Paul HO (iCompareLoan.com)

On 23 June 2016, The United Kingdom voted to leave EU. This created a wave as nobody thought the Leave camp would prevail. We attempt to drill down on the possible impact of BREXIT.

Brief History of the European Union (EU)

EU came into being at on 1 Nov 1993 via the Maastricht Treaty. It is a political as well as an economic union of sorts which streamlined raw materials in one country and production in another country. Integration work started way back in 1945 in various forms before EU came into being in 1993. The main aim is to create a common market place.

The EEC created several supranational bodies: a Council of Ministers to make decisions, a Common Assembly (called the European Parliament from 1962) to give advice, a court which could overrule member states and a commission to put the policy into affect. (Reference 1)

As a result, some level of sovereignty was surrendered to the council of ministers and European parliament. Regulation can be enacted by EU under Article 288. (Article 288, Treaty of the funcitoning of the European Union, Formerly Article 249 TEC) which is then simultaneously enforceable as law in each EU member state. A directive issued by the EU will need to be transposed into national law within a stipulated time period or face a fine.

The legal basis for the enactment of regulations is Article 288 of the Treaty on the Functioning of the European Union (formerly Article 249 TEC). (Reference 2, Treating on the functional of the European Union)

The Euro is the primary currency used within many of the the EU member states, with the exception of the Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Lithuania, Poland, Romania, Sweden, and the United Kingdom. (Reference 3, EU member states not using euro)

Benefits of EU

The benefits of the EU was the creation of a single large market where flow of goods and services became easier via Tax free trade. A common currency smoothed out some issues relating with currency uncertainties.

It also allows freedom of movement within EU states by Citizens of EU members.

This allows access to educational opportunities as well as job opportunities for people in poorer EU countries.

It also serves to rein in richer countries and support weaker countries and to prevent future wars.

Disadvantages

Loss of sovereignty, cumbersome, divergent economic performance leads difficulty in implementing a single monetary policy.

For example, Germany managed to balance its accounts and appeals for austerity while many EU member states have high budget deficits and high unemployment, they may need stimulus to get people back to productive work. This divergence is also a cause of unhappiness.

Costly directives and regulations on just about anything from bread to milk and pavements, etc., all in the name of harmonizing product specifications for trade, it is a top down bureaucratic approach that serves to create trade barriers to those outside of the EU.

The bureaucrats that set these regulations and directives are not democratically elected and are not accountable to the electorate, causing much anger.

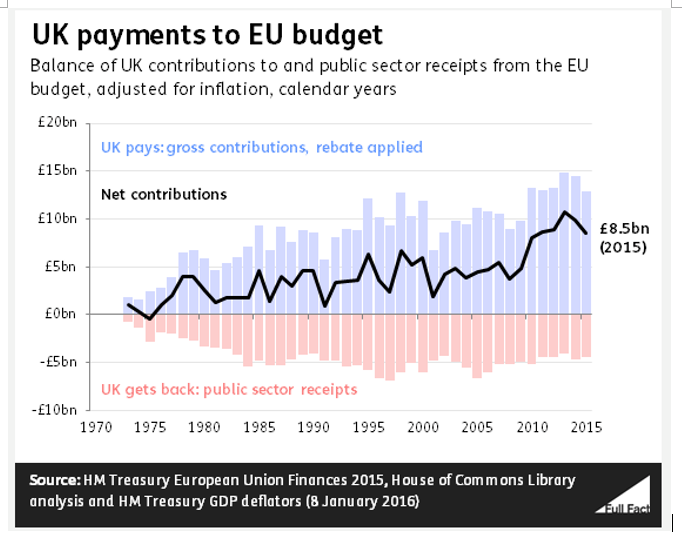

UK pays a net GBP of 8.5 billion into EU. The UK’s Budget in 2016 is expected to be GBP 759 billion. Net Payments into EU represents just over 1% of UK’s budget.

