum height of 36 storeys. As the property is in the Central Area, the usual restriction on the maximum number of dwelling units (based on an average unit size of 70 sq m or 100 sq m) does not apply and there is no specific cap on the number of dwelling units according to URA’s guidelines.

The subject property sits in the heart of Orchard Road, boasting a desired central location. It is within proximity to a myriad of amenities which includes shopping and dining establishments, entertainment and lifestyle options, as well as top-notch healthcare facilities. The popular River Valley Primary School is also within 1km of the property.

While the property is currently within walking distance to Somerset MRT station on the North-South Line (NSL), accessibility will be further enhanced upon completion of the upcoming Great World MRT station serving the Thomson-East Coast Line (TEL), which will only be a five-minute walk away.

Senior director of ET&Co’s investment advisory Tan Chun Ming said: “In recent months, along with improvements in the global economy, we have witnessed brisk sales for new residential projects in the vicinity such as Gramercy Park, New Futura and Martin Modern.”

He added: “These positive take-ups highlight the confidence of the market in the luxury and high-end residential segment. This property, given its single-owner status, provides certainty in completion timeline, offering developers the opportunity to leverage on the current upbeat market sentiments.”

The asking price of $68m reflects a land rate of $2,190 per square foot per plot ratio (psf ppr) including an estimated development charge of $10.56m to intensify to plot ratio 2.8.

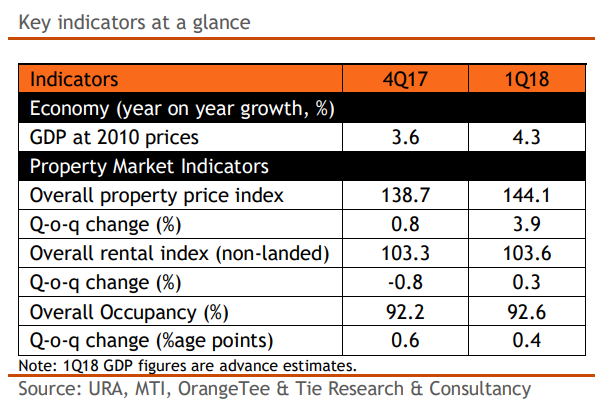

The sale by tender of the freehold redevelopment site in District 9 comes at a time when sentiment in the private residential market continued to be buoyant.

Table of Contents

Overall private property prices rose across most market segments, with the largest price surge seen in the Core Central Region (5.5%) and Outside of Central Region (5.6%).

As developers’ existing stock continues to diminish and supply of completed homes remain low, many projects especially those in the CCR have raised prices of their unsold units, some by even double-digits this year. Private residential market continued to gain traction with individual re-sellers have also seized the opportunity of increasing their asking prices in light of the more positive market sentiment fueled by the recent collective sales frenzy.

An earlier report by ET&Co said that higher launch prices at some new projects slowed the buying momentum in the primary market, as sales volume dipped 15.2% quarter-on-quarter. Some developers have also held back their launches in the first quarter in anticipation of higher asking prices. While overall sales had slipped 14.2% q-o-q, volume rose 2.4% on a y-o-y basis.

With positive sentiments of the private residential market, sales is predicted to pick up significantly in the months ahead as more projects are slated to be launched and the prevailing market valuations be supported by banks at the higher benchmark prices.

OrangeTee & Tie research and consultancy head Christine Sun noted: “As it seems, demand for resale homes had rebounded strongly by 67.3 per cent year-on-year, the highest number of Q1 resales since 2012.”

She added: “Owing to higher land cost, stronger economic growth and pent-up demand, we expect prices to trend even higher. Some new homes may even see prices rise beyond 15%, going by the recent pricier enbloc acquisitions.”

Median rents for private homes are expected to stabilize this year as there is less supply of completed homes now as compared to the last two years. The limited supply coupled by the positive macroeconomic conditions will mitigate further downward pressure on the private rental market, the report said.

https://www.icompareloan.com/resources/median-resale-prices-hdb-drop/

Mr Paul Ho, chief mortgage consultant at icompareloan.com noted that Core Central Region (CCR) comprising of Districts 1, 2, 10 and 11 besides District 9, has risen less compared to Rest of Central Region (RCR) for many years now, and that the price differential is narrowing.

“Either RCR is overpriced or CCR is underpriced. For investors who are looking at superlatives, definitely the best of the best will do. Savvy investors (those who already have more than 1 property) will stay away from the market as the prices are crazy and the fundamentals are weak and there is huge supply in the pipeline.

“Current investors, such as those that bought the New Futura comprise mainly of foreigners. I doubt how they will recover their investment given the low rental yields, rising interest costs.

“I got a sense that it is more a portfolio diversification play given that they feel bullish about the Singapore Property market – given that the malaise of over supply has been digested for many years.

“The situation is nowhere as dire. So, this is more about the confidence and the sentiments. The fundamentals of the Singapore property market remains weak.”

Mr Ho believes that value buys in the property market right now are are landed inter-terrace houses which’s per square feet price on the built-up area is usually less than $1000.

—

If you are home-hunting in District 9, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and a promotional home loan. The services of our mortgage loan experts are free. Our analysis will give best home loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com for a free assessment.