58% percent of of PropertyGuru survey respondents feel newly launched property prices should be better controlled by government – up from 49% in 2H 2018

- 58% percent of respondents feel government should control prices of newly launched properties, up from 49% in 2H 2018

- Singaporeans expect rent to fall across all property types in the remainder of 2019

- Mismatch in investor and renter expectations regarding size of housing

PropertyGuru Group, Asia’s leading property technology company, today released its Consumer Sentiment Survey for H1 2019. The key finding: Singaporean property buyers are increasingly adopting a wait-and-see approach.

Conducted half-yearly since 2009, PropertyGuru’s Consumer Sentiment Survey measures property sentiments and expectations around the property market to help consumers, property agents and developers gain a better perspective of the local property market. The H1 2019 survey saw 794 respondents in Singapore.

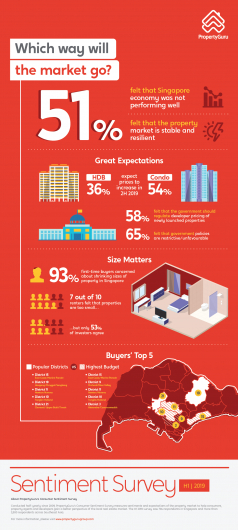

The buyers’ cautious mentality is reflected in the Property Purchase Intent index, which measures the likelihood of respondents buying a property in Singapore in the next six months. The index dipped from 41 in 2H 2018 to 38 in 1H 2019—an all-time low since the survey began nine years ago. At the same time, slightly more than half (51%) of respondents also felt the Singapore economy was not performing well, up significantly from 37% in H2 2018.

Meanwhile, the survey’s overall Sentiment Index dipped by 5 points from 45 in H2 2018 to 40 in H1 2019, reflecting a multitude of concerns including affordability, overall real estate climate, interest rates, property prices and perceived government intervention in the property market.

Property prices still seen as too expensive overall and many feel newly launched property prices by developers should be controlled by Government

Despite the influx of new private residential units in 2019 and 68% of respondents being aware of the increasing supply, 8 out of 10 felt that properties in Singapore are still priced too expensively, even after taking into account the July 2018 cooling measures.

Furthermore, 58% felt that the government should regulate newly launched property prices by developers, up from 49% in H2 2018.

(The URA reported in its Q3 2019 flash estimates that the Singapore private residential Property Price Index increased for the second consecutive quarter).

“Although there are expectations of falling property prices in 2020 due to an under performing economy, this logic might not apply to Singapore. This is because property in Singapore continues to be positively differentiated from regional counterparts and is a relative safe haven given its political stability and good governance. As such, investors with diversified portfolios continue to see Singapore real estate as an asset class that can ride out volatility in the medium- to long-term.” said Tan Tee Khoon, Country Manager of PropertyGuru Singapore.

Expectation of falling residential rental across the board

In the survey, the number of Singaporeans who feel that rents across HDBs, condominiums, and landed properties will decrease in the remainder of 2019 outweigh those who felt that rent would increase. Over one-third (36%) felt that condominium rents would decrease overall—the most among the various types of housing.

“In Singapore, the competition among landlords is already beginning to be felt, with over 25 condos attaining Temporary Occupation Permit [TOP] this year,” said Tee Khoon. “The increase in supply is most significant in the Outside of Central Region [OCR], and investors of these properties will feel that they need to reduce their asking rent to avoid prolonged vacancies with the dampening economic outlook.”

- 58% percent of respondents feel government should control newly launched property prices, up from 49% in 2H 2018

- Singaporeans expect rent to fall across all property types in the remainder of 2019

- Mismatch in investor and renter expectations regarding size of housing

Mismatch in landlord and renter expectations

Where the trend of smaller property sizes (i.e. floor area) is concerned, the Sentiment survey also uncovered differences in opinion among investor-landlords and renters. While only 53% of investors and 59% of landlords felt that homes are getting smaller, 7 out of 10 (70%) of renters surveyed felt that way.

Tee Khoon said, “This finding is a sobering discovery for property investors, who would do well to focus on liveability and meeting the spatial comfort of prospective tenants rather than just looking at the quantum of their purchase when making a property investment. For instance, renters may ultimately prefer a 500 square foot one-bedder over a 400 square foot unit.”