New Launch Condo home loans – How much do I have to pay if I am a first time home buyer in Singapore

Table of Contents

New Launch Condo home loans are going to be affected by the Cooling measures effective on the 6th July 2018.

Singaporeans and PR alike, maybe even the occasional foreigner simply loves Singapore and love New launch condos in Singapore. As there are no restrictions in how small a condominium unit can become, the condominium sizes have become ever smaller and as a result, the per square feet prices of new launch condos have shot through the roof. Developers are incentivised to tear down perfectly good condominiums to build ever smaller size units and sell for higher per square feet unit prices. So there is huge incentive to build smaller units, hence the cooling measures.

Developers buy these condominium developments via En bloc sales process. This has led to the destruction of many perfectly good conditioned older condominiums with bigger condo units.

Image Credits: Search for Best Home Loans for New Condos, iCompareLoan.com

Get an approval-in-principle done to find out how much the bank can lend you.

Why the Cooling measures effective on or after 6th July 2018?

The cooling measures announced on the 5th July and effective on and after 6th July 2018 is aimed squarely at the run-away price hikes due to the rampant en bloc sales of development, so there will be some impact on the new launch condo home loans.

We still think that the additional taxes such as Additional buyer stamp duties (ABSD) are not really helpful. The better way, is to SET a minimum liveable size of a condominium unit, this will greatly restrict the ability to reduce condominium unit size and raise per square feet price. Since HDB 3-room flats are around 700 Square feet, perhaps condominiums must be a minimum mandated size of 700 sq feet. With this suggested restriction, drastic taxation will not be required to cool the market.

New launch condo home loans – Affected by Additional Buyer Stamp Duty?

How is your home loan affected by the 06th July 2018 cooling measures?

If you are really not bothered about reading more, you could also engage a mortgage broker to assist you. It’s free of charge as they act as “distributors” of bank’s packages. Check out a mortgage broker.

Are you affected by the Additional buyer stamp duty (ABSD)?

If you are a citizen buying the 1st residential property or Singapore PR buying your 1st property, you are not affected by the ABSD, so there is nothing to worry.

The following table describes Singapore’s Additional Buyer Stamp Duty (ABSD) rates for the different types of people and housing status: –

|

Rates on or before 5 July 2018 |

Rates on or after 6 July 2018 |

|

|

SCs buying first residential property |

0% |

0% (No change) |

|

SCs buying second residential property |

7% |

12% (Revised) |

|

SCs buying third and subsequent residential property |

10% |

15% (Revised) |

|

SPRs buying first residential property |

5% |

5% (No change) |

|

SPRs buying second and subsequent residential property |

10% |

15% (Revised) |

|

Foreigners buying any residential property |

15% |

20% (Revised) |

|

Entities buying any residential property |

15% |

25% (Revised)# |

|

Plus additional 5% for developers^ (New, non-remittable)* |

Table 1: Revised Additional Buyer Stamp Duty – Cooling measures for Property purchase 6th July 2018, MAS, http://www.mas.gov.sg/News-and-Publications/Media-Releases/2018/Raising-Additional-Buyers-Stamp-Duty-Rates-and-Tightening-Loan-to-Value-Limits.aspx

New launch condo home loans – Reduction in Loan-to-value means lesser loan quantum

If I am a first time property buyer, I am not affected by the Additional Buyer Stamp Duty (ABSD) but I am affected by the reduced Loan-to-value ratio.

There is a slight impact on the loan-to-value ratio. This means a lesser loan available for your house.

In short, there is a 5% reduction in every category of loans. So if originally the Loan-to-value is 80%, it becomes 75%.

For example, a 75% loan-to-value means a downpayment of 25%, made up of 5% cash and 20% CPF (Provided you have enough CPF).

For example, for a $1,000,000 house: –

- $50,000 cash downpayment

- $200,000 CPF Ordinary account balance (OA) for downpayment

- Buyer Stamp Duty (BSD), 1% on the first $180,000, 2% on the second $180,000 and 3% on the next $640,000 and 4% thereafter. For a S$1m property, the 4% stamp duty does not apply.

- Loan-to-value of 75%, that is $750,000. This 75% of loan is subjected to the usual Total debt servicing ratio (TDSR) which limits the person’s overall debt to be within 60% of a his/her gross income.

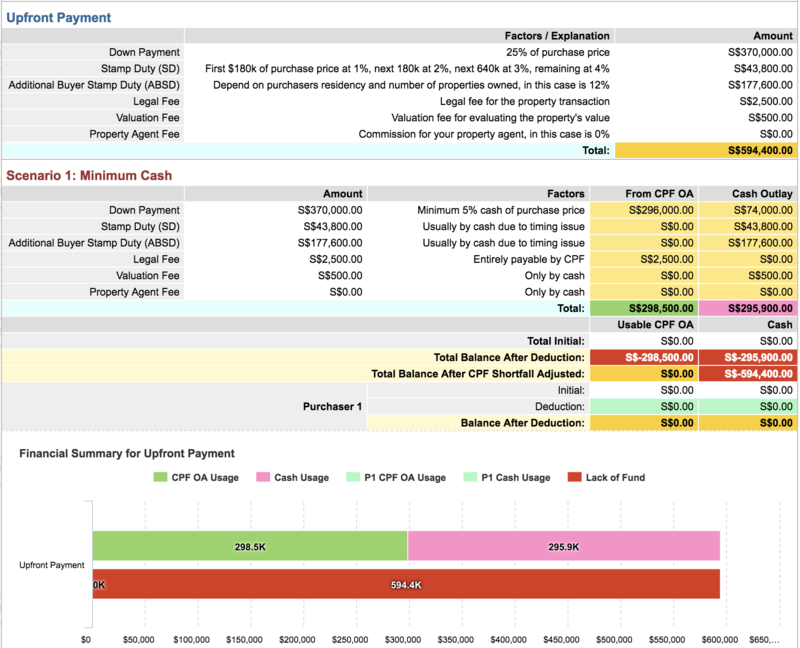

Image Credits: iCompareLoan Home Loan Report for new launch condo home loans calculation, Screenshot, www.iCompareLoan.com/consultant