Chart 1: UK Net payments to the EU Budget, Fullfact, HM Treasury European Union Finances 2015, Reference 4

The Myth of becoming part of EU in order to trade

You do not need to be in the EU to trade. Switzerland is not the EU and it has the lowest unemployment, one of the highest exports per capital and many world class companies are Swiss. This is because of the ease of doing business in Switzerland compared to within the EU.

Impact of Britain’s Exit from EU

Note: The figures are reported in USD and GBP. The figures reported in USD and GBP are indicative of the exchange rate at the time of the references, report, i.e. 2014 or 2015 or 2016 and is not adjusted for today’s actual exchange rate.

Chart 1: US Dollar versus Euro, GBP, SGD 02 July 2016, Oanda

In 2015, the UK GDP was worth US$ 2849.35 Billion dollars (Trading Economics), this represents 4.6% of the world economy. UK’s GDP growth rate is 2% (y-o-y, in the 1st 3 months of 2016), a respectable growth for an advanced economy.

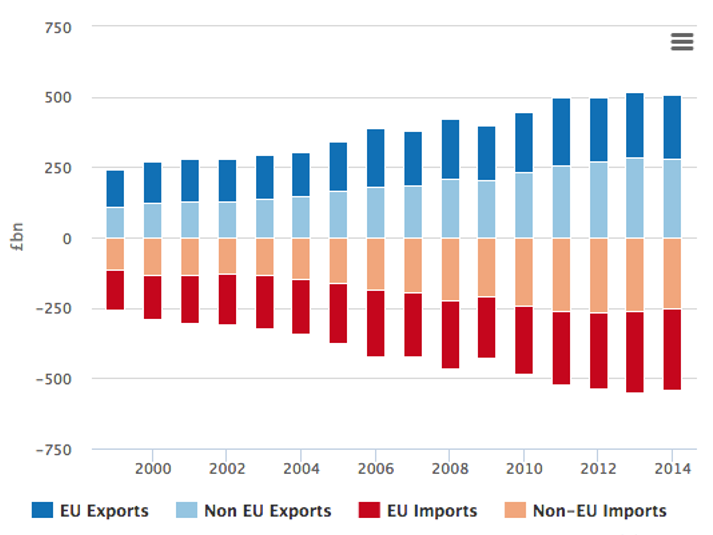

The UK’s total trade (exports and imports) amounts to over GBP 1 Trillion Pounds, of which exports to EU in 2014 amounts to GBP 226 Billion pounds, 44.6% of UK’s total exports. (UK Telegraph, Reference 5)

UK’s imports from EU amounts to GBP 288 billion pounds in 2014.

This export of GBP 226 billion pounds is slightly more than 10% of UK’s GDP.

Chart 2: UK’s Imports and Exports to EU and Non EU zones, Telegraph, Office for National Statistics, Reference 6.

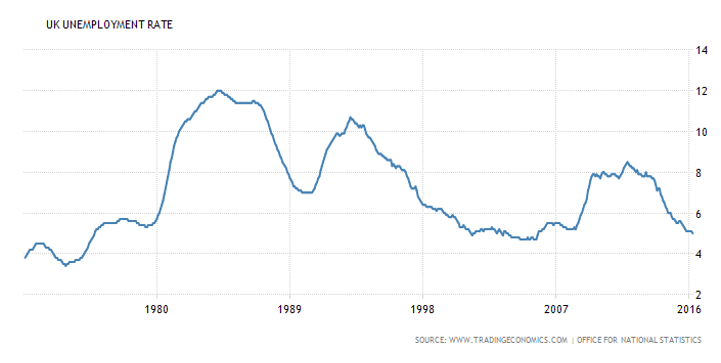

Exports to the EU have grown at a slower rate than exports to non-EU countries. If we take into account the Rotterdam effect in which Rotterdam buys UK products for transshipment to other countries and possibly being exported to non-EU countries, the percentage share of EU import of UK products are even less. The United Kingdom has an unemployment rate of 5% in Apr 2016. This is close to full employment.

