Commenting on Urban Redevelopment Authority’s (URA) statistics, Ms Tay Huey Ying, JLL’s Head of Research and Consultancy for Singapore said the tightening office space supply amid firm demand drove office rents further north.

The URA release of 3rd Quarter 2018 (3Q) real estate statistics showed that prices of office space increased by 0.1% in 3rd Quarter 2018, compared with the 1.9% increase in the previous quarter. Rentals of office space increased by 2.5% in 3rd Quarter 2018, compared with the 1.6% increase in the previous quarter.

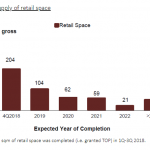

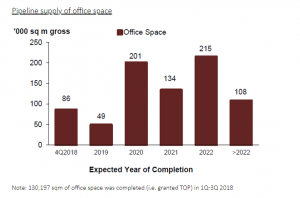

As at the end of 3rd Quarter 2018, there was a total office space supply of about 793,000 sq m GFA of office space in the pipeline, compared with the 725,000 sq m GFA of office space in the pipeline in the previous quarter.

The amount of occupied office space increased by 45,000 sq m (nett) in 3rd Quarter 2018, compared with the increase of 74,000 sq m (nett) in the previous quarter. The stock of office space supply increased by 28,000 sq m (nett) in 3rd Quarter 2018, compared with the increase of 60,000 sq m (nett) in the previous quarter. As a result, the island-wide vacancy rate of office space dropped to 12.0% at the end of 3rd Quarter 2018, from 12.2% at the end of the previous quarter.

Demand for office space has continued to outpace office space supply for the fourth consecutive quarter in 3Q18, and this has driven a fifth straight quarter of rent growth.

Table of Contents

Ms Tay said, “all in, the URA’s office rental index for the Central Region had climbed 12.2% from the bottom in 2Q17, but are still some 8.5% below the recent peak in 1Q15. Given expectations of healthy economic growth underpinning demand, and tapering office pipeline supply, the rental index for office space in the Central Region is poised for further growth going into 2019.”

JLL noted that based on the URA’s statistics, only 49,000 sqm gross floor area of office space is expected to be completed in 2019. This is just about half of the 86,000 sqm expected to come on stream in 4Q18 on top of the net new supply of 99,000 sqm that was injected into stock in the first three quarters of 2018.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

“Zooming into Grade A office space in the CBD, JLL’s research showed that their average monthly gross rents have climbed by more than 18% from the bottom of SGD8.41 per sq ft in 1Q17 to SGD9.93 per sq ft by the end of 3Q18. However, rent growth has slowed for three consecutive quarters, suggesting the setting in of occupier resistance.”

Good grade office space supply outside of CBD to enjoy spillover demand from CBD

Ms Tay said: “In the near term, good grade offices outside the CBD can look forward to enjoying spillover demand from the CBD. Rising rents and shrinking leasing opportunities for good grade offices in the CBD are driving a growing number of occupiers to explore the option of maintaining a small presence in the CBD while locating the rest of the operations outside the CBD. This will boost demand for office space outside the CBD and help in the government’s push to bring work closer to home.”

https://www.icompareloan.com/resources/singapore-office-rents/

An earlier research by JLL showed that office leasing market in Singapore is tracking expectations with Singapore office rents climbing for the sixth consecutive quarter in 3Q18. Specifically, the gross effective Singapore office rents of Grade A office space in the CBD edged up 2.3 per cent quarter-on-quarter (q-o-q) in 3Q18 to average SGD 9.93 per sq ft per month.

The reported predicted that by the end of 3Q18, CBD Grade A Singapore office rents had climbed a steep 18.0 per cent over six quarters and are a mere 6.0 per cent below the 1Q15 peak of SGD 10.56 per sq ft per month. It is not surprising, therefore, for rent growth to moderate. In fact, JLL’s research indicates that the pace of CBD Grade A rent growth has been decelerating for three consecutive quarters, from a recent high of 4.2 per cent q-o-q in 4Q17, to 2.3 per cent q-o-q in 3Q18.

Ms Tay said then: “The slowing down of rent growth is a positive, as it makes for a more sustainable growth trajectory. Steady, as against volatile, rent growth will support Singapore’s attractiveness as a corporate location as well as an investment destination for investors seeking stable returns.”

Ms Tay added, “Singapore’s CBD Grade A Singapore office rent is well-positioned for sustainable steady growth in the near and mid-term. The demand and supply dynamics of Grade A office space in the CBD is supportive of continued rent growth, but the availability of good grade office space outside the CBD during this period should keep growth in check and sustainable.”

How to Secure a Commercial Loan Quickly

Are planning to capitalise on good grade office space supply outside CBD by investing in commercial properties but unsure of funding? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner.

Alternatively you can read more about the Best Commercial Loans in Singapore before deciding. Our brokers have close links with the best lenders in the industry and can help you compare Singapore commercial loans and settle for a package that is tailored and best suited your commercial purchase needs.

Whether you are looking for a new commercial loan or to refinance, our brokers can help you get everything you need, right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all our services are free of charge. So, it is all worth it to secure a bank loan through us.

For advice on a new commercial loan or Personal Finance advice.

To speak to our distinguished Panel of Property agents.

For refinancing advice on your properties.