This article has also been featured on The Edge Property

Singapore’s owes its industrial transformation and modern day success to Dutch economist Dr. Winsemius who in 1960 led the United Nations team to examine Singapore’s potential in Industrialization. Dr. Winsemius presented a 10-year development plan to transform Singapore from an already successful entrepot into a centre of manufacturing and industrialization. With his help, Singapore also attracted Shell and Esso to establish refineries here and Philips to set up manufacturing. He continued to work as Chief Economic Advisor from 1961 to 1984 working hand-in-hand with Goh Keng Swee, Lee Kuan Yew and Goh Chok Tong to develop Singapore into the economic success it is. (Reference 1: Wikipedia)

Early stages of industrialization was focused on labour intensive industries and increasingly move upstream into higher value-added industries and eventually with the advent of electronics, moved into High technology. (Reference 2: EDB)

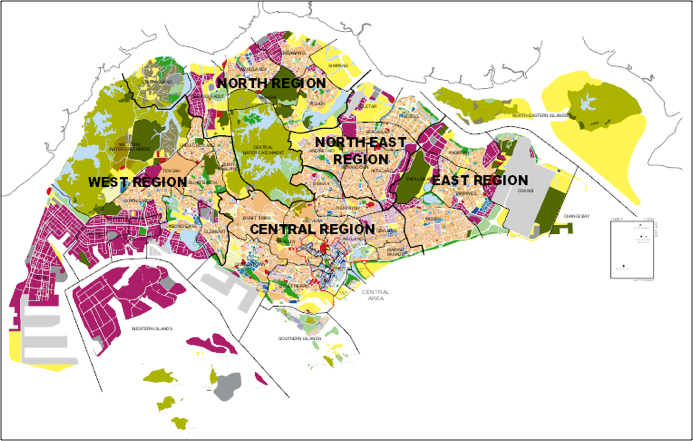

The early part of the industrialization was located in Jurong. Comparing the 2014 Master plan versus the 2003 master plan, Industrial B2 zone has spread out into the North East region and also added new zoning in the West region, north of Jurong. This is in line with the aim of Urban planning to bring jobs closer to homes and to reduce commuting time.

Map 1: Master plan 2014, (Source: URA)

Map 2: Master plan 2003, (Source: URA)

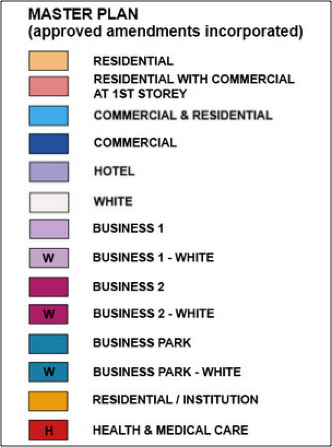

Map 3: Legend of Master plan (Source: URA)

The largest Industrial Business 2 (B2) zone is concentrated in Jurong with some scattered in other areas, such as Woodlands and near the airport. Certain businesses (industries) that are deemed a potential disturbance to residents are subjected to a 50m nuisance barrier and placed under B2 zones.

Blurring of Lines between Industry and Commercial

The restructuring of industries across the world shifts from heavy industries to a focus on light industries such as Information and Telecommunication, knowledge industry and cloud computing. The definition of “industry” is changing. Production no longer simply meant having people sit beside lathe machines milling precision parts. A modern day “Industry” could also mean having teams of people tapping profusely into the laptop doing programming and coding. There is a blurring of lines between these industries and that of other commercial activities, and development to be used for offices.

Commercial zones are defined by URA as “…Area used or intended to be used mainly for commercial development.”

Such as developments to be used for: –

- Offices

- Mixed Uses (e.g. Office/Shopping/Cinema/Hotel/Flat)

- Convention/Exhibition centre, commercial school

- Bank

- Market/Food centre/Restaurant

- Cinema

- Entertainment

- Foreign Trade mission/Chancery

- Recreation club.

Is Commercial A Premium Compared To Industrial Zone?

Commercial zones are premium and concentrated in Central Business District (CBD), there are also commercial zones located outside of category 1 where rentals are cheaper.

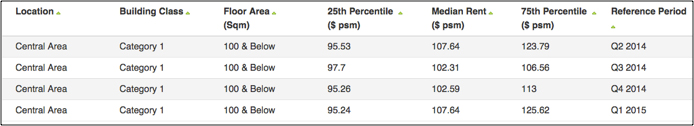

Table 1: URA, Commercial Offices – category 1 median rentals are ~$107 psm or about ~ $10.09 psf. Q2 2014, Q1 2015.