Receive a free home loan analysis report from iCompareLoan, to get your property agent to run a home loan report for you.

Hence, if you have a surplus of CPF OA savings to the tune of 5% of the purchase price, this will not affect you.

|

1st Housing Loan |

2nd Housing Loan |

From 3rd Housing Loan |

|

|

Individual Borrowers |

|||

|

LTV Limit |

Existing Rules 80%; or 60% if the loan tenure is more than 30 years* or extends past age 65 Revised Rules 75%; or 55% if the loan tenure is more than 30 years* or extends past age 65 |

Existing Rules 50%; or 30% if the loan tenure is more than 30 years* or extends past age 65 Revised Rules 45%; or 25% if the loan tenure is more than 30 years* or extends past age 65 |

Existing Rules 40%; or 20% if the loan tenure is more than 30 years* or extends past age 65 Revised Rules 35%; or 15% if the loan tenure is more than 30 years* or extends past age 65 |

|

Minimum Cash Down Payment |

No change to existing rules |

||

|

5%; or 10% if the loan tenure is more than 30 years* or extends past age 65 |

25% |

||

|

Non-Individual Borrowers |

|||

|

LTV Limit |

Existing Rule Revised Rule |

||

* 25 years, where the property purchased is a HDB flat.

Table 2: Loan-to-value for 1st property, 2nd property and 3rd or more properties for individual borrowers and non-individual borrowers, MAS

Home buyers : Who are hit by the Additional Buyer Stamp Duty (ABSD)

For Singaporeans and Singapore PRs buying second or third properties, the additional buyer stamp duty (ABSD) is hefty. Obviously this does not affect the new launch condo home loans as this is the ABSD portion. But it does make it difficult to buy and sell properties.

Foreigners will also be hit with the revised ABSD from 15% to 20%.

The hardest hit will be entities buying residential properties. These entities are typically Private equity firms set up to buy residential properties or such firms set up by the developers to mop up any unsold units from property development projects so as to meet the time-line to sell all the condominium units within a stipulated timeline to meet the qualifying certificate.

The ABSD for entities goes up from 15% to 25%. This could dampen some sentiment for the runaway en bloc redevelopment sentiment as there will be some slight cost increase for unsold units. Ironically, developers could then build in more margin (pass off the cost to property buyers) at the early stages so that they can offload the unsold units to private equity firms and incur 25% ABSD. If all units are sold, then the 25% ABSD is remitted, but this does also mean that the developer has to find someone to buy up all the unsold units.

Developers are also additionally hit by 5% Additional Buyer Stamp Duty (ABSD) upon buying a residential development and this 5% “is to be paid upfront upon purchase of residential property.” (MAS). There is NO Remission of this ABSD.

This means that for a $1 billion dollar residential property project, just the ABSD tax on the property developer is $50 million.

Commercial and Industrial properties – Cooling measures must come soon

Commercial and Industrial properties are not yet affected by the cooling measures that affects new launch condo home loans. Ironically the overheated residential market could spill over to commercial and industrial properties. But if you are a buyer, please do so with your eyes opened and be selective with your buy.

Developers have also to be extra careful as regulation probably looms over commercial properties as well. Especially those that are mixed commercial cum residential properties, these will be highly risky projects that can BURN a Developer.

For commercial property buyers, who bought into expensive commercial (offices) in some development projects in town, they are now sitting on unrented units while forking out monthly repayment.

The headlines on RENT rising or dropping vacancy rates signalling the so called “pick-up” in the commercial property segment, I urge you to go into deeper details and I will take it with a pinch of salt. This segment is dominated by REITs where they would rather leave some units it empty than rent it out at lower rates. REITs have holding power and they are effectively holding onto many empty units and absorbing the vacancy rate while still pricing the occupied units at a higher rent. In other words, you will see that REITs are unwilling to drop rental prices to rent out more units, they would rather keep more rent. REITs is holding Singapore’s business cost ransom.

Here is an illustration of how REITs is killing small businesses: –

- Rent out 85% of 100,000 square feet of space or 85,000 square feet at $10/mth = $850,000 per month.

- Rent out 95% of 100,000 square feet of space or 95,000 square feet at $9/mth = $855,000 per month.

Would the REITs bother to do that? Very likely not, so as to maintain superior prices.

Strata titled commercial offices bought by individuals will probably not have this kind of unfair holding power and will face rent competition. It is not advisable to buy commercial properties and expect to yield good rentals, unless the price is good or an opportunistic buy.

Check out the best home loans in Singapore for 2018 here for your property purchase. Read more about Housing Loans here also.

Read more about Buying New launch condo (BUC) properties.

https://www.icompareloan.com/resources/buying-guide-building-under-construction-condos/