With MAS well intention of Total Debt Servicing Ratio (TDSR) in order to ensure Singapore’s long term property sustainability, there are some side effects.

Apart from what we discussed previously about side effects of TDSR trapping people who has bought properties previously http://www.icompareloan.com/resources/tdsr-causes-home-loan-refinancing-hardships/. We are glad that MAS is receptive to feedback and has issued a relaxation of TDSR rules for those who has bought their properties before TDSR comes into effect.

Another side effect of the Total Debt Servicing Ratio and “proof of debt” is such that, the terminology, “TOTAL” is all inclusive. And hence the burden on the banks to check each and everyone of an individual’s Debt.

What does this mean?

MAS requires banks to check each of an individual’s debt, such as Car Loan, housing loans, credit cards outstanding balances, personal loans, guarantors for loans, overdraft balances, etc.

Complexities in implementing such TDSR

Table of Contents

Instead of relying on individual declaration form which is simpler and places the responsibility on the individual to declare truthfully and honestly, many banks still require the individual to show their bank statements. Here is an example of what needs to be shown: –

Scenario of a person who owns 2 properties and refinancing one of them: –

Existing property loan 1

- Provide current bank statement on existing and up to date current outstanding balances.

- Provide the letter of offer when the loan was signed, to understand the loan structure such that the bank can determine what is the mid/long term servicing cost of this property.

- Problem – Many banks no longer give monthly statements, some are half yearly and some don’t.

Personal loans

- Most personal loans are given have an initial letter of offer of loan facility, they may or may not give monthly statements on outstanding balances. Many in fact are settled through GIRO.

- Problem – You may not get a monthly statement.

Overdraft

- Banks want to see the original letter of offer to understand what was being granted, i.e. the max credit extended.

- Some banks want to see average balances over the past 3 to 12 months. This means that 3 to 12 months of statements may be required.

- Problem – Not every bank give monthly statements. Not everyone can easily dig out 12 months of statements of an overdraft account. Not many people even remember if they ever signed a facility letter.

Credit cards

- Statements of each of the credit cards an individual holds.

- Not all banks give monthly statements. Those cards that you have not spent money with, may not send you a statement/update.

- Problem – This is especially troublesome. As many consumer do not even remember how many credit cards they own. Often they have more credit cards than they can recall. There is also the issue of balance transfers as well as hire purchase on credit cards giving 12 installments or 24 installments, which imposes a debt-servicing load. These all add to a person’s debt servicing burden.

