HSBC mortgage relief measures will be extended to those who own homes in Singapore or overseas

- To help individuals meet their loan and insurance commitments;

- To support SMEs with continued access to bank credit and insurance cover; and

- To ensure interbank funding markets remain liquid and well-functioning.

HSBC mortgage relief measures will benefit both local and overseas customers promises CEO

HSBC mortgage relief measures will benefit both local and overseas customers promises CEO

Tony Cripps, CEO, HSBC Singapore shared: “HSBC applauds the MAS’s move to develop a common set of relief programmes for the most impacted across Singapore, which we will be adopting. With Singapore’s international openness, we understand that the impact for our individual and business clients extends beyond these shores.”

“That is why for our retail clients, HSBC Singapore will extend the mortgage relief measures to those who own homes in Singapore or overseas. And for our business and corporate clients who have overseas business partners and supply chains, HSBC has in place relief measures across several key markets – including Malaysia, China, Hong Kong, and Australia – to support our business clients there.”

Besides the HSBC mortgage relief measures additional measures the bank will be implementing includes:

| Special Financial Relief Measures | How it works | |

| Individuals | ||

| Insurance | To ensure that individuals’ long-term protection needs remain unaffected during this challenging time, qualified policyholders will be able to defer their premium payments for up to 6 months, interest free |

|

| Mortgage | From 6 Apr to 31 Dec 2020, HSBC will be offering the following relief options to existing HSBC mortgage customers for both their Singapore & Australia properties:

|

Once the relief programme is offered,

|

| Personal loan including credit card | Available from 6 Apr to 31 Dec 2020, HSBC will be introducing a new term loan to all existing unsecured credit customers including credit cardholders. Key features are:

|

Once the relief programme is offered,

|

| SMEs | ||

| Secured Term Loans | As part of its commitment to their clients, HSBC is offering its SME clients an option to defer principal payments on their secured term loans up to 31 December 2020.

*The deferral of principal payments is subject to HSBC’s credit and internal approvals. |

|

Besides HSBC mortgage relief measures it offer other measures for SMEs

HSBC is a participating bank for the enhanced measures extended via the following Enterprise Singapore financing schemes, as announced by the Singapore Government in the Unity, Resilience and Solidarity Budgets. Below is a short summary of measures which may be of importance to SMEs:

- The maximum loan quantum under the Enterprise Financing Scheme – SME Working Capital Loan – has been raised from SGD 600,000 to SGD 1 million.

- The Temporary Bridging Loan Programme (TBLP) has been expanded to provide additional cash flow support for all business sectors. Under this programme, eligible enterprises can now borrow up to SGD 5 million, with the interest rate capped at 5% p.a. from HSBC.

- The enhanced Enterprise Financing Scheme (EFS) – Trade Loan which will increase the maximum loan from SGD 5 million to SGD 10 million

- Businesses eligible under the EFS – SME Working Capital Loan and TBLP may also apply for up to 1-year deferral of principal repayment to help manage their debt.

Additionally and besides the HSBC mortgage relief measures, the Government announced on 6th April that it will increase the risk share of loans from 80% to 90%, effective 8th April, applying to the Temporary Bridging Loan Programme, the Enterprise Financing Scheme – SME Working Capital Loan, and the Enterprise Financing Scheme – Trade Loan.

Wider action besides the HSBC mortgage relief measures

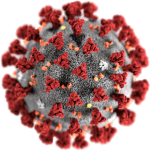

Today’s announcement follows the introduction of a series of other relief measures by HSBC in support of individuals, businesses and communities in Singapore that have been impacted by COVID-19. These include:

- On 10 February, HSBC Life launched a COVID-19 Complimentary Special Benefits to its life insurance customers and their immediate family in Singapore. These customers and their family members will receive additional benefits on diagnosis, hospitalisation and death-related to the COVID-19 at no additional cost.

- On 14 February, HSBC announced a range of customer support measures to help Singapore’s flow of commercial trade including maturity extensions to SGD600 million of current trade loans.

- On 20 February, HSBC introduced a series of customer support measures to help businesses manage their cash and liquidity. In particular, they are designed to ease the impact felt by corporate treasuries and support the ongoing collection, handling and deployment of cash.

More broadly, HSBC is working with individuals or businesses facing financial distress as a result of COVID-19 outbreak to review their current situation and identify appropriate arrangements.