An Australian who is the en bloc condominium owner who is facing the prospect of a collective sale, has taken to a forum to say why the collective sale is at best a “mixed blessing”.

The en bloc condominium owner said that Singaporeans are wrong when they say “oh you’ll be rich” with the en bloc sale. The “reality is that the premium paid (~25 to 35 percent) is not worth the issues it will cause.”

Table of Contents

He said that he is a permanent resident and did not pay the Additional Buyer’s Stamp Duty (ABSD) when he bought his current property, but reckoned that he’ll have to pay a hefty ABSD when he buys a new property.

The ABSD was first introduced on 7 December 2011 to cool the residential market and was revised upwards on 12 Jan 2013 due to the further acceleration in the escalation of the price of residential properties. ABSD is applicable to certain groups of people who buy or acquire residential properties (including residential land). This duty, which is in addition to the existing buyer’s stamp duty, is applied as follows in most cases:

| Buyer’s Citizen Type | Rate of 1st Property Purchase | 2nd Property Purchase | 3rd and subsequent Property Purchase |

|---|---|---|---|

| Singapore Citizen | Not Applicable | 7% | 10% |

| Singapore Permanent Resident (SPR) | 5% | 10% | 10% |

| Foreigners & Non-Individuals | 15% | 15% | 15% |

The Australian en bloc condominium owner pointed out that even if the property is successfully sold to a bidder, he will not be able to buy right away as he will need to wait for at least a year for payout, and for that one year he faces an uncertainty with “what looks to be a rising market.”

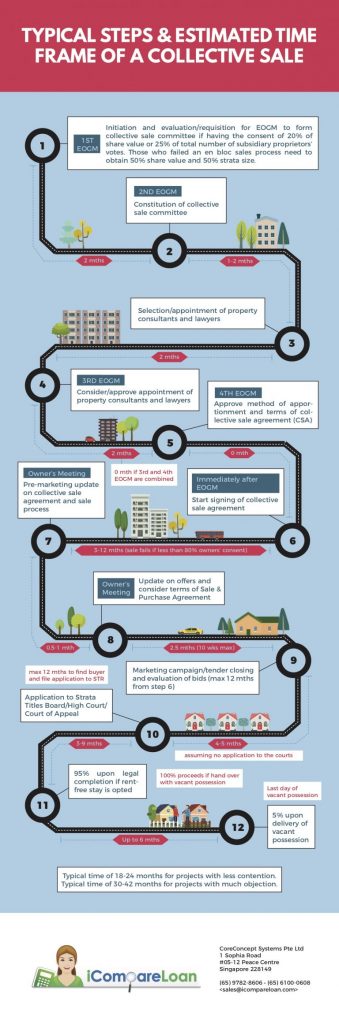

Paul Ho, the chief mortgage officer of icompareloan.com said that the Australian’s expectation of payout after sales completion is an underestimation. “En bloc sales process takes easily 18 to 40 months to complete, and in a rising market, the prices of properties could easily have risen by 5 to 10% a year, rendering the premium obtained from en bloc not worth it,” he said.

Another problem the Australian said he faced was that of getting another attractive long-term bank loan. “At 55, I’ll be lucky to get a 10 year loan, so I’ll be forced to pay cash which is painful and restricts my choices and/or take a mortgage with extremely high payments (e.g. $6,000 in monthly payments instead of $3,000).”

What the en bloc condominium owner is worried about is the Loan-To-Value (LTV) ratio. The LTV ratio is the amount of financing that the bank can provide. An LTV ratio of 80 per cent (the maximum possible for a home loan) means the bank can loan you up to 80 per cent of your property price or valuation, whichever is lower.

Not everyone will get the maximum LTV of 80 per cent. If you have an outstanding home loan, for example, your LTV can fall to 50 per cent. Likewise, older properties, the age of the borrowers, and your credit score can all cause the bank to lower the LTV.

To get the maximum LTV, you must meet two age-related conditions: first, your loan tenure must not exceed 30 years (for Condo and 25 years for EC) . Second, your loan tenure plus your age must not exceed 65 if you want 80% loan.

For example, if you are 43 years old, and you want to get 80 per cent LTV, you must have a loan tenure of only 22 years (43 + 22 = 65). If you are 23 years old and you want to get 80 per cent LTV, your loan tenure still must not exceed 30 years; even if your age plus the loan tenure would fall below 65.

At any rate, note that the maximum loan tenure for private properties is 35 years.

If your loan tenure plus your age would exceed 65, or your loan tenure exceeds 30 years, then the maximum LTV will fall to 60 per cent (this if is this is your Only property). If you also have outstanding home loans on top of this, the maximum LTV will fall further to 30 per cent.

Unfortunately, the LTV may not be the only problem the Australian may face. Singapore’s home loan interest rates are expected to be impacted by the recent Monetary Authority of Singapore’s tightening of the Singapore Dollar exchange rate, as well as the Federal interest rates hike.

https://www.icompareloan.com/resources/home-loan-interest-rates-mas/

The en bloc condominium owner further said that he does not want to downgrade to a Housing & Development Board (HDB) flat. “HDB is NOT an asset that appreciates (and (Singaporeans) are waking up to this – even their own (Government) admitted it,” he said.

He was probably referring to the the public uproar that ensued following HDB’s chief executive’s suggestion that home buyers should pay less for resale flats with shorter leases. “The price you pay (for your resale HDB flat) should (be) commensurate with the lease,” Dr Cheong Koon Hean said at her 2nd Institute of Policy Studies-Nathan lecture.

https://www.icompareloan.com/resources/hdb-chief-shorter-leases-pay-less/

Besides all these hassles, the foreign en bloc condominium owner may also be liable for taxes from the Australian Tax Office. Australian residents are generally taxed on any capital gains they make on overseas assets (for example, when they sell an overseas property, they must report the gain in their tax return).

As his wife is an American, he may use his wife’s name to purchase the next property. Under the United States – Singapore Free Trade Agreement (USSFTA), American citizens do not pay ABSD on the first property they purchase in Singapore. But he reckons that his wife may have tax issues with the Inland Revenue Authority Of Singapore if she does so.

The biggest problems for the en bloc condominium owner (as are with most buyers affected by the collective sale) are location and the size of his prospective new property. “The location we are in is hard to buy in again, and yet it’s an ideal location near my son and my daughter’s schools,” he said.

He added: “I have a large 1500 sqft place (and such large apartments) barely exist now.”

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

He pointed out that he would have sold his current apartment at some point in time, but the en bloc attempt will force him to make a new purchase; and he would have to wait 3 – 4 years more before disposing of the new apartment, as he would be deterred by the Seller’s Stamp Duty.

Being a Permanent Resident, he is also bound by the Central Provident Fund (CPF) rule. This rule will be a big disadvantage for him. He explains:

“The CPF board will grab my housing monies to repay CPF and I will turn 55 in the process which means I cannot use CPF again for the next purchase as my Ordinary Account will become Retirement Account (which I can’t touch). That’s (almost $200,000) of purchasing power gone.”

He laments that his $50,000 renovation for his current condo unit is also wasted.

“The whole en bloc has been highly contentious and emotional, (leading to) broken friendships (which) brought calamity upon our heads,” he said.

He added that although his condo sales committee got 81 per cent to consent to the collective sale, they have forgotten that a relatively large number people in the condo do not want it.

—

If you are home-hunting, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and a promotional home loan. Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com.