Chart 3: UK Unemployment Rate, Trading Economics, Office for National Statistics

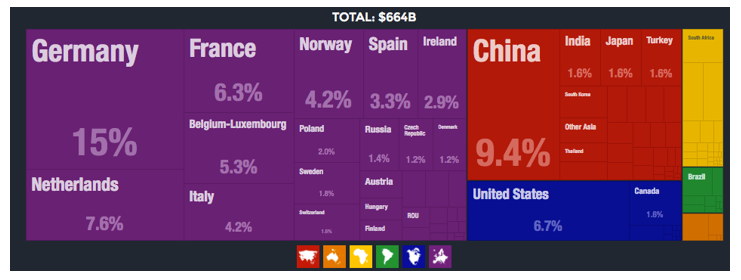

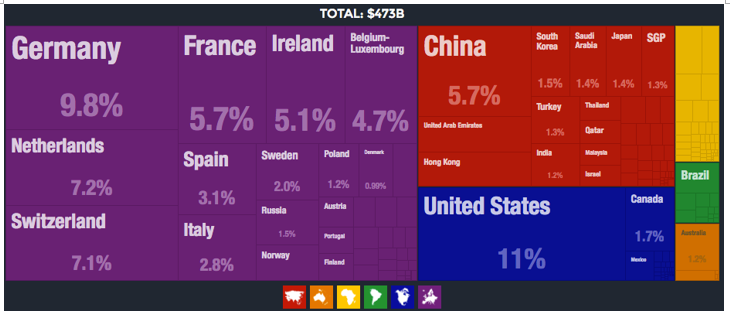

Chart 4: UK Major Import Origins 2014, Atlas Media MIT, Reference 7

United Kingdom imports the most from Germany (2014) valued at about US$100 billion, while exports only US$ 46.5 billion to Germany, a hefty US$54.5 billion in trade deficit.

Chart 5: UK Major Export Destinations 2014, Atlas Media MIT, Reference 8

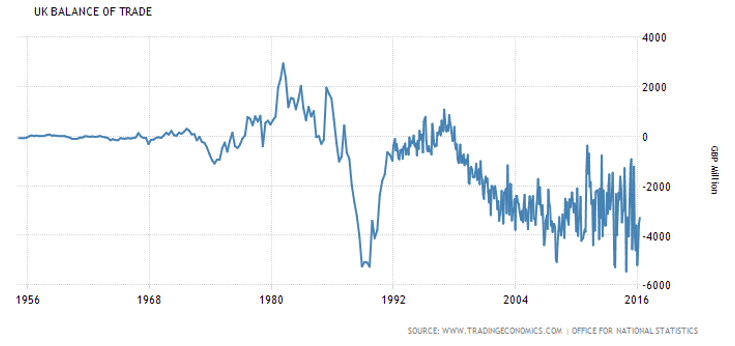

United Kingdom runs a consistent trade deficit since 1998, according to trading economics, “is due to increased demand for consumer goods, decline in manufacturing, appreciation of the pound.” The biggest trade deficits were with Germany, China and Netherlands.

Chart 6: UK Balance of Trade GBP millions, Trading Economics

The United Kingdom also runs a relatively high, but improving budget deficit of 4.4% (2015) of the GDP, and the rest of the EU member states runs budget deficits on the average of about 3%, France runs a budget deficit of 3.6% (2015) while Germany runs a budget surplus of 0.7% (2015) of the GDP. This shows the divergence of country’s economic fortunes within the EU. Germany is pulling ahead while the rest of Europe is languishing.

Chart 7: UK Government Budget as a percentage of GDP, Trading Economics, Eurostat.

