The Urban Redevelopment Authority (URA) and the Housing & Development Board (HDB) today (Oct 31) released two residential Government Land Sales sites and one White site for sale today under the 2nd half 2018 Government Land Sales (GLS) Programme. The URA site at Kampong Java Road and the HDB Executive Condominium site at Tampines Avenue 10 are launched for sale under the Confirmed List while the URA White site at Marina View is available for application under the Reserve List.

Together, these three Government Land Sales sites can yield about 2,000 residential units.

Table of Contents

In addition to residential use, the White site at Marina View is envisaged to be a mixed-use development with about 540 hotel rooms, complemented by supporting retail and food and beverage uses. The tender for the two land Government Land Sales sites at Kampong Java Road and Tampines Avenue 10 will close at 12 noon on 15 January 2019 at URA and HDB respectively.

Commenting on the Government Land Sales sites, Colliers International noted that developers have generally been more circumspect about land acquisition following the roll out of new cooling measures in July this year.

“The government land tenders which had closed in September saw more subdued bidding – with the exception of the Canberra Link Executive Condo (EC) site,” it said.

Colliers added that it expects developers to continue to adopt a cautious stance in evaluating this latest slate of Government land sales sites that have been launched.

Ms Tricia Song, Colliers International’s Head of Research for Singapore, said: “Given the dearth of unsold ECs in the market and their continued popularity among the “sandwiched class”, we would expect the Tampines Avenue 10 EC site to attract keen interest from developers. Meanwhile, response to the Kampong Java site could provide an indication of developers’ confidence in the high-end home market after a spate of collective sales in the area and the recent announcement on revised unit size guidelines. The Marina View white site which has been launched for application on the Reserve List is eye-catching owing to its attractive location within the Downtown Core.”

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

She commented further saying:

“Kampong Java:

The first private residential site to be launched on the Confirmed List since the minimum average unit size guidelines announcement, the tender for the plum site in Kampong Java Road – in prime District 9 – would be a litmus test. Based on the map of Central Area, this site sits just outside of the Central Area and thus should be subject to a minimum average unit size of 85 sq m come 17 January 2019. However, this site also presents a relatively palatable size which can potentially house 380 units (assuming average size of 85 sq m), and sufficient room for developers to calibrate the design and unit layout to cater to a wide group of buyers. In addition, it is near the Newton MRT and several good schools

Bukit Sembawang bought the adjacent smaller freehold Makeway View via a collective sale in March for SGD168 million or SGD1,626 psf ppr. There are no recent launches nearby – freehold Newton One, Miro and Newton Edge transacted in the secondary market at SGD1,600-2,000 psf year-to-date 2018. Hence we estimate for this fresh 99-year leasehold site, developers could target a SGD2,100 psf average selling price and thus a land bid of SGD1,350 psf ppr or SGD470 million.

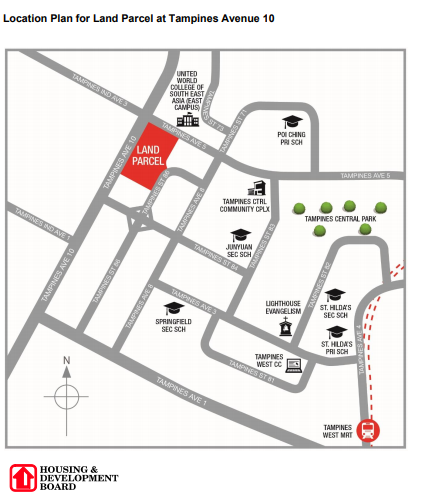

Tampines Ave 10 (EC):

The last EC plot tendered in the vicinity was the site for the current Arc at Tampines in November 2010, which saw six bids with the top bid of SGD302 psf ppr. As the minimum occupation period of five years is not up yet, there were only a couple of secondary market transactions this year at SGD909-942 psf. Nearby, new private condo project The Tapestry has sold 530 units or 62% as of end-September 2018 at an average price of SGD1,350 psf since its launch in March 2018.

