Should you pay down Home Loan using CPF OA?

Table of Contents

Paul Ho (iCompareLoan.com) 05 Mar 2017.

Paying off outstanding home loan with CPF OA

A few couples whom I have met, they have built up ample Central Provident Fund Ordinary Account balances (CPF OA).

A couple in their early 40s whom I have spoken to some years back, has close to $300,000 in CPF OA funds and almost $300,000 in outstanding home loan mortgage.

The wife insisted to pay up the outstanding Home Loan, while the Husband prefers not to, but over-ruled by the wife.

The wife wants peace of mind and no debt. She says she cannot take it with debt hanging on the neck and wanted to pay up the debt and not to refinance their home loan. She says the home loan interest cost is eating them alive and it is very expensive.

Before you read on, take 10 seconds to think about why you should or should not pay down your home loan using CPF OA.

1.5%* home loan interest rate versus CPF OA 2.5%

* For Private residential bank loan

Just use the simplest of calculations as a rough estimate, what is 1.5%* interest cost, assuming 1 year interest and interest payment under a yearly interval.

$300,000 @ 1.5%* = $4,500 interest cost

whereas

$300,000 @ 2.5% = $7,500 interest earned.

If you earned $7,500 in interest and spent $4,500 interest cost, you have a net interest earned of $3,000.

*Estimate is based on interest rate for bank loan. Interest rate for HDB loan is pegged at 0.1% above the prevailing CPF OA interest rate.

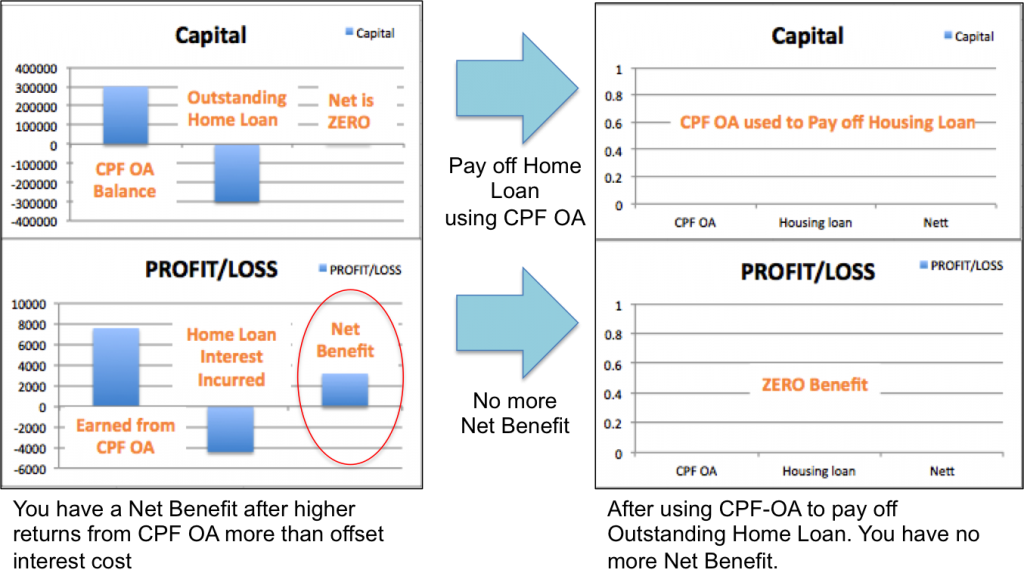

Info-graphic 1: Illustration of Loss of Interest earned if CPF OA was used to prepay Home Loan debt.

The wife focused on her savings of $4,500 of interest cost and insisted to use her CPF to pay off the $300,000 outstanding home loan. I respect their decision, as a person’s peace of mind is more important, and not everything needs to be logical.

In simple mathematics, if you saved $4,500 but gave up $7,500 in earnings, you forego $3,000.

Conversation Transcript (between the Wife and Mortgage Broker)

Here is an outline of roughly how the conversation went: –

Wife said, “Oh, but we are not gambling or investing, so we don’t lose money. We only want to save money.”