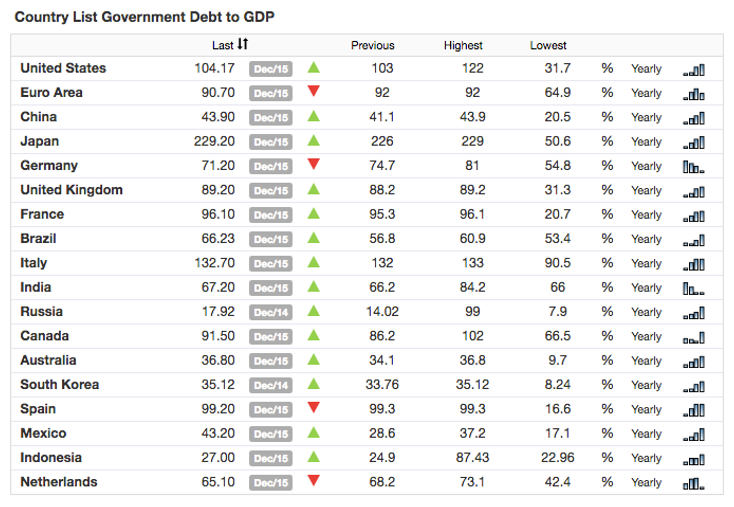

The United Kingdom’s Debt-to-GDP is in line with Euro Area’s Debt-to-GDP, and better than France, Italy, Spain but worse than Germany and Netherlands.

Chart 8: List of Country’s Debt-to-GDP

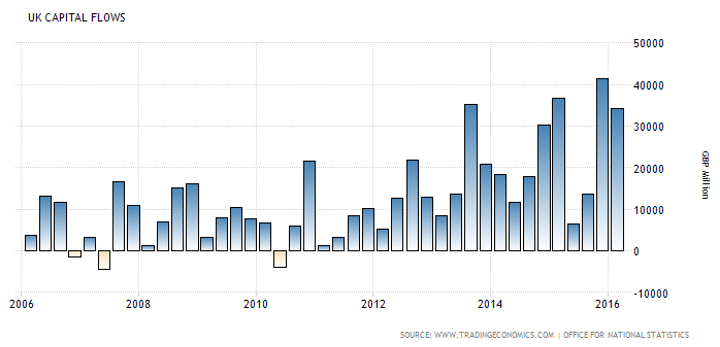

In order to fund the UK deficits, it needs capital inflows, else constant trade deficits will deplete its foreign currency reserves and GBP will be again under siege for possible devaluation.

Chart 9: United Kingdom Capital Flow in GBP, Trading Economics, Office for National Statistics

According to a speech at bank of England, “About 81% of net UK capital flows in 2014 were foreign direct investment, a more stable form of financial flows than the “hot money” that is more likely to “suddenly stop” and generate a crisis.”

(The UK Current Account Deficit: Risky or Risk-Sharing?, Reference 9)

Hot money typically flows into the property market, share market, money markets to seek a higher return and can disappear in the blink of an eye lid. Hence this signifies that the United Kingdom is still a favoured destination for Foreign Direct Investments (FDI).

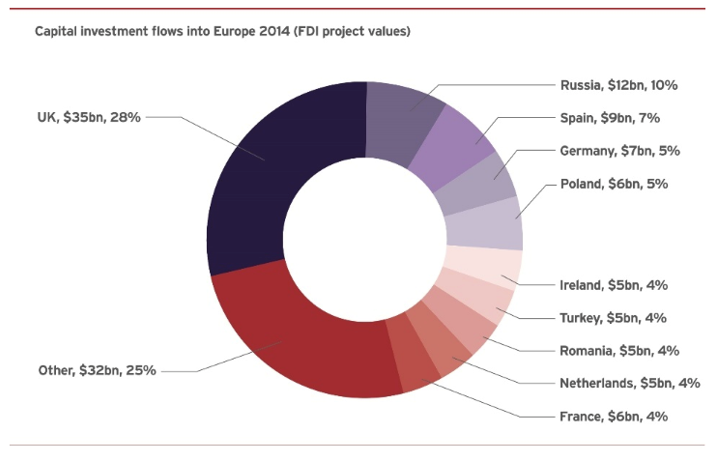

UK also captured the bulk of Foreign Direct investment flows in Europe. (UK Trade & Investment’s corporate report, Reference 10)

Chart 10: Capital Investment Flows into Europe 2014, UKTI Inward Investment Report 2014 to 2015, Reference 10

And cumulative Foreign Direct Investments in UK exceed US$1.7 Trillion dollars, just behind China US$2.7 Trillion dollars and USA US$5.4 Trillion dollars. This signifies its robust investment climate and the ease of doing business in the UK. The investment is robust as it spreads across many sectors and are not merely concentrated in using UK as a base for exporting into European Union.