Category 1 (refers to city core), https://www.ura.gov.sg/realEstateIIWeb/comm/rentalOffice/submitSearch.action

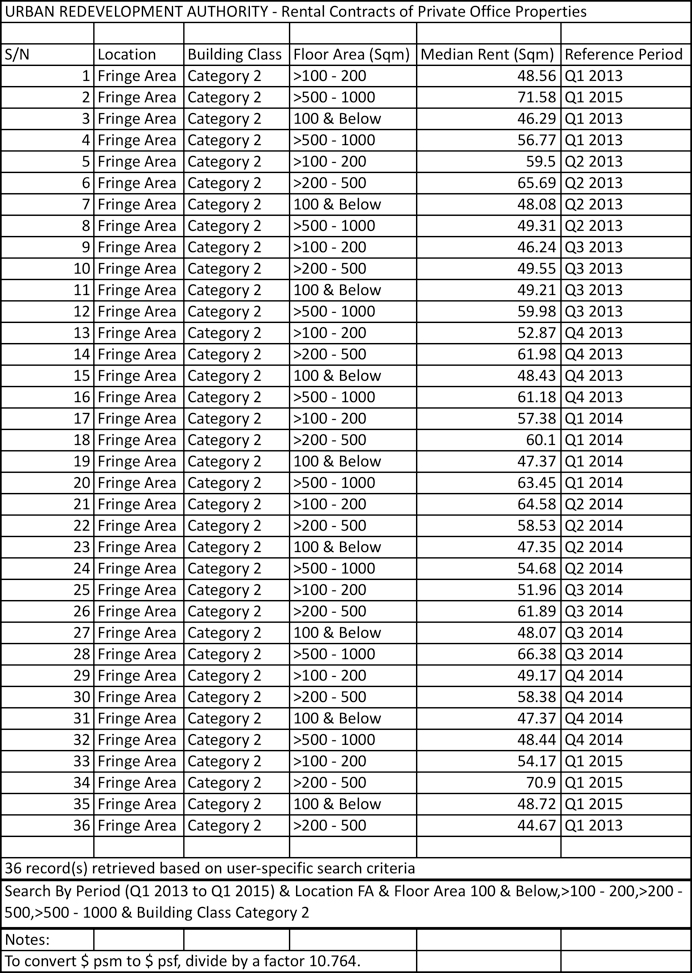

Category 2 (refers to properties outside of category 1) median rentals (Appendix 1) are in the range of $47 to $70 psm or about $4.37 to $6.5 psf.

We randomly selected District 3 and 5 for comparison. The Industrial median rentals in the city fringe Queenstown, Tiong Bahru, Clementi New Town comes in at $19.87 to $32.82 (Level 2 or higher) psm or $1.85 to $3.05 psf.

Postal Districts:

03 – Queenstown, Tiong Bahru,

05 – Pasir Panjang, Hong Leong Garden, Clementi New Town,

Table 2: JTC, 2015Q1 Median rentals in city fringe District 3 and District 5

(http://cwapps.jtc.gov.sg/applications/IndustrialStatistics/Rentalstatistics.aspx)

There is no real apple-to-apple comparison. For the purpose of this study, we assume that Category 2 (fringe area) of commercial zoneswould be a rough approximation to Industrial B1 properties in D3, D5, one of whichis in the city fringe.

Commercial properties still command a premium rental of $4.37 to $6.5 psf compared to industrial B1 properties at $1.85 to $3.05.

Chart 1: Commercial offices category 1, 2, and Industrial Fringe (District 3, 5) rental price (per square feet)

(Source: URA, JTC, iCompareLoan.com)

Table 3: Rental table of commercial offices category 1, 2 and Industrial fringe District 3 and 5 prices factored with ancillary use (Source: URA, JTC, iCompareLoan.com)

As industrial properties can only have 40% of the space for ancillary use, hence we computed an implied rental based on only 40% of ancillary usage for Industrial properties.

Between Commercial Cat 2 – Upper versus Industrial Fringe – Upper range

• A comparable $6.5 versus $7.625 psf of rental

Between Commercial Cat 2 – Lower versus Industrial Fringe – Lower range

• A comparable $4.37 versus $4.625 psf of rental

If you compare only the usable ancillary space allocated for office use, the industrial properties are almost on par with commercial offices, in fact industrial property is slightly more expensive if we did not factor the other usable 60% space for industrial use.

However Industrial B1 properties confer the advantage of using the rest of the 60% space for designated industry use. This pretty much lowers the cost of the overall space.

