If you have an outstanding debt problem and are having difficulties servicing it, before fixing it, you first have to acknowledge that you have a problem.

By: Hitesh Khan/

If you are facing difficulties in making minimum payment to your credit cards or loans, and if you are defaulting on your monthly payments to your credit cards or loans, you may be having an outstanding debt problem and may need to seek advice on handling your creditors.

If you are unable to make the lump sum settlement for your outstanding debts or experiencing difficulties servicing the monthly payments under the current terms and conditions, you can write in to the creditor to appeal for a more manageable installment payment arrangement.

Below are some pointers to self-administer your outstanding debt problem.

Table of Contents

1. Accept the need to make changes

You will need to change your lifestyle and money management habits to better manage your finances so that you will have the funds to make payment to your creditors.

2. Take stock of all your resources

You could think of ways to increase your income (e.g. rent out a room, take up a part-time job), explore if there are assets (eg. shares) to sell, and list down all your available income sources.

3. Take stock of all your debts

You should list down all your debts owing to the banks, telcos, town council, Singapore Power, IRAS, CPF, HDB, etc and also to the individual creditors like parents, siblings, friends and colleagues, etc.

Write down the names of all your creditors, the amount owing and the existing monthly payment amount for each of them.

https://www.icompareloan.com/resources/personal-loan-restrictions/

4. Discuss your financial situation with your family member(s)

Be upfront with your family about your outstanding debt situation. Even if your family may not be able to help you financially, their moral support is very important. Your family members could work together to help contain or take over some expenses so that you could have a little bit more funds to make payment.

5. Work out a monthly budget

Your monthly budget should make provisions for all expenses that you may need to make payment either on a daily, weekly, monthly, yearly or ad-hoc basis.

The monthly budget should take care of all possible expenses that you may incur within a year (e.g. gifts for wedding, medical fees, buying new shoes). Ensure that the budget takes care of all necessary expenses and is not luxurious

For example, no overseas holidays until the outstanding debt is settled.

6. Prepare a repayment plan

Based on your available budget surplus (income minus expenses), pro-rate the amount to each of your creditor.

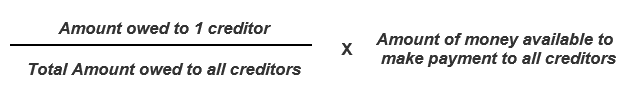

Pro-rata payment basically means that the biggest creditor receives the biggest chunk of your available funds, and the smallest creditor receives the smallest chunk of your available funds.

Prepare the repayment plan by listing down the creditors’ names, the amount you owe and the pro-rata payment amount you propose to pay to each of them.

Pro-rata Calculation Formula:

7. Write an appeal letter with supporting documents to your creditors

An appeal letter is basically to inform your creditor that you need help to repay your debts.

In the letter, you may want to explain about the adverse changes in your financial situation that renders you unable to meet your outstanding debt obligations under the existing terms and conditions. You are to indicate your repayment intention and request for the creditor’s kind indulgence to review your proposal.

The letter should include supporting documents such as the income document, your monthly budget and your repayment plan.

https://www.icompareloan.com/resources/getting-loans/

If you have already discussed with your loved ones about your outstanding debt problem, considered all your options and came to the conclusion that there is really no way to repay the debts you owe, you may want to learn more about bankruptcy. But before you make your final decision on filing for bankruptcy, it is advisable for you to quickly attend a free Info Talk by Credit Counselling Singapore on debt management.

Credit Counselling Singapore (CCS) is a non-government-link organisation and a registered charity. Unlike other debt advisors they are not driven by profit. They have been helping people with an unsecured consumer debt problem in Singapore through education and debt repayment plan since 2004.

CCS has compiled a list of organisations and their contact details that may be useful information when managing a debt-related issue:

- Information on Bankruptcy

- Free legal counselling

- Credit Report

- Licensed and unlicensed money lenders

- Counselling for emotional crisis

- Counselling for gambling and other forms of addiction(s)

- Disputes with financial institution(s)

- Financial assistance

- Consumer banks in Singapore

How to Secure Personal Loans Quickly

If you have limited capital and are searching for personal loans to expand your business, the loan consultants at iCompareLoan can set you up on a path that can get you a it in a quick and seamless manner. Our loan consultants have close links with the best lenders in town and can help you compare various loans and settle for a package that best suits your needs. Find out money saving tips here.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

If you are looking for a new home loan or to refinance, our Mortgage brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us for your business expansion needs.

Contact us for advice on a new home loan.

Contact us for home loan or refinancing advice.