OCBC joins DBS and UOB in New Launch Home Loan Price War

OCBC officially join the Price War on 03 Mar 2017 (evening) for New Launch Building-under-construction (BUC) properties.

In our previous breaking news we reported about the DBS and UOB Price War for BUC New condominium launches projects. As the rates were already 0.6% (with conditions to buy mortgage insurance) and 0.65% (No conditions) were already very low, we speculated that no new player will join the fray and if they did, they would most likely only “Match” the rates and not go lower.

Paul Ho (iCompareLoan.com) 04 Mar 2017.

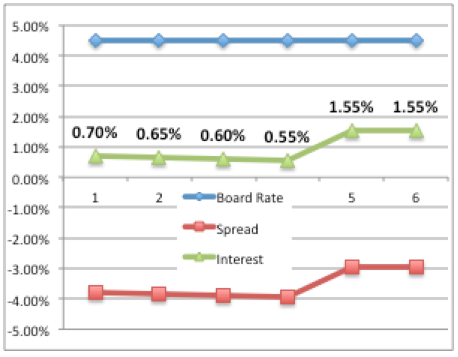

OCBC joins the BUC new launch price war at a descending rate of 0.7% and ending at 0.55% in year 4.

Table of Contents

Are we seeing a property recovery? If super low interest rates, right pricing would not fire up the New Condominium launch market, nothing will.

Comparing OCBC, DBS and UOB New Launch rates

DBS likes to bundle their rates with mortgage insurance, which is to the annoyance of some customers and convenient for others who do not mind buying such insurance.

OCBC and UOB tends to be more direct without bundling, what you see is what you get.

Both DBS and UOB were originally slated to end their promo by 6th Mar 2017, with all loans to be accepted.

OCBC launched (03 Mar 2017 evening) their New Launch Condominium rates starting from 0.7% in year 1 and 4th year at 0.55% and thereafter at 1.55% flat (Pegged to Board Rate), valid till 17 Mar 2017 (All loans to be issued and accepted).

Both DBS and UOB are pegged to fixed deposit rates that the bank offered their fixed depositors, while OCBC’s rates are pegged to their Mortgage Board Rate.

OCBC BUC rates Pros and Cons

The 1st year may be higher than DBS and UOB, but it is a descending rate structure for years 1 through 4. This is very good as the loans disbursements tend to be higher in later years while interest rate drops, giving better savings.

A Unique feature of OCBC’s package is that, even if your property attains Temporary Occupation Permit (TOP) in year 2, they will honour the rates for year 2, 3 and 4. Therefore this is really the most significant plus point for OCBC package for Under construction (BUC) property development launches with TOP coming soon.

Properties with TOP slated for 2018 and 2019 are: –

Bijou, Botanique at Bartley, Cassia Edge, City Gate, Floraview, Highline Residences, Kap residences, Lakeville, Liv on Sophia, Riverbank @ Fernvale, Rivertrees residences and many more. Please check for eligibility.

OCBC also has the lowest thereafter rates (Year 5 onwards) compared to DBS and UOB, but the downside is being pegged to Mortgage Board Rate.

The disadvantage is, Board rate is not as resistant to interest rate hike and if Sibor rises, this leads to an increase in cost of funds and consequently Mortgage Board Rate also rises. But OCBC offers you the choice of 1 free conversion to any other package should they raise their board rate.

DBS BUC Rate Pros and Cons

DBS offers the lowest 4 years, this is a major plus, but forces you to buy Mortgage Insurance. People in their 40s or early 50s who are 2nd time home buyers or HDB upgraders may have pre-existing conditions, hence may not qualify for the mortgage insurance.

UOB BUC Rate Pros and Cons

Clean cut, no pre-conditions to require you to buy mortgage insurance. However years 1 through 4 higher than DBS. Years 5 and 6 is lower than DBS.

Perhaps DBS and UOB may extend their offer since OCBC enters the fray, after-all, how can OCBC have all the limelight while DBS and UOB sit out?

Here is the Side-by-Side comparison of DBS, UOB and OCBC rates.

Table 1: DBS-UOB-OCBC Home Loan rates for Building Under Construction (BUC) New Launches.

Chart 1: OCBC Building-Under-construction Home Loan Rates, in Green.

Chart 2: DBS (Left) – UOB (Right) Building-under-construction Home Loan Rates, in Green.

Apply BUC Home Loan here through us (Mortgage Broker) and get $100 voucher* offered by our partners. (Check for Eligibility)

Now that 3 banks have joined the war, will there be more?

Buying a House in Singapore has never been more exciting. As long as the New launches are priced attractively and rates are crazy, a mini boom may yet be possible. However do note that property vacancy rate is still high, hence for those buying for own stay, it is fine, for those buying for investment, do not say we did not warn you.