Minister for National Development Lawrence Wong revealed in Parliament on Oct 7 that LBS paid out average proceeds of $177,000 per household.

The Minister was responding to a parliamentary question when he answered how much LBS paid out on average per household:

“What are the average amounts of funds that seniors receive in CPF and cash by monetising their HDB flats through the Lease Buy Back Scheme; and how has this scheme boosted their retirement adequacy whilst continuing to live out their retirement in their flats.”

Mr Wong in responding to the question said that LBS paid out average proceeds of $177,000 per household

Table of Contents

“The Lease Buyback Scheme (LBS) was enhanced in April 2015 to extend to 4-room flats and provide seniors with more choices in the length of lease to retain. Since then, seniors who took up the LBS received average proceeds of $177,000 per household, including the LBS cash bonus. The proportion of proceeds that they receive in their CPF Retirement Account (RA) and in cash depends on their CPF RA balances before they took up the LBS.”

The Minister said that in general, LBS paid out seniors who had higher CPF RA balances to begin with, a higher proportion of their proceeds in cash. He added that after LBS paid out, “most seniors have enough CPF RA savings to benefit from a lifelong income stream of about $1,000 per month on a household basis under CPF LIFE. Beyond that, most seniors also receive some of their LBS proceeds in cash, in addition to the cash bonus.”

https://www.icompareloan.com/resources/best-ocbc-home-loans-guide-trend/

Mr Wong assured the House on Sep 2 that the Housing and Development Board (HDB) will be willing to exercise flexibility on the age requirement for the Lease Buyback Scheme (LBS) for those with long term medical expenses. The Minister was responding to an MP who had asked if “the Government will consider lowering the minimum age requirement for the HDB Lease Buyback Scheme for flat owners who need long-term medical treatment for chronic illnesses.”

In responding to the MP, Mr Wong revealed the average of how much LBS paid out:

“The qualifying age for LBS is set at the CPF Payout Eligibility Age of 65 to allow seniors to receive their monthly CPF payouts immediately after they take up the LBS. Nevertheless, HDB is prepared to and has exercised flexibility on the age requirement for those with long term medical expenses.”

In thanking the MP for his feedback, Mr Wong said that his Ministry will take it into consideration as it continues to review its schemes.

The Minister for National Development, Lawrence Wong, announced in August last year that the LBS will be extended to all HDB flats, including 5-room and larger flats. Writing in his blog, the Minister said that the Lease Buyback Scheme “is a good scheme but it only applies to those living in 4-room or smaller HDB flats” at the moment.

Mr Wong said: “The original thinking was that it would make more sense for those living in bigger flats to right-size. But there are seniors who prefer to age in place. Some also have grandchildren who come over to visit regularly, and would like a bigger space for the extended family.”

Adding: “After considering the matter carefully, I have decided to extend the LBS to all HDB flats, including 5-room and larger flats. This will enable many more Singaporeans to benefit from the scheme.”

At the moment, you are eligible for the Lease Buyback Scheme or LBS as an additional monetisation option if you are from an elderly household living in a 4-room or smaller flat. Through this scheme, you will be able to tap on your flat to receive a stream of income in your retirement years, while continuing to live in it.

You can sell part of your flat’s lease to HDB and choose to retain the length of lease based on the age of the youngest owner. The proceeds from selling part of your flat’s lease will be used to top up your CPF Retirement Account (RA). You can then use your CPF RA savings to purchase a CPF LIFE plan, which will provide you with a monthly income for life.

In order for your household to qualify for the LBS, the following conditions must be met:

How the LBS Works as illustrated by HDB:

If your household is eligible for the LBS, you will be able to:

- Sell the tail-end lease of your 3-room or smaller flat, or 4-room flat to HDB, and receive up to $20,000 or $10,000 of LBS bonus, respectively

- Use the net proceeds to top-up your CPF Retirement Account (RA) to the specified requirements as shown:

For households with 1 owner, he or she will have to use the proceeds to top-up the RA to the current age-adjusted Full Retirement Sum (FRS).

For households with 2 or more owners, each owner will have to use their share of the proceeds to top-up their RA to the current age-adjusted Basic Retirement Sum (BRS).

Determining the LBS bonus

Your household will receive the full bonus as long as the total top-up to the flat owners’ RA is $60,000 or more. If you are unable to do so, you will receive a pro-rated bonus of:

- $1 for every $3 CPF top-up for 3-room or smaller flats; or

- $1 for every $6 CPF top-up for 4-room flats

Amounts in excess

After you have topped-up the RA to the requirements stated above, any excess proceeds can be withdrawn in cash, up to a maximum of $100,000. If your household has more than $100,000 of proceeds after the top-ups, owners will have to use their share of the proceeds to further top-up their respective RAs to the current FRS after your household has retained $100,000 in cash.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

CPF LIFE

Your full RA savings will be used to buy a CPF LIFE plan if you have at least $60,000 in your RA after the top-up. You will not be eligible to join CPF LIFE if you are aged 80 and above.

Options for lease period

Your household will have the flexibility to choose the length of lease to be retained, based on the age of the youngest owner. The duration of the lease retained determines the amount of net proceeds unlocked.

Illustrating an example

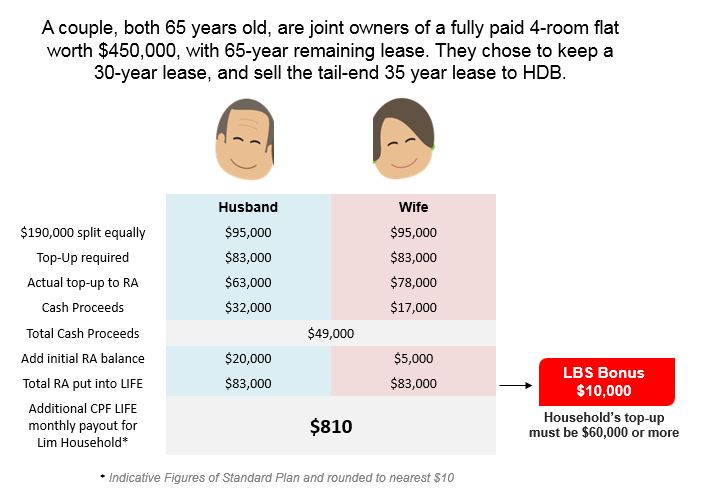

Joint Singapore Citizen (SC) Owners aged 65 years old

Assumptions:

- 4-room flat held under joint tenancy

- No outstanding loan

- Balance lease: 65 years

- Market value: $450,000

- Choose to keep a 30-year lease

- Sell the tail-end 35-year lease to HDB for $190,000

In his blog entry, the Minister said that he is looking at ways to improve the liquidity of the resale market for older flats in order to facilitate “right-sizing”. “Currently, CPF can be used for the purchase of older HDB flats but subject to certain restrictions,” he said.

Adding: “These rules are meant to ensure that buyers purchase a home for life, without compromising their retirement savings.

Mr Wong said his ministry is working with the CPF Board to review and update rules to provide more flexibility for buyers of shorter-lease flats while safeguarding their retirement adequacy.