Impact on property sales in UK to UK residents

Banks tend to have herd mentality, as a result of Brexit, some banks will start to restrict lending while the uncertainty lingers. Many more banks may follow suit to restrict lending. The risk appetite of banks will also drop.

Banks in UK may start to reduce the loan-to-value lending limit, this will have a negative impact on transaction and hence prices as there will be more cash down-payment required.

For UK residents buying a property in UK, the impact is likely to be muted as banks will not completely stop lending, while the Gross Debt Servicing Ratio (GDSR) remains in place to select the most worthy of borrowers.

Property developers who are based in the UK, having most of their assets in GBP (pounds) and are developing properties for the UK buyers will probably face minimal impact except for some restriction and tightened lending in the short-term. It’s a slight negative for these property developers.

Foreign property developers in the UK, developing properties for the UK residents will likely face short-term currency exchange losses due to the pound’s depreciation in the near term if they report their earnings in a currency other than the GBP.

Raw material cost that is imported for construction will raise construction cost. Hence property developers will be faced with increased cost of construction at the bottom line and restriction of pricing power at the top line due to less leverage from banks.

The Buy-to-let property segment is considered discretionary investment, will be hit with more uncertainty. Those buy-to-let for UK residents will be more impacted, but the more volatile ones will be those that are buy-to-let targeted at expatriates.

Impact on property sales in UK to Non-UK residents

As local UK banks may restrict or reduce lending to Non-UK residents, smaller price quantum units may see lesser impact. Some foreign banks may also temporarily stop lending for mortgages pending internal risk assessment.

Without access to leverage, a segment of borrowers that typically need financing for their investments will dry up.

Cash rich foreigners will then start to eye prime properties and enter the market.

Property developers that are developing mid-tier properties will likely suffer. Property developers that develops the best in class properties in the most prime and sought after districts will still be able to move their properties if they are willing to negotiate, as there will still be plenty of cash rich buyers eyeing the UK as a 2nd home where money is no object.

Property developers with the whole emphasis of targeting the mass market Non-UK residents will be hit hard by lending restrictions.

Overall on Properties in UK

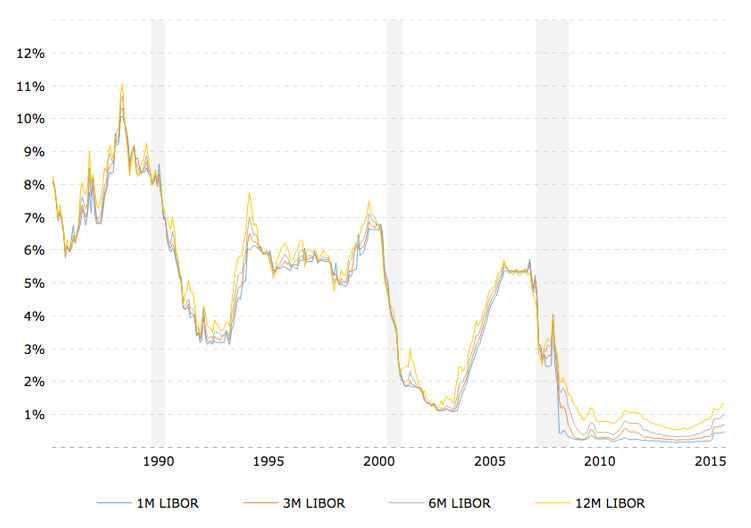

The depreciation of the pound presents buying opportunities in good locations. However any such buyer will need to be more liquid and be prepared to hold on to the property for longer periods of time. The financing cost may also increase as Libor rise in response to possible speculative attacks on the GBP to combat capital outflow.

Overall, London is still an attractive destination for investments and foreign direct investments now will be faced with cheaper properties, possible lower rentals, lower industrial and commercial property prices, lower staffing costs and cheaper to relocate their personnel to the UK to head up the operations.

