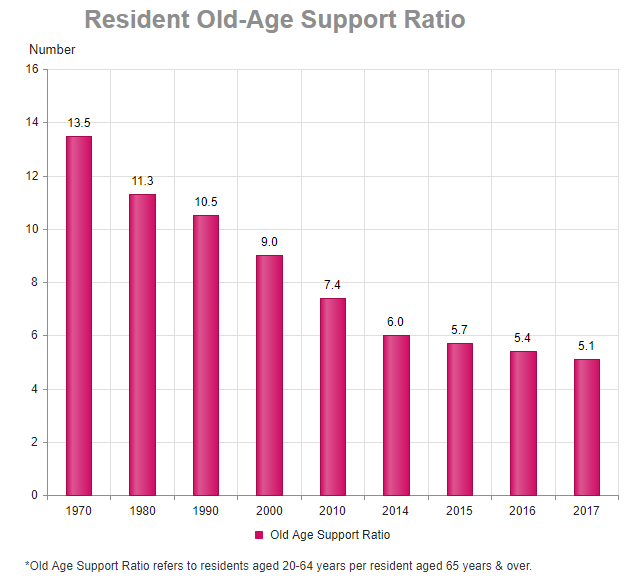

Ultimate Guide to Integrated Shield Plan. In the last decade, Singapore’s population has been ageing with more elderly and fewer youths. Our government has already warned that Singapore will continue to grey at a faster pace compared to the last decade. 2018 also marked an ominous turning point for Singapore as the elderly population starts to crowd out the youth. As we age, we need to start preparing for higher medical expenses in the later years of our lives. This is especially as Singapore’s old-age support ratio continues to decrease.

https://www.freepik.com/free-vector/composition-with-health-insurance-icons_1240255.htm

Source: SingStat

How can we start preparing for the ever-increasing medical expenses as we age? One way is to start preparing early and buy an Integrated Shield Plan when you are young.

Integrated Shield Plan? What Is That?

Table of Contents

Based on the latest statistics from Ministry of Health (MOH), more than 60% of Singaporeans already own an Integrated Shield Plan. Despite its high percentage ownership, do we really understand what Integrated Shield Plan covers and how it works?

Dissecting Integrated Shield Plan

Integrated Shield Plans are made up of two components:

- A MediShield Life component and

- a private insurance coverage component.

Integrated Shield Plan: MediShield Life Layer

MediShield Life is a national health insurance scheme that provides lifelong protection against large medical bills. It is a scheme that includes all Singaporeans and Permanent Residents (PRs). MediShield Life is administered by the Central Provident Fund (CPF) to provide every Singaporean and PR with basic health insurance. Under MediShield Life, you will be covered for large hospital bills and selected costly outpatient treatments like dialysis and chemotherapy.

Unlike most private insurance, you will still be covered under MediShield Life even if you have pre-existing conditions. The subsidised MediShield Life premium is being paid for through your Medisave. Even for those who cannot afford the premiums after subsidies, you can still be covered under the Additional Premium Support.

While MediShield Life does provide health insurance protection for all Singaporeans, its coverage size is for subsidised treatment in public hospitals. MediShield Life hospitalisation coverage is pegged at Class B2/C wards. The government understands that Singaporeans might want to enjoy better hospitalisation coverage like staying at Class B1/A or seek treatment at private hospitals. Thus, Integrated Shield Plan was introduced.

Integrated Shield Plan: Private Insurance Layer

Since MediShield Life only covers up to Class B2, the private insurance layer of Integrated Shield Plan will enhance your MediShield Life plan. By enhancing your MediShield life with an Integrated Shield Plan, your private insurer will top out any payout that is not covered by MediShield Life based on your Integrated Shield Plan’s coverage.

For example, staying at a class B2 ward for a day will cost $79 per day. The maximum amount that MediShield Life will cover is $79 per day. If you choose to stay at a class A ward ($466.52 per day), you will need to pay $387.52 per day out of your own pocket. However, if you bought an Integrated Shield Plan, your insurer will cover the $387.52 for you.

How To Pay For Your Integrated Shield Plan Premiums?

There are two ways you can pay for your Integrated Shield Plan premiums. The first, and the most straight forward way, is to pay using cash. The other option is to pay using your Medisave. The second option of paying via your Medisave is what most Singaporeans/PR would choose. However, there is one thing you must take note. There is a maximum withdrawal limit that you can use from your Medisave each year. The maximum withdrawal limit is dependent on your age.

|

Age |

Additional Withdrawal Limits (AWLs) |

|

1 – 40 |

$300 |

| 41 – 70 |

$600 |

| 71 & Above |

$900 |

Is There A Claim Limit For An Integrated Shield Plan?

MediShield Life has a maximum claim limit of $100,000 per policy year. If your aggregated hospital bills exceed $100,000, you will need to pay the rest in cash. While it is unlikely to exceed the claim limit, it is not impossible.

On the other hand, Integrated Shield Plans have a higher maximum claim limit. The maximum claim limit varies depending on your private insurer. For example, Great Eastern’s Supreme Health has a maximum claim limit of $1,500,000 per policy year. AIA’s Healthshield Gold Max has a maximum claim limit of $2,000,000 per policy year for treatments at public hospital.

Integrated Shield Plan Full Rider Option No Longer Available

Prior to 2018, you would have been able to purchase a rider with your Integrated Shield Plan to cover the full amount of your hospital bills. However, since 8th March 2018, the full rider is no longer available. On 8th March 2018, Minister of Health announced that all riders will have to include a co-payment option that is at least 5% of the hospital bill. This means that if you have a hospital bill of $10,000, you will need to pay $500.

Learn more about the new rider Integrated Shield Plan change here.

Since Integrated Shield Plan Sounds So Good, Should Everyone Get One?

Since Integrated Shield Plans can help us to defray potential hospital bills, should everyone get one? You need to first think about whether you have a need for an Integrated Shield Plan. MediShield Life provides coverage to help you defray the cost for class C/B2 wards in public hospitals. If you do not feel that there is a need to stay in better class wards, then you do not need an Integrated Shield Plan. But if you prefer to stay in class B1/A wards or seek treatment at private hospitals, getting an Integrated Shield Plan would be ideal.

If you want to find out whether you need an Integrated Shield Plan, check out NTUC Income’s health insurance checker. Or contact us, we will pass your contact to an Advisor Representation to call you.

https://www.icompareloan.com/resources/health-insurance/