Landed property refers to residential property where the owner owns the land as opposed to a slice of a multi-unit condominium or apartment occupying the same plot of land.

Non-Singaporeans and Permanent Residents need approval from the Singapore Land Authority to buy landed property in Singapore.

Landed property also falls under the category of private residential property, thus Singaporeans can’t own both a landed property and a HDB.

Image Credits: Landed Property along Coronation Road, Paul Ho, www.iCompareLoan.com

Checklist:

- Should you invest in landed property?

- Types of landed property

- What to look out for?

- What are the costs involved?

- Can you afford the property?

- House hunting

- Decide on home loan

- Making an offer for the property

- Appoint the lawyer

- Complete property purchase

- Should you invest in landed property?

Pros:

- With limited supply of land in Singapore and long-term demand on an uptrend, landed property is exclusive and sought after by both home owners and investors.

- Each property is unique. You are free to choose the architecture design of the house.

- No mandatory maintenance fees.

- You own the land so you have control over the quality of roofing and plumbing works on the upper floors instead of worrying about plumbing issues of your neighbour on the upper floor.

- For detached houses, you have the luxury of space for building a garden/pond/waterfall/car porch and significant distance from your neighbour so it is relatively free from noise from your neighbour.

Cons

- Maintenance and renovation can be costly.

- Susceptibility to pests and stray animals.

- Unlike high rise condo units, landed property are low rise and hence may not enjoy as good an air flow or view.

- Typically involves larger cash outlay.

- If you own landed property, you can’t buy HDB.

- If you don’t drive, it can be inconvenient as some property are located about 15 min walk away from nearest bus stop.

- Types of landed property

- Terrace houses

- Detached houses, including good class bungalows,

- Semi-detached houses, and

- Strata-landed houses or cluster housing which is a hybrid of landed and non-landed property.

Comes in 99- year, 999-year lease or freehold.

- What to look out for?

- Location

Proximity to MRT, amenities?

Along major highway or busy street with restaurants and pubs?

- Look out for cracks in the house as it indicates whether the property has weak foundation and can be costly to fix.

- Soil Condition. Look around the estate whether there are any neighbours that has built 2 floors or 3 floors. If possible, strike a conversation with them to understand the soil condition. (Start by asking: May I know when you build your house, did you use piling or footing?) Certain parts of Singapore such as the bay area are made up of clay and mud, so the land condition is not great, you may incur a lot of cost to do “Sheet piling” to prevent soil movement as well as very deep piling for the pillars. This is very expensive. Some parts of Singapore such as in Thomson or Upper thomson, the soil is also very soft, constructing there will be costly. As you will not want to do a SOIL TEST as it will cost you thousands and nobody will allow you to drill a hole into their ground, you can simply ask around the neighbours for an indication.

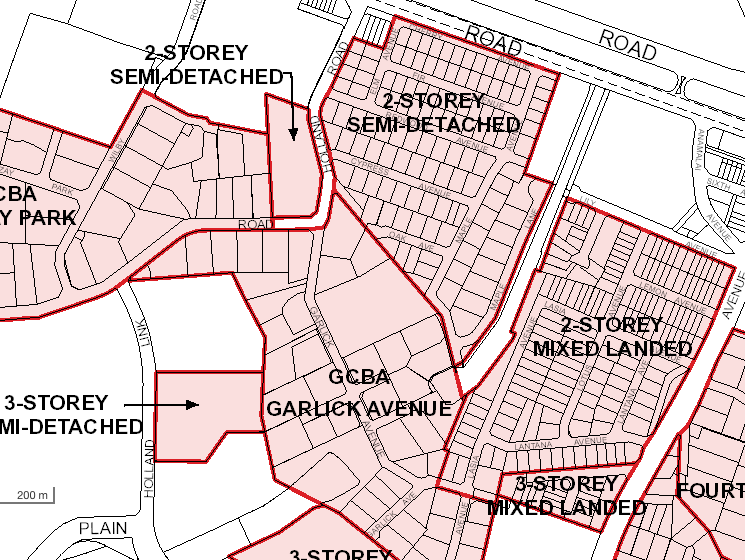

Image Credits: URA Map, Screen shot of Landed Area Housings Plan.

Note: There are zones for 2-Storey or 3-Storey, etc.

- Check if the roof leaks after a rainstorm as it can be costly to fix if you don’t intend to do up the whole house from scratch.