SUMMARY OF BREXIT

On Trade with EU

The UK is strong enough to leave EU. The EU probably needs UK more than the UK needs EU as UK runs a trade deficit with EU, so it a major market for the EU. Imposing tariffs on UK exports risks retaliation and hence reduce EU’s exports to the UK.

On the Markets

While the speculators will be quick to take profit from shorting the Pound, exiting the share markets, UK’s capital inflows and cumulative investments are predominantly not portfolio funds, and hence would not leave UK in the whim of the moment. Many firms choose UK as the regional Headquarters as it is easier to hire and fire someone in the UK compared to mainland Europe.

On the financial Markets

UK may lose some staff as international banks relocate some of their staff, pending exit negotiations. However London will not lose its status overnight. Some of London’s loss may be Hong Kong, New York or Singapore’s gain.

On the Euro

EU is starting to see cracks. As Euro is used in most member states that have converged on the monetary policies and budget deficits, but many have started to diverge. As you will see that businesses that became stronger are those in Germany. Many member states such as Greece, Portugal, Spain are under strain. Germany which managed to balance its budget will like to see austerity and tightening of spending while the other countries may see a need for stimulus spending to use up excess capacity. There will probably be pressure from UK invoking Article 50, to leave the EU.

On the Stability of the UK

In reality, EU seems to have become a trade bloc whose regulations are very hard to understand. This is also perhaps one of the reasons UK wins hands down in Foreign Direct Investments. Without the EU, the budget deficit will improve from 4.5% to 3.5%.

Example of Switzerland not needing EU

Switzerland did not need to be in the EU to be able to trade. There is really no need to be in the EU to be able to trade with EU amidst the stifling top down regulations which potentially aims to stifle creativity and business creation.

Flexibility and ability to move faster

Leaving the EU allows the UK to move faster on creating trade deals or to explore trade with the non-EU markets, which are growing at almost twice the speed as EU markets.

On the Pound

Capital inflows may slow down due to uncertainty around the EU exit. However most funds may not exit UK. The UK pound has weakened, this gives UK exporters greater international competitiveness. As the Pound weakens, UK’s food prices will likely go up as UK is only able to produce about 60% of the food it needs. The purchasing power of the people will drop, but that is not a bad thing as there has been a persistent imbalance of trade, that perhaps needs to be righted. Unless those imports are from industries that the UK no longer exists, then the imports may not drop by much.

The Libor may rise at times to combat potential funds outflow.

If the markets attack the pound again the Libor may rise to cushion the impact.

Chart 11: Libor Rates, Reference 11

If Libor goes crazy, so will a lot of financial products that are pegged to the Libor. Again the banks would be crazy to rock the boat to create another financial centre from scratch.

Impact for UK properties

It is expected that banks in the UK will tighten lending. Banks lending to UK will also become more selective as they worry about higher volatility. The lowered exchange rate for the pound creates potential buying opportunities. UK institution of higher learning are still amongst the best in the world and studying there will become cheaper.

UK and Global Trade

With UK’s exit of EU, there will be some political uncertainty with the change or leadership. UK will need to quickly develop trade missions to pull closer to China, Asia, USA and other markets. UK is the 2nd European country that has joined the Asian Infrastructure Investment Bank (AIIB), just 1 day behind Luxembourg. And there are 15 to 20 seats on the board of AIIB of which only 3 seats for reserved for non Asian members for which there are 7 countries fighting for.

We will likely see UK moving eastward again as it had done in the past.

As the exit negotiations are not yet started, it is hard to tell what the outcome will be, but it would be very unwise for EU to cut its nose just to spite the face. Do expect a few surprises and some volatility, but there is nothing to be alarmed unless EU presses the self-and-mutual destruct button.

Afterall, the UK had once ruled over colonies and land where the sun never set on the British empire, while having fought and won against the Spanish, hostility towards the French and Germans and still dominated.

It may never recover its past glory of its empire, but it could well find its place of trade in the east where the emerging markets are growing faster than EU and tag along, afterall the UK is no stranger to Asia.

Will UK’s exit of EU lead to Sibor volatility?