We expect this EC plot to be popular, given the robust bidding at the recent EC land sales at Anchorvale Crescent and Canberra Link which saw seven and nine tight bids (SGD576 and SGD558 psf ppr) respectively, unperturbed by July’s cooling measures. The new minimum average unit size of 85 sq m should also have minimum impact for ECs as ECs are targeted at families in the first place and the average unit size suggested by the development cap of 700 units is well above the 85 sq m. We expect seven to nine bidders and a top land bid of SGD560 psf ppr or SGD420 million.

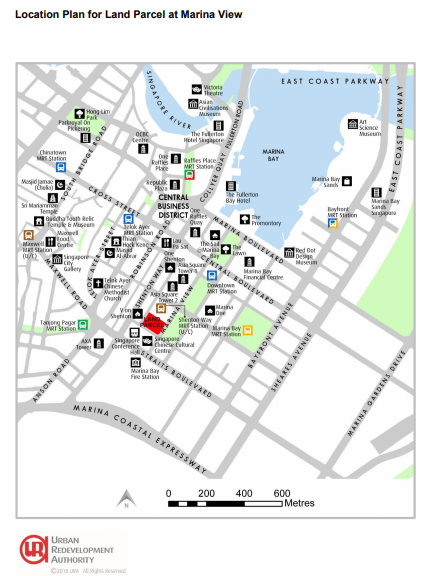

Marina View (available for application under Reserve List):

The White site at Marina View is envisaged to be a mixed-use development with about 540 hotel rooms and 905 housing units, complemented by supporting retail and food and beverage uses. Sitting next to the future Shenton Way MRT station and flanking the Marina Bay and a rejuvenating Shenton Way, we expect this site to offer an attractive proposition to developers with hotel interests or developers with varying interests can form a Joint Venture. The whole development excluding the GFA for residential use, shall be held under a single strata lot.

Land Use: Plot 1: White (Residential and Hotel use with complementary uses)

Plot 2: Underground Pedestrian Link

Maximum permissible GFA and use quantum:

- Maximum GFA : 101,629 sqm

- Minimum GFA : 91,467 sqm

- Minimum 51,000 sqm is to be for Residential use. Service Apartments will not be allowed within the minimum Residential quantum.

- Minimum 26,000 sqm is to be for Hotel rooms and Hotel-related uses.

- Maximum 2,000 sqm for optional Office use.

- Maximum 2,000 sqm for Commercial use: Shop and Restaurant use; and b) Outdoor Refreshment Area (on the first storey only); and c) Other Commercial uses (excluding office, commercial school, hotel ballroom / banquet room and hotel meeting room / function room) such as those for fitness centre, gym, medical clinic, bar, pub, massage establishment etc. as may be approved by the Competent Authority under the Planning Act (Cap. 232)

Given the numerous permutations of the final product, we estimate the top bid could range from SGD1,380 – 1,600 psf ppr or SGD1.5 – 1.75 billion.”

https://www.icompareloan.com/resources/singapore-banks-transferring-interest-volatility-risks-consumers/

Getting A New Home Loan or Refinance in Singapore Is Now Easier Than Ever

If you are eyeing private properties to capitalise on the strong property prices growth following announcement of the Government Land Sales sites but unsure if you have sufficient funds, you can get a mortgage loan Singapore quickly through iCompareLoan Mortgage Broker. Having helped thousands of Singaporeans acquire homes, you can trust the firm to walk with you every step of the way. You can easily calculate mortgage affordability, determine favorable interest rates and compare Singapore home loans from different lenders to identify a package that best fits your home purchase needs.

It doesn’t really matter whether you are applying for a loan for the first time or second subsequent time. The broker will recommend to you the best lenders in town with a solid reputation and with the highest success rates in terms of loaning. And since their services are absolutely FREE, you’ll save more as you enjoy greater convenience and faster loan acquisition.

For advice on a new home loan.

For refinancing advice.