Commercial Activities Redefined As Industrial Use

Industrial B1 zones are scattered across Singapore interspersed amongst commercial and residential areas.

In the past, industrial buildings are dreadful looking with dirt, grime and noise.

Newer industrial buildings such as those by Ascendas are well built with many amenities.

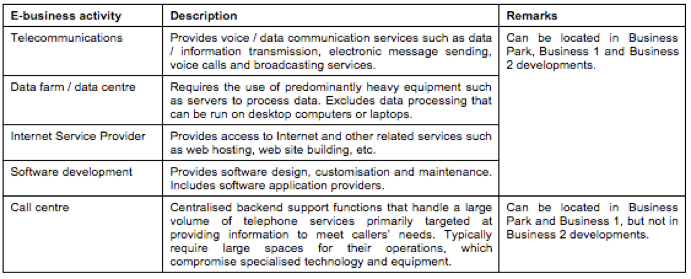

Some E-business activities have been regarded as Industrial uses and can be considered as part of the 60%.

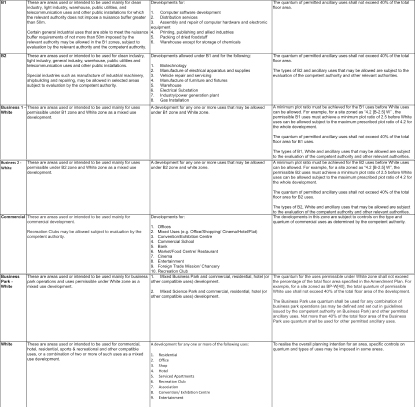

Table 4: E-Business Activities regarded as Industrial use (Source: URA, Non-resi-handbook, Reference 3)

As a result of this classification, many banks and insurance company’s call centres, IT centres, Data centres have been moved to Business Parks, Industrial B1 and B2 zones such as those in Kaki Bukit, Changi business parks. Many of these activities were previously considered supporting office functions of Banking and Finance are now considered “Industry”.

With these new definitions, it eases business cost pressures on such commercial activities, but shifted demand into Industrial properties.

Demand From Commercial Activities Diverted To Industrial Properties

Many newer industrial properties sitting on Business 1 (B1) zones are increasingly sophisticated and looking like Commercial buildings. In fact you might not even tell them apart unless you refer to the URA Zoning Master Plan.

Since industrial B1 zones are better located nearer to housing estates or regional centres and no longer mainly in Jurong, there is substantial advantage to break the zoning rules.

In 2009, retailer Mustafa has been issued with a writ of summons for operating a supermarket in the warehouse in Kallang Pudding road. Due to the rental price differential between retail and warehouse zoning, there is a lot of temptation to break these zoning rules.

In 2012, CEA issued a circular (Reference 4) to property agencies and Key executive officers warning agents against misleading marketing of Industrial properties in which agents purportedly talked up the potential of using the industrial properties.

In fact, many such breaches would never be found, as inspection would be costly and time-consuming. On top of that, the lines are greyed between commercial activities and industrial activities, meaning that it can be debatable whether there is an actual real breach or not. There is huge benefit to arbitrage the difference in rental yields, hence a lot of incentive to breach the zoning rules, softly or blatantly.

And in the URA circular issued to KEOs on CEA Practice (Reference 4), where URA stated, “However, URA recognises that certain non-industrial activities, such as ancillary offices1, staff canteens and showrooms are needed to support the predominant industrial uses.”

And in this circular, URA clarifies that it allows Showrooms to support predominant industrial uses. Hence giving Industrial B1 properties the legality to become commercial showrooms. The rental prices are even better for commercial showrooms. Allowing for showrooms in Industrial B1 zoned properties will significantly enhance the valuation for such industrial properties, especially those at level 1. Many showrooms tends to have on-the-spot retail functions, which are of course not allowed.

Conclusion

• E-businesses activities are being reclassified as Industry use and allowed in Industrial B1 zone. Many banks and financial institution’s back office, call centres, IT centres, data centres have moved to Industrial B1, B2 and business parks in search of lower rental. In essence this moves some of the commercial demand to industrial.

• There would be no benefit for a business to use only 40% of the space for ancillary use such as an office if they do not have a significant industry component to use up the 60% of the space. For example, there may be some industry where their Industry component may only use up 20 to 30% of the Industry space, while the office is 40%. Therefore there would not be substantial rental savings.

• Businesses such as IT, programming and info-communication would benefit the most as these industries would use up the full 60% for industry and 40% for offices. In fact you would walk into an such a factory/unit and you would not even feel its an “Industry”, rather there would be neat rows of office partitions and people working on their computers, just like another other commercial offices.