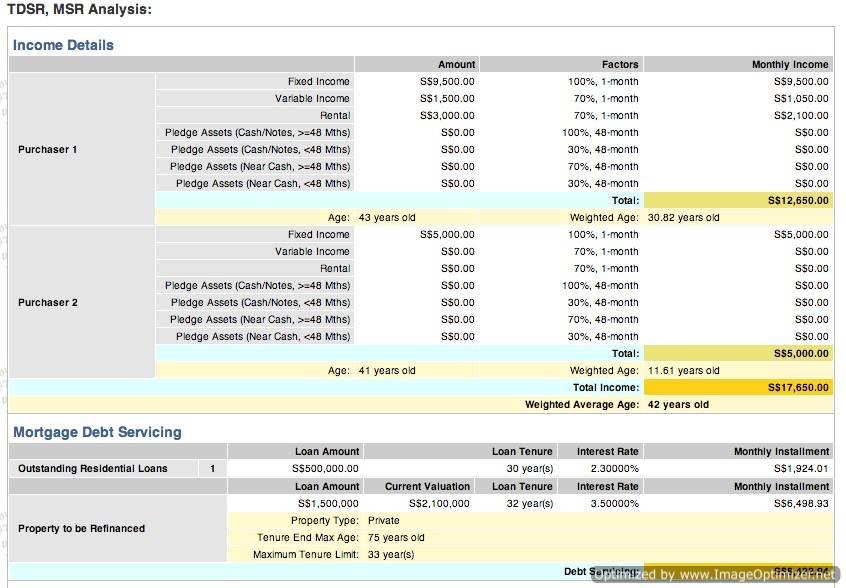

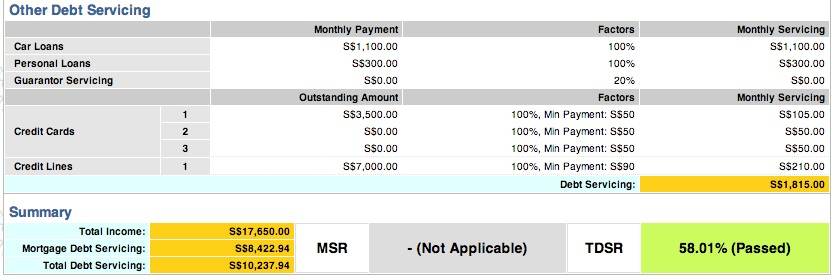

An illustration of a TDSR estimate from iCompareLoan consultant area.

Figure 1: Part 1 of TDSR Home Loan Report (Source: iCompareLoan.com/consultant)

Figure 2: Part 2 of TDSR Home Loan report (Source: www.iCompareLoan.com/consultant)

Banks imposes Fees and takes forever to give statements

When an individual asks the banks for statements, the banks are charging $20 per page or $30 per statements or the individuals have to “write in” to requests or an individual have to wait 2 to 4 weeks for the statements to be sent to them (with or without cost). The charges may vary.

While the idea of a TDSR is generally good, the implementation has been hampered by bank’s cost cutting over the years. These cost cutting measures often result in service level cuts and in many instances, 6 monthly statements or yearly statements in place of monthly statements, or statements will be given on the month with transactions only, if there are no transactions, you won’t receive a statement.

As consumer banking is a cut throat business, competitiveness is the key to survival. By imposing TDSR on the banks, it will invariably raise the cost of doing business for the bank.

Demand impacted by Inability to get banks to give statements quickly

Refinancing demand as well as new home sales demand is now affected by Banks not being fast with giving statements. These imposes loss of productivity on individuals to try to gather tons of documentations. Also, it artificially reduces demand of people buying properties or refinancing.

What is a better approach

We appeal to MAS to consider practical implementation challenges before any new policies. These should as much as possible be manageable on a macro level than on a minute Micro level.

Could MAS have consulted the banks on implementation prior to implementing these new regulations? If they did, that would have perhaps given rise to less issues.

Could MAS have asked Credit Bureau to take on more responsibility of collecting credit statement balances for the implementation of TDSR? If they did this, banks could have asked Credit Bureau instead of asking from the individual several tens of documents and statements.

Could MAS have asked all banks to start issuing out monthly statements to all customers so that the implementation of TDSR would be smooth and seamless where customers will automatically have access to all their statements to comply with the TDSR regime.

MAS has done well to protect Singapore’s financial reputation via financial prudence, however the implementation aspects has rooms for improvement. More consultations with the stakeholders as well as consumers prior to any implementation may serve the citizens better. A series of micro policy changes made Singapore’s property investment climate more complicated and potentially impact Singapore as an investment destination. This is an area that deserves some attention.

Ultimately, we understand that MAS is the proverbial “bad-guy” doing the clean up due to uneven supply and demand which was created by another ministry, so whatever MAS does is considered a Brute force mechanism.

For example, if there are 200 water melons and 500 thirsty water melons buyers causing water melons to sky rocket, do you produce enough water melons and make up the short fall of 300 water melons over time and maintain a balanced supply and demand or do you impose regulations, set up barriers and ready the firing squad on 300 thirsty water melon buyers such that they back out of buying water melon?

You decide.

As the chinese saying goes: “擒贼先擒王“ which literally means, if you want to catch the thief, first catch the king. Hence whatever MAS does is just treating the symptoms and not treating the root cause of uneven supply and demand caused by Ministry of National Development as well as government land sales (GLS) release mechanisms.

For advice on a new home loan.

For refinancing advice.

Read more articles at

iCompareLoan.com/resources/category/faq/

References

1. How is Singapore land supply managed, http://www.icompareloan.com/resources/how-is-singapore-land-supply-managed/

2. TDSR causes Home loan refinancing hardships, http://www.icompareloan.com/resources/tdsr-causes-home-loan-refinancing-hardships/

3. MAS broadens Exemptions from TDSR thresholds,

Download this article here.