Last week, HSBC and UOB joins DBS and Bank of China (BOC) to offer 3 Years Fixed Rate Mortgage Packages. The home loan market in Singapore is starting to become receptive to fixed rates mortgage packages again with more choices on offer.

13 Sep 2017

When President Trump was elected, the market was flushed with excitement of an interest rate increase by the Federal Reserve. Many of the infrastructure projects touted by Trump are expected to cause inflation (by overheating the economy) and as a result of that, an expectant rising interest rate and hence stronger funds flow into the US economy.

To his credit several well known big companies have indeed committed to investing in the USA, including foxcomm who committed to a US$10 billion plant in Wisconsin.

Here is an article on interest rate movement and trends.

https://www.icompareloan.com/resources/singapore-mortgage-interest-rate-trends/

https://www.icompareloan.com/resources/mortgage-interest-rates-key-factors-that-impacts-it/

And Regional currency outlook explaining how currency movements are affected by economic growth and debt levels.

https://www.icompareloan.com/resources/regional-currency-outlook-2016/

Why are Banks suddenly joining the fray to offer Fixed Rates?

Table of Contents

In short, the following factors affect the US Interest rates. They are: –

- USA Economic development and growth

- USA Domestic interest rate environment (i.e. Federal Reserve Overnight Target Rate)

However the above did not materialise as the US dollar has in fact softened, indicating that this economic recovery is indeed not as strong as expected. Also Trump’s infrastructure projects will also take time to roll-out hence the inflation expectation on the US economy is rather muted. Hence the weakness in the US dollar.

If you are a fund manager holding USD and you anticipate it to depreciate in value against the SGD, what will you do?

Will your park your money in Singapore instead of the USA?

Perhaps this explains the recent strengthening of the SGD against the USD.

Chart 1: USD versus SGD from Mar to Sep 2017, Oanda

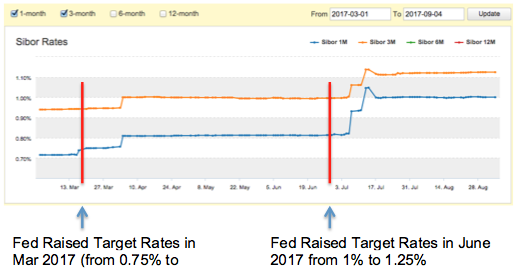

Singapore dollar continued to strengthen against the US dollar since Mar 2017. This perhaps cushions the magnitude of potential Sibor interest rate hike. However as you can see on the Sibor Chart, when the Federal Reserve increases its target rate in March and June, Sibor follows suit shortly after, but not in the same magnitude.

Chart 2: Sibor Chart, Mar to Sep 2017, Association of Banks Singapore (ABS), iCompareLoan.com

If the outlook is such that fund managers expect SGD to strengthen against the USD, then the interest rate environment in Singapore is expected to remain low as the system will be amply flushed with funds.

With an expected benign US economic recovery now, as opposed to a more rapid economic expansion, the chances of more Federal Reserve Rate Hike has become less likely. Hence Sibor will also look more stable.

It is possible that Interest Rate hedging costs have also come down and it is now able to work out an attractive package given the lowered costs and yet be able to make money. (These are treasury functions and product costing functions that we should not be overly worried about)

HSBC and UOB Joins DBS and Bank of China to offer 3 Years Fixed Rates

With HSBC and UOB entering the market in Fixed Rates, this signals their internal view of the interest rate environment being benign. One is HSBC, one of the world’s largest banks and UOB is one of Singapore’s largest banks and a strong regional player.

HSBC and UOB joins DBS with 3 Years fixed rate (lock in 3 years) : –

Year 1: 1.68%

Year 2: 1.68%

Year 3: 1.68%

While Bank of China offers 3 years Fixed Rate (lock in 3 years) at: –

Year 1: 1.48%

Year 2: 1.58%

Year 3: 1.68%

With several banks in the fray for 3 years fixed rates, it is perhaps indicative of their view of the longer term interest rate environment. Perhaps it has also become cheaper for the banks to hedge into and secure fixed rates into year 2 and year 3 given the new realities in the market place.

OCBC has not yet participated meaningfully with Fixed Rate packages at the time of publishing, but they could very well join in anytime.

However do note that the sentiments and interest rate outlook could yet change with impending geo-political or economic developments and an elevated risks of armed conflicts in the horizon.

For those who believe that interest rate is still on an uptrend and that the interest rate is only taking a breather, they should quickly take the fixed rates.

For those who believe that the rates will go sideways or flat, they should consider Sibor packages.

For those who have many considerations, you can work with a mortgage broker who would work you through your situation in detail.

Here is a 10 Year Sibor Chart if history is any indication.

Chart 3: Sibor Chart, Sep 2007 to Sep 2017, ABS, iCompareLoan.com

It is usually not about punting and speculating where the interest rates will be. It is about find a home loan package that you can afford given the circumstances and market realities.

Connect with iCompareLoan on Facebook or

Connect with Paul Ho on Linkedin if you do not yet have any questions to ask and just want to stay updated on the property market.