Yes, it is likely that any attempt to attack the Libor, the pound or UK share market will have some effects on the global financial markets.

The impact is likely to be transmitted via impacting the confidence on the financial markets. Hence UK’s exit of EU impacts the confidence due to uncertainty of what the politicians will do, rather than any concrete impact on the fundamentals of the UK and global economy. As a result of this, the global markets are factoring a drop in global growth due to UK’s exit, and hence interest rates globally are dropping.

Remember, the market does not always respond to fundamentals, but are instead a reflection of greed and fear.

REFERENCES

- Reference 1, European History, http://europeanhistory.about.com/od/governmentandlaw/a/europeanunionhist.htm

- Reference 2, Treaty on the functioning of the European Union, https://en.wikipedia.org/wiki/Treaty_on_the_Functioning_of_the_European_Union

- Reference 3, EU member states not using euro https://en.wikipedia.org/wiki/Eurozone

- UK Net payments to the EU Budget, Fullfact, HM Treasury European Union Finances 2015, Reference 4, https://fullfact.org/europe/our-eu-membership-fee-55-million/

- Telegraph, The EU’s dwindling Importance to UK trade in three Charts, http://www.telegraph.co.uk/finance/economics/11700443/The-EUs-dwindling-importance-to-UK-trade-in-three-charts.html

- UK’s Imports and Exports to EU and Non EU zones, Telegraph, Office for National Statistics, http://www.telegraph.co.uk/finance/economics/11700443/The-EUs-dwindling-importance-to-UK-trade-in-three-charts.html

- UK Major Import Origins 2014, Atlas Media MIT, Reference 7, http://atlas.media.mit.edu/en/visualize/tree_map/hs92/import/gbr/show/all/2014/

- UK Major Export Destinations 2014, Atlas Media MIT, Reference 8 http://atlas.media.mit.edu/en/visualize/tree_map/hs92/export/gbr/show/all/2014/

- The UK Current Account Deficit: Risky or Risk-Sharing?, Kristin Forbes, External MPC Member, http://www.bankofengland.co.uk/publications/Pages/speeches/2016/890.aspx#footnotes

- UK Trade & Investment’s corporate report, UKTI Inward Investment Report 2014 to 2015, https://www.gov.uk/government/publications/ukti-inward-investment-report-2014-to-2015/ukti-inward-investment-report-2014-to-2015-online-viewing

- Libor Rates, Macrotrends, http://www.macrotrends.net/1433/historical-libor-rates-chart

APPENDIX 1: Timeline of EU history

- 2016 – UK holds aMembership Referendum and votes to secede from the EU

- 2013 –Accession of Croatia

- 2009 –Lisbon Treaty abolishes the three pillars of the European Union

- 2007 –Accession of Bulgaria and Romania

- 2005 – France and the Netherlands reject theConstitution

- 2004 –Accession of ten countries; signing of Constitution

- 2002 –The euro replaces twelve national currencies

- 1999 –Fraud in the Commission results in resignation

- 1995 –Accession of Austria, Finland and Sweden

- 1993 –Copenhagen criteria defined

- 1992 –Maastricht Treaty formally called the Treaty on European Union – The European Union is born and the Euro was introduced as the fellow currency (Denmark and the UK are not included in the EMU (European Monetary Union)).

- 1989 – The fall of theIron Curtain in Eastern Europe

- 1986 –Single European Act; Accession of Portugal and Spain; flag adopted

- 1985 –Delors Commission, Greenland leaves Community.

- 1981 –Accession of Greece

- 1979 –First direct elections to Parliament

- 1973 –Accession of Denmark, Ireland and the UK

- 1967 –ECSC, EEC and Euratom merged

- 1963 –Ankara Agreement initiated a three-step process toward creating a Customs Union which would help secure Turkey’s full membership in the EEC.

- 1963 –Charles de Gaulle vetoes UK entry

- 1957 –Treaty of Rome creates Economic Community

- 1951 –Treaty of Paris creates Coal and Steel Community

- 1945 – The end ofWorld War II