Mandarin Gardens failed in its en bloc attempt reported Today online. Mandarin Gardens failed despite raising its reserve price to $2.93 billion just weeks ago.

The collective sale attempt of Mandarin Gardens failed as less than 80 per cent of owners consented to the en bloc sale by the time the collective sale agreement expired on March 24.

Table of Contents

Today online reported that it sighted a letter by the chairman of the collective sales committee, Mr Vincent Teo, to the owners of the condominium saying Mandarin Gardens failed in its en bloc attempt as only 68.34 per cent of owners signed on the collective sales agreement.

“This being our first attempt at collective sales, we have learned valuable lessons which will certainly be very helpful in our next journey. The general feeling is that the current market sentiment for en bloc sales are heading south, as evidenced by the non-bidders in the tender process of several large estates.”

According to the newspaper, Mr Two added that the condo’s homeowners could attempt another en bloc sale without having to wait for the two-year lapse period if market sentiment permits and enough owners are in agreement.

n early March, the Straits Times reported that only 67 per cent of owners have agreed to the Mandarin Gardens collective sale – 13 per cent short of the mandated 80 per cent for the sale to get through.

In a letter to owners on Feb 21, the CSC said it raised the reserve price by 5 per cent and adjusted total land cost to the developer to $1,250 psf ppr from $1,191 “to better help achieve the 80 per cent consensus required.”

“As the validity of the CSA ends on March 24, 2019, we appeal to all (owners) who are still considering, to make an immediate decision to sign the CSA,” the CSC said.

“If the 80 per cent consensus is not achieved by March 24, the whole en bloc sales process will come to a halt. … However if we achieve the 80 per cent, we are given a 12-month period to find a developer/buyer for our land,” it added.

If this new reserve price for Mandarin Gardens collective sale had gotten through, owners of the smallest unit (732 sq ft) would have received get $1.86 million, while the largest unit at 3,800 sq ft would have gotten $5.98 million. Owners of 1,500 square-foot to 2,000 square-foot units may have gotten between $3.016 million and $3.5 million.

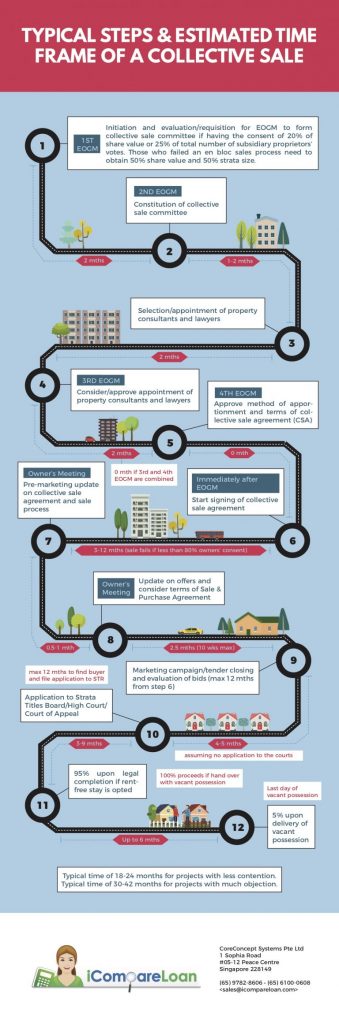

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

Paul Ho, chief mortgage consultant at iCompareLoan, said the en bloc sale Mandarin Gardens failed because it is so big that given the current market conditions, even the big boys may not have a risk appetite for it.

“Developers interested in bidding for collective sales of Mandarin Gardens would be mindful of other cost factors like development charge and Additional Buyers’ Stamp Duty, which may push up the actual costs for them even higher,” Mr Ho said. Adding: “With the upgrading premium, the actual bill for the developer could be pushed to be in the region of $3 – $4 billion.”

The attempt to sell Mandarin Gardens en bloc failed 10 years ago when the sales committee pushing for the collective sales of the condominium was accused of trying to control the management council running the estate and voting down proposals to upgrade estate facilities.

“But still there were possibilities, ” said Mr Ho. “Mandarin Gardens Collective Sale could be the single biggest uniting force to let property developers come together and work together,” he added.

“Previously, it was a case of too many developers and too few Government land sales plots. As no developer want to wind down their business, they bid increasingly higher to win land bids. The ability to price higher depends on whether there is a recession or not and whether people have sufficient choices of units to choose from. This is like 3 or 4 projects worth of condominium in 1 deal.

Are we trying to fish for a giant developer such as Century Garden or maybe Forest City type. These kind of developers could hail from China. They could easily move many units to Chinese buyers. In a new twist, the new condominium would go from “Mumbai” Gardens to “Chinese” Gardens. This is like an entire town in one condominium project, maybe it can have it’s own school, it’s own clinics, own police stations, own cinemas, own LRT tracks within the compound.

Fancy the new project being able to house 3,000 to 5,000 units? And each house having 4 people. That’s like an entire Electoral ward in a condominium. And maybe you can have your own MP stay within your condo as well. And the Condo manager is also your Management committee chairperson and your MP.

But it could also signal the start of developers cooperating to share bigger projects and consolidate their work force. There are too many developers and too many units in Singapore, least we want another property glut which we believe is coming, developers can work together and prevent bidding over the top. The only beneficiary is the Singapore government, not the people, nor the developers.”

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!