• As Industrial B1 zones are spread out across the island and no longer concentrated in Jurong (which is generally regarded as inconvenient location), there is a growing benefit to arbitrage the rental yield whether legally or illegally. The fact that URA sees a need to issue a Circular to all property Key executive offices (KEOs) as well as developers (Reference 3) attests to this growing segment of Commercial looking Industrial properties.

• Allowing for Showrooms within Industrial B1 properties will indirectly compete with Commercial retail zones. This creates a bigger arbitrage opportunity as Commercial retail has even higher rental compared to Commercial Offices.

• Now that Singapore has become the world’s costliest city, perhaps with these rules in place, Singapore could in time become the place where you see the most beautiful industrial buildings. Ascendas REITs, Mapletree logistics and various large scale industrial property owners are likely beneficiary of these policies with rents generally around $3 to $5 per square feet.

URA has an unenviable task of managing Master plan zones as it will not be easy. URA has done a great job in urban planning and zoning and I believe will continue to do so in the future. It just has to gradually tweak the rules to ensure that there is not too great an arbitrage opportunity between commercial zones and industrial zones. Enforcement may be an option, but unlikely to be economical.

References: –

1. Wikipedia, Albert Winsemius (1910-1996),https://en.wikipedia.org/wiki/Albert_Winsemius

2. EDB,

https://www.edb.gov.sg/content/edb/en/about-edb/company-information/our-history.html

3. URA, Non-Resi-handbook, Some aspects of e-businesses considered as industrial,

http://www.ura.gov.sg/circulars/text/non-resi-handbook.htm

4. URA,Circular No: CEA Practice Circular 3/12 URA/PB/2012/08-DCG, Misleading Marketing of Industrial properties

, 20 Jun 2012, http://www.ura.gov.sg/uol/circulars/2012/jun/dc12-08.aspx

Extract: “To ensure that limited industrial land is used mainly for industrial uses, the URA requires at least 60% of the total floor area of an industrial development to be used for core industrial activities. However, URA recognises that certain non-industrial activities, such as ancillary offices1, staff canteens and showrooms are needed to support the predominant industrial uses. Hence, such supporting non-industrial uses, together with other ancillary areas (e.g. lift lobbies and circulation spaces) are allowed to occupy up to 40% of the total floor area of an industrial development.”

APPENDIX

1. URA, Fringe area, Category 2 Median Rental for Periods Q1, 2013 to Q1, 2015. (https://www.ura.gov.sg/realEstateIIWeb/comm/rentalOffice/submitSearch.action)

Definition:

Category 1 refers to office space in buildings located in core business areas in Downtown Core and Orchard Planning Area which are relatively modern or recently refurbished, command relatively high rentals and have large floor plate size and gross floor area. Category 2 refers to the remaining office space in Singapore which are not including in Category 1.

2. URA Zoning description

What does iCompareLoan.com do?

www.iCompareLoan.com is a Loan Portal and a Mortgage & Loan broker, helping property buyers and home owners to get the best fit home loan and business owners obtain Business loans for business expansion.

Home Loan Report ™ is Singapore’s first Cloud based Home Loan Report ™ platform to be used by Property agents, financial advisors as well as other Mortgage brokers to prepare reports for their customers.

Home Loan Report ™ – Enterprise allows a property agent’s website to immediately add a loan section. Improve your Google Ranking, let’s viewers increase Time-on-site. Property or Finance sites that deployed Home Loan Report ™ – Enterprise loan section sees viewers stay on their site longer by between 30% to 350% after 4 to 8 weeks of installing the Embedded Loan Plugins.

About PAUL HO:

Paul holds an a B.Eng(Hons) Aberdeen University (UK) and a Masters of Business Administration (MBA) from a Macquarie Graduate School of Business (MGSM) Australia. He also serves as current President of Macquarie University Alumni Association of Singapore and Hon. Secretary of British Alumni.

He is founder of www.iCompareLoan.com, his articles have been syndicated/featured on STproperty, iProperty, BTInvest, TheEdgeProperty, Propwise, Propquest, Yahoo and TheOnlineCitizen amongst many other sites.

He has also given speeches, guest speeches, trainings and/or seminars at NUH Lunch time talk, iProperty, David Poh and Associates, Getty Goh’s Ascendant Asset property, NTU (Guest Lecture on SEO), Panel discussions at GPS Alliance, C&H, Skillup just to name a few.

He is passionate about helping people enhance their wealth and in making money work harder for them.

Copyright © – www.iCompareLoan.com

For advice on a new home loan.

For refinancing advice.

Download this article here.