As Senior Minister Minister Goh Chok Tong accurately noted in 2010, HDB dwellers prefer to move to condominiums and statistics suggest that the trend of moving to private apartments has continued.

“Singapore achieved rapid economic growth through the 70’s, 80’s and 90’s. Incomes went up. So did the aspirations of the young. By the 90’s, the Singapore Dream had been elevated to the 5 Cs – cash, credit cards, car, condominium, and country club membership. Owning a HDB flat was the norm. So Singaporeans dreamt of owning condominiums.” – Goh Chok Tong

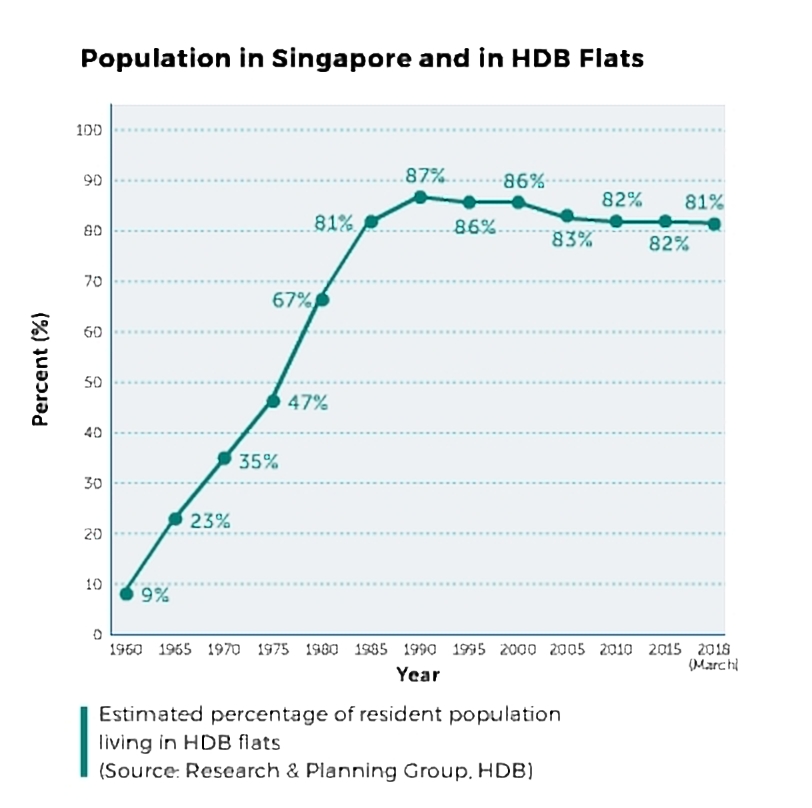

Statistics released by the Housing & Development Board (HDB) in its latest Annual Report shows that the trend of HDB dwellers has been gradually trending downwards.

Table of Contents

In releasing its Annual Report for Financial Year (FY) 2017/ 2018 today (Oct 22), the Housing & Development Board (HDB) said that it launched 4 Build-To-Order (BTO) exercises in this period, comprising 19 projects and 17,192 flats across mature and non-mature towns such as Geylang, Sengkang, Tampines and Woodlands. Another 7,347 flats located across various towns were offered in 2 Sale of Balance Flats (SBF) exercises.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

A new sales mode, Re-Offer of Balance Flats (ROF), that pools together flats not selected in previous SBF exercises, was also launched in this period. A total of 2,100 flats was offered under 2 ROF sales exercises where 95 per cent of the flats were set aside for first-timer families.

HDB completed a total of 31,325 new flats in the FY. These comprised 26,771 BTO units, 1,045 units under the Selective En bloc Redevelopment Scheme (SERS), and 3,509 rental units. As of 31 March 2018, 65,957 flats, comprising 62,100 BTO and SERS flats and 3,857 rental flats were under construction.

Commenting in the Annual Report, HDB chairman Bobby Chin Yoke Choong said: “This Financial Year (FY), HDB continued to put in place policies and measures to ensure that public housing remained within reach of Singaporeans. With an eye on the longer-term demographic and population trends, HDB carefully calibrated its building programme to provide a stable supply of new flats to meet new needs”

Chief Executive of HDB Dr Cheong Koon Hean said that HDB had been successful in meeting the housing aspirations HDB dwellers.

“In meeting housing aspirations, we offered about 17,200 flats under the Build-To-Order (BTO) exercises and another 7,300 flats under the Sale of Balance Flats (SBF) exercises across mature and non-mature estates this FY. To help young couples buy their first homes earlier, we have commenced the construction of 1,100 BTO flats in Sembawang, Sengkang and Yishun, ahead of their sales launch in the second half of 2018. The first batch of BTO flats with a shorter waiting time of about 2.5 years from time of application will come with an open kitchen concept, where feasible, which is popular among young families.

Another 2,100 flats were offered under the new Re-Offer of Balance Flats (ROF) sales mode, which comprised unsold units from previous SBF exercises. This new sales mode for unsold balance flats enabled those with more urgent housing needs and are less particular about location to have quicker access to a flat.”

Commenting on HDB’s latest Annual Report Ku Swee Yong, Chief Executive Officer of International Property Advisor, said that the total stock of HDB flats increase is the largest in 18 years. Writing in his Facebook, he noted: “Total housing stock (HDB, Executive Condominium and private residence) increased 193,000 units in the last 4 years while total population (which include foreign domestic workers and home-caregivers) increased 169,000 in the same period. Rentals continue to slide even as buyers continue to flock to new launches. Really, how many more homes do we need even as deaths climb while births stagnate?”

https://www.icompareloan.com/resources/new-launch-condo-home-loans-cooling/

An earlier forecast by DBS Research suggested that should the population of Singapore grow to 6.5 million in 2030, annual demand will range from 12,000 to 13,500 units – the majority coming from HDB dwellers upgrading. Given the stagnation of HDB resale flat prices, many do not now see HDB as an ever-appreciating asset. This could be one factor why HDB dwellers are moving to private apartments.

If the estimated percentage of resident population living in HDB flats will continue its downward trend is anyone’s guess. But given the aspiration of HDB dwellers to acquire a private property, and given the general affluence of the Singaporean society, it is quite likely that the trend will continue.

How to Secure a Home Loan Quickly

If you are HDB dwellers and want to upgrade to condominiums, but unsure if you qualify for mortgage loans, our mortgage consultants at iCompareLoan can set you up on a path that can get you a home loan in a quick and seamless manner.

Our consultants have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. You can find out money saving tips here. You can get more resources for buying, selling and refinancing by browsing through our website, iCompareLoan.

Owning a private apartment is a common aspiration in Singapore. Or a sign that you’re one of the ‘miserable lot’ with a household income of, say, $12,001 a month – then it’s your only option because you can’t buy a HDB flat. Well don’t panic! Whether you are looking for a new home loan or to refinance your existing one, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

If you need advice on a new home loan.

If you need refinancing advice.