Edmund Tie, the sole marketing agent for the sale of KH Kea Building at 333 North Bridge Road, announced on Nov 25 the sale of the property to UOL Group Limited at $79.3m.

The 9-storey commercial building enjoys a 999-year leasehold tenure and occupies a total site area of 435.2 square metre (approximately 4,684 square feet) with a total gross floor area (GFA) of 2,698.7 square metre (approximately 29,049 square feet). There is a further GFA of approximately 299.0 sq m (approximately 3,218 sq ft) that may be built.

Prominently located on a corner plot with dual frontage along North Bridge Road and Cashin Street, accompanied by views of the iconic Raffles Hotel across, KH Kea Building occupies a prime spot at one of the most exciting and vibrant work-live-play precincts in the city centre.

Prominently located on a corner plot with dual frontage along North Bridge Road and Cashin Street, accompanied by views of the iconic Raffles Hotel across, KH Kea Building occupies a prime spot at one of the most exciting and vibrant work-live-play precincts in the city centre.

Well-served by a wide host of amenities that is readily available in the vicinity, the property enjoys excellent accessibility, being served by four MRT stations located within a 500-metre radius – the Raffles Place financial district and Orchard Road shopping belt are both just an MRT stop away.

Situated in a prime location and well-served by a wide host of amenities that is readily available in the vicinity, the property enjoys excellent accessibility being served by four MRT stations located within a 500-metre radius – the Raffles Place financial district and Orchard Road shopping belt are both just an MRT stop away. Major expressways located within proximity includes Nicoll Highway, East Coast Parkway, Pan Island Expressway and Kallang-Paya Lebar Expressway.

Key landmark developments in the neighbourhood of KH Kea Building includes Raffles City, CHIJMES, The South Beach, DUO, Funan, The Capitol, Suntec City and Marina Square. Already a bustling and vibrant precinct, the area is set to become even more exciting with the upcoming development of Guoco Midtown, the new Shaw Tower and two condominium developments located at Middle Road and Tan Quee Lan Street by Wing Tai and GuocoLand respectively.

As KH Kea Building is zoned commercial, it is not subject to additional buyer’s stamp duty or seller’s stamp duty and is eligible for purchase by both local and foreign buyers.

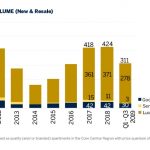

Executive director of investment advisory, Swee Shou Fern, commented, “The tender attracted very keen interest from a wide spectrum of end-users, investors and developers, both local and international, highlighting the rare availability and consistently strong demand for well-located prime commercial buildings. This also underscores Singapore’s position as one of the top cities for real estate investment. Total investment sales value in Singapore jumped 33.8 per cent q-o-q in Q3 2019, with heightened sale activity for commercial assets. Investment sales in the office segment increased from approximately $2.827bn to $3.180bn from Q2 2019 to Q3 2019”

An earlier report by JLL said that the biggest gainers following the new property cooling measures will likely be owners of commercial buildings. Mr Paul Ho, Chief Mortgage Consultant at iCompareLoan, said that despite the property curbs introduced by the Government last year, Singapore is still an attractive residential market for investors.

Properties such as the KH Kea Building may be bought under personal name, but total debt servicing Total Debt Servicing Ratio (TDSR) will apply on the individual’s income on such purchases. To buy a commercial or industrial property under company name, total debt servicing ratio TDSR also applies on the individual director’s income if the company is an investment holding company or an operating company that is loss-making or does not have sufficient cash flow to servicing the repayment.

Although the property market exuberance has been curbed to some extent with the property cooling measures introduced last year, Singapore as a property market investment destination still remains among the top – shoulder to shoulder with other cities in the world like London, New York, Shanghai and Sydney.

“We have to be mindful that there is a lot of excess capital fluidity here and at 1.9 – 2 percent, Singapore has one of the lowest interest rates for home loans in the region,” he added.

Prime commercial building will be especially attractive to investors because of its location, as investment properties of such nature are scarce in that area. Investors who are looking to invest in commercial properties should seek the help of mortgage brokers.

Mortgage brokers are specialists who are well versed with the banking loan process and have access to hundreds of mortgage and loan packages across many banks. Mortgage brokers help property buyers to get the best home loans and home owners to refinance home loans.

Sure, you can easily walk into the bank and ask for quotes. Most of the time, your property agent would also refer to you a contact at a bank. The point is, does the property agent know which bank package is good for you? How to calculate your loan affordability and interest costs? Do the property agents have the supporting home loan reports to assist you to find the right home loan packages and layout the facts for you?

In Singapore, where we have a good number of local and foreign financial institutions, the choice of a lender and its packages can be mind boggling. Imagine having to compare over hundreds of different loan packages and wondering which is best for you. Even if you are a specialist in finance, it is not so straight forward as there are quite a few variables.

That is where the mortgage broker comes in. The mortgage broker is typically an experienced professional who is familiar with the loan approval process, and having worked with different banks, they know their criteria and what makes the cut. As they are independent, they will also be able to tell you which lender offers the most suitable loan package rather than selling the loan package from the financial institution they represent.