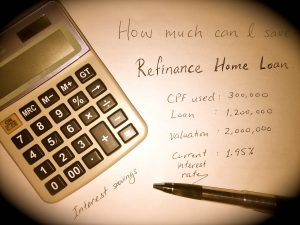

Diligence home loan comparisons to assess best fit may give you better savings over the long-run

HOME LOAN COMPARISONS SHOWS YOU WHY DO DIFFERENT HOME LOANS OFFER DIFFERENT RATES?

Table of Contents

If you have been shopping around for best home loans you may have noticed that different banks offer different rates and that even these may greatly vary at different points in time. The one big reason why this is so is because mortgages are complicated business and in this industry, there is no such thing a ‘one-size-fits-all’ approach.

From local and foreign banks, to financial institutions, and credit cooperatives, there are many players in the mortgage business. These players have different amounts of funds at their disposal at different points in time, and based on supply and demand, these lenders offer different rates and repayment schemes.

The better known names of these lenders may offer higher rates in exchange for their perceived trust and familiarity of their brand. While smaller players may offer near-rock-bottom rates just to stay in contention with the ‘big boys’. Whatever it may be, there is big competition among the mortgagees and this is good news for the mortgagor.

HOW DO I DETERMINE WHICH RATE IN THE HOME LOAN COMPARISONS IS GOOD FOR ME?

The industry players offer different rate types such as 1-month Singapore Interbank Offered (SIBOR), Swap Offered Rate (SOR), 18-month Fixed Home Rates (FHR18), and floating rates.

SIBOR and SOR are open to public scrutiny as they are determined by the interactions between multiple banks. These rates are therefore quite popular among home buyers as they offer transparency and security for the mortgagors.

Fixed Home Rates (FHR) means the interest rate of the property loan is pegged to the bank’s fixed deposit rate. The FHR is usually followed by a number (such as 18). The number denotes the average fixed deposit rate over a given period. This means that the FHR 18 is pegged to the lender’s 18-month, average fixed deposit rate (which would differ from FHR9, and so forth).

There are some inherent risks in FHR as the mortgagee can unilaterally exercise control over the interest rates, thereby increasing costs for the borrowers. But financial institutions are often not very inclined to raise such rates because by doing so they increase costs to themselves.

Floating rates which are usually offered with a ‘lock-in’ period may charge lower interest at the outset, will fluctuate on a daily basis as the SIBOR or SOR rates move up or down. As such, floating rates could rise above the fixed rates or could drop even lower.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

HOME LOAN COMPARISONS AND DIFFERENT MORTGAGE RATES FOR DIFFERENT BORROWERS

When doing home loan comparisons, be mindful that not everybody qualifies for the same mortgage rates. That’s because lenders use different tools and models for assessing risk, and for pricing loans based on the perceived risk the borrower brings. The interest rates your mortgagee offers you are partly determined by your credit score, your debt to income ratio, and the amount of money you were planning to put down on the loan. These are some of the strongest factors that influence rates (though they’re not the only ones).

The bottom-line in home loan comparisons is, different mortgage rates for different borrowers is good news for the mortgagor. But you have to be diligent in comparing the different home loans to see which fits you best and gives you better savings over the long-run.

Mortgage shopping is necessary as home loans are available from several types of lenders — commercial banks, cooperatives and finance houses. Different lenders may quote you different prices, so you should contact several lenders to make sure you’re getting the best price.

You can also get a home loan through a mortgage broker. Brokers arrange transactions rather than lending money directly; in other words, they find a lender for you. A broker’s access to several lenders can mean a wider selection of loan products and terms from which you can choose. Brokers will generally contact several lenders regarding your application, but they are not obligated to find the best deal for you unless they have contracted with you to act as your agent.

When you are mortgage shoppers, whether you are dealing with a lender or a broker may not always be clear.

Some financial institutions operate as both lenders and brokers. And most brokers’ advertisements do not use the word “broker.” Therefore, be sure to ask whether a broker is involved. This information is important because brokers are usually paid a fee for their services that may be separate from and in addition to the lender’s origination or other fees.

A broker’s compensation may be in the form of “points” paid at closing or as an add-on to your interest rate, or both. You should ask each broker you work with how he or she will be compensated so that you can compare the different fees. Be prepared to negotiate with the brokers as well as the lenders.

Be sure to get information about mortgages from several lenders or brokers. Know how much of a down payment you can afford, and find out all the costs involved in the loan. Knowing just the amount of the monthly payment or the interest rate is not enough. Ask for information about the same loan amount, loan term, and type of loan so that you can compare the information.

When doing home loan comparisons be mindful that there is no harm in asking lenders or brokers if they can give better terms than the original ones they quoted or than those you have found elsewhere.

Once you are satisfied with the terms you have negotiated, you may want to obtain a written lock-in from the lender or broker. The lock-in should include the rate that you have agreed upon, the period the lock-in lasts, and the number of points to be paid. A fee may be charged for locking in the loan rate.

This fee may be refundable at closing. Lock-ins can protect you from rate increases while your loan is being processed; if rates fall, however, you could end up with a less-favorable rate. If that happens, try to negotiate a compromise with the lender or broker.