- Some owners may be willing to sell at an attractive price if the house is old and this could allow you to buy cheaply and rebuild the house according to your preferences.

- Check out for infestation by termites or other problems.

- Water Pressure. Check out what is the elevation of the land. For example, the height of the land is 15m above mean sea level (AMSL), and you build 3 storeys. Each storey is 4.5m for example. At the 3rd level floor slab, your AMSL will be 24m and at the attic your height will be 28.5m, if you place your shower head at 2m, the height of the shower head will be 30.5m above mean sea level. (Note: Above around 20 or 25m above sea level, the water pressure from PUB will not be sufficient. You will then need to build a water tank at level 3 or level 3+ Attic and you will also need to invest in a water pump. All these could easily add $20,000 to $30,000 to the cost and you will need stronger pillars and foundation that will add tens of thousands to the construction cost)

- Check out what is the number of floors allowed under the landed planning region so you will know how much Build-up area you can create for New Erection or Re-construction of the property. Land zoned for 3 floors allows you to build 3 floors plus attic, hence the land tends to be more expensive. Land zoned for 2 floors allows you only to build 2 floors plus attic, hence tends to be cheaper.

NOTE: There is No plot ratio for Landed properties. If your property agent tells you that Landed Property has no plot ratio, do not think that they are cheating you. Landed property goes by Planning restrictions and guides. I.e. Height Restrictions such as Above mean sea level (AMSL), number of floors and offsets from the perimeter of the land and individual floor height restriction.

- What are the costs involved?

Depending on what you are buying, you will need to include the following costs:

- Renovation – This may account for a significant percent of costs depending on whether the property you buy is an old or ready to live in. (Renovation is called, “Amendments and alterations”)

- or Reconstruction or New Erection.

- Insurance

- Stamp duty

- Mortgage payment interest

- Legal fees

- Agent fees

- Can you afford the property?

Similar to other forms of housing, do check your affordability before house hunting.

Apart from cash and CPF, you need to know how much you can borrow.

There are two ratios which can give you a rough gauge of the loan you can obtain from the bank.

– Total Debt Servicing Ratio (TDSR), Loan To Valuation (LTV)

The TDSR, set by the Monetary Authority of Singapore (MAS), puts a limit on the amount you can borrow: Your monthly repayment on all debt (including personal, car, home, credit card, etc) should not exceed 60% of your gross monthly income.

You can click here to calculate.

Inputs required include:

- Monthly fixed income

- Annual variable income

- Pledged assets

- Non pledged assets

But please do not take this as definite. Banks can choose not to lend for a number of factors which are not within your control.

LTV, which is the loan quantum offered by banks, is typically at 80% for first time home buyers.

- House hunting

This is driven by personal preferences and other factors. Do take your time to do proper research eg visiting the place at different times of the day and getting to know the neighbourhood.

- Decide on home loan

Unless you are flush with cash, likelihood is you will need a loan. Furthermore, if you are able to achieve an investment rate higher than mortgage loan rates, then it may make sense to borrow even if you have cash.

There is a wide array of loan packages available in the market, which are mainly the fixed or floating rate plans. To read more about fixed vs floating rate loans, please click here.

Before committing to any property on loan, it is best to get an Approval-in-principle (AIP), which is a conditional approval for a loan.

If you submit all the required documents, the AIP could be obtained in 3 to 5 working days. But as this involves administrative work on the part of the bank, please ask for an AIP only when you have thought through carefully on the loan you are going for.

For advice on the home loan most suited for you, you can contact us here.

- Making an offer for the property

After narrowing down your choices and house hunting and making sure you can afford the property, you are ready to make an offer!

Do read the option to purchase carefully and consider all the above factors on the checklist before signing.

- Appoint a lawyer

You need a conveyancing lawyer to do the paper work involved in a property purchase and when getting a home loan. This includes lodging a caveat with the Singapore Land Authority to register your legal interest in the property, reviewing the option to purchase, liaising with the bank’s lawyer to ensure smooth disbursement of loan.

If you are getting a loan, the lawyer needs to be on the panel of lawyers of the borrower – bank/CPF.

- Complete property purchase

The final step is to complete the property purchase where all the payment of the agreed and contracted property sale price is made to the seller and the ownership of the title is transferred from the seller to the buyer.

Buying a landed property in Singapore can be daunting. We can help you through this process. Contact us here.

For a guide to property investing, click here.

To read up on key considerations before buying a property in Singapore, click here.

To read up on where to buy property for rental in Singapore, click here.