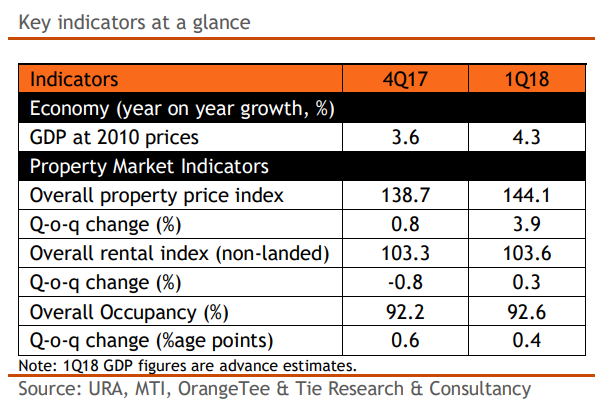

Sentiment in the private residential market continued to be buoyant in the first quarter of this year, said a report by OrangeTee & Tie Research and Consultancy. Overall private property prices rose across most market segments, with the largest price surge seen in the Core Central Region (5.5%) and Outside of Central Region (5.6%).

As developers’ existing stock continues to diminish and supply of completed homes remain low, many projects especially those in the CCR have raised prices of their unsold units, some by even double-digits this year. Private residential market continued to gain traction with individual re-sellers have also seized the opportunity of increasing their asking prices in light of the more positive market sentiment fueled by the recent collective sales frenzy.

Higher launch prices at some new projects slowed the buying momentum in the primary market, as sales volume dipped 15.2% quarter-on-quarrter. Some developers have also held back their launches in the first quarter in anticipation of higher asking prices. While overall sales had slipped 14.2% q-o-q, volume rose 2.4% on a y-o-y basis.

With positive sentiments of the private residential market, sales is predicted to pick up significantly in the months ahead as more projects are slated to be launched and the prevailing market valuations be supported by banks at the higher benchmark prices.

OrangeTee & Tie research and consultancy head Christine Sun noted: “As it seems, demand for resale homes had rebounded strongly by 67.3 per cent year-on-year, the highest number of Q1 resales since 2012.”

She added: “Owing to higher land cost, stronger economic growth and pent-up demand, we expect prices to trend even higher. Some new homes may even see prices rise beyond 15%, going by the recent pricier enbloc acquisitions.”

Median rents for private homes are expected to stabilize this year as there is less supply of completed homes now as compared to the last two years. The limited supply coupled by the positive macroeconomic conditions will mitigate further downward pressure on the private rental market, the report said.

The public housing market however has not kept up with the private residential market. Median resale prices of Housing & Development Board (HDB) flats continued to drop even as the public housing developer announced the release of thousands of new Build-To-Order (BTO) flats. In late April, the HDB today announced that the Resale Price Index (RPI) of HDB flats fell by 0.8 per cent, from 132.6 in 4th Quarter 2017 to 131.6 in 1st Quarter 2018.

https://www.icompareloan.com/resources/median-resale-prices-hdb-drop/

It is however unlikely that the HDB resale prices will continue to free-fall. Analysts are almost unanimous in predicting that there will be more demand for HDB resale flats in the near future, which may drive up the prices of public housing. PropNex Realty CEO Ismail Gafoor, for example, said that there may be “a greater demand for HDB resale properties with some en bloc owners considering bigger sized resale flats in the second half of the year”. Mr Ismail believes that HDB resale prices could climb by 1 per cent this year, especially given the ongoing en bloc fever.

The upbeat private residential market sentiments together with the belief that the Government will intervene to prevent a steady-decline in prices of the public housing market, may reverse the decline of resale flat prices. For the full year, experts expect HDB resale prices to be flat or grow by up to 1 per cent. How much it will grow by next year, as we draw nearer to the next General Election, is anyone’s guess.

—

If you are home-hunting, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and a promotional home loan. Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com.