Mortgage Broker said, “Let me put it in another way, madam, you earn $7,500 in interest from your CPF-OA and you spend $4,500 on interest for bank loan, so you are well.”

Wife said, “But I want to save $4,500 interest cost so I want to pay up my home loan.”

Mortgage Broker: “Yes madam, if you pay up your home loan debt of $300,000 you will save $4,500, but you will forego the interest earned on the CPF OA of $7,500. So if you save $4,500 but forego $7,500, you are $3,000 worse off.”

Wife: “I do not get it how you all calculate. Are you sure? How come I will not earn $7,500?”

Mortgage Broker said in a calm voice, “ Madam, you took out your CPF OA and used it for paying down Home Loan of $300,000, so you will not have any balance in CPF OA that earns you 2.5% interest, remember?”

As this stage the Wife is very confused.

Wife: “But interest rate is not stable, and I don’t trust banks. What if interest rate goes up?

Mortgage Broker: “Madam, banks are neither evil nor good, they are there to serve a function. If home loan interest rates goes up beyond 2.5%, more than what CPF OA can earn you in interests, you can serve one month’s notice to pay down your home loan using CPF OA funds.”

You can make partial repayment with 1 month’s notice or full repayment serving the bank 3 month’s notice, of your Housing Loan (as long as the Home Loan packages are not locked-in and your financing bank agrees.)

On CPF’s site you can find clear instructions to do it and it will only take a few minutes to get it done.

Husband: “Do you understand, dear? Let’s refinance and not pay down the home loan using our CPF OA”

Wife: “I do not want to keep this debt lah.”

In the end, as far as I can remember, they decided to use up their CPF OA to pay down their home loan debt.

You can read more about “Investing tips for Women” in our soon to be released issue. Just do a search for “Investing tips for women by iCompareLoan”.

Is your Home Loan Interest Calculation correct?

Some home owners asked, “Are you sure this home loan calculator is correct? Are you sure this is the right way to calculate the interest cost difference?

Here is the very detailed calculation.

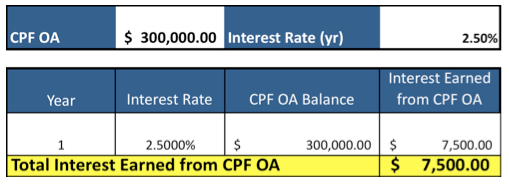

CPF pays you 2.5% per annum in your ordinary account on an annual rest method. Let us examine the detailed calculation, assuming that you are using cash to pay the monthly instalment. The total interest earned on $300,000 OA balance will be $7,500 for the year.

Table 1: CPF OA interest earned from $300,000 @ 2.5% (Annual rest)

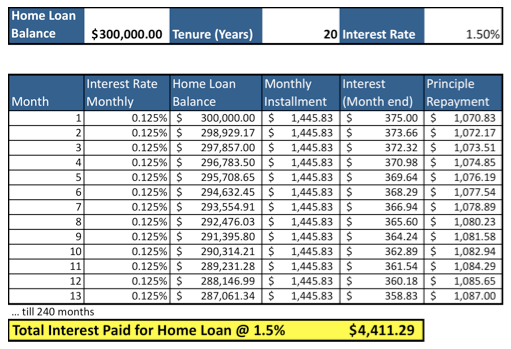

Table 2: $300,000 Home Loan over a 20 year tenure, with Principal + Interest repayment @ 1.5%, monthly rest.

The Net Interest earned from CPF OA $7,500 less off Home Loan interest cost $4,411,29 is $3,088.71.

In Summary

This savings or difference in earnings of $3,088.71 per year can help you reduce your interest payment to the tune of $257.39 out of a monthly instalment of $1,445.83 of a $300,000, 20-year tenure loan. This is 17.8% of savings against your monthly instalment.

Hence if mortgage interest rate is lower than CPF OA interest rate, you might want to consider not using your CPF OA to pay down your home loan, unless you absolutely have to. You can always activate CPF OA funds within 1 month if home loan interest rates ever go above CPF OA interest rates.

A little less emotion, a little less fear, a little more rational, you could live life a little better and become more financially sound.