Knowledge that can be gleaned from a property buying guide is often ignored by Singaporeans as they felt that buying property is easy as everyone around them owns a property. A strong cornerstone of what it means to be a Singaporean is to own a property (in property crazed Singapore) which we call our home. From generation to generation, we have been instilled with the mindset that getting a roof over our heads is essential. It is a good mindset to instil in the younger generation.

However, while our parents have instilled the right mindset in us, they have failed to impart the mistakes that they have made during their search for their desired property. These mistakes are vital in helping us learn from their mistakes to make better property buying decisions in our property search.

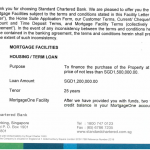

Image Credits: Street picture of Commercial Shop Houses along Jalan Sultan, Paul Ho, iCompareLoan.com

To help Singaporeans like yourself become better decision makers, we highlight the top four mistakes that past homeowners have made which you should avoid when buying your first/next property.

Property buying Guide – Top 4 Mistakes To Avoid

Table of Contents

-

Rushing Into A Decision

Properties in Singapore have a lifespan of 99 years (less if you are buying an older property). Depending on how long we live, the property will be our home for the next 60-80 years. For most of us, we would probably be living in the space for at least the next few decades.

Yet, for something which has such importance in our lives, some of us are rushing into making a decision. Instead of taking the time to explore our options, we give ourselves mental pressure to make up our mind quick. This could be due to:

- The pressure from parents to get married and settle down earlier

- Desire to get rid of the additional mental stress from all the home viewing; or

- An unethical property agent trying to make you feel anxious by saying he has a few interested buyers waiting to sign an option-to-purchase (OTP)

So, when you find yourself in such mental pressure into making a decision, take a step back and be open to exploring all your options. Do not let it affect your decision.

Many times a property buyer enter into the deal without even knowing how much home loan they are eligible for. Also they forget to read up on the latest home loan terminologies and do not simply restricted yourself to the usual DBS, OCBC, UOB for home loan choices.

Read also: 8 NEGOTIATION TIPS TO BUY GOOD PROPERTY DEAL

-

Mistake High Price For Value

“Price is what you pay for, but value is what you get”. Warren Buffett’s golden advice says it all. Often, people mistake high price for value. While it could be true that valuable things do not come cheap, expensive properties doesn’t mean they are valuable.

There is a way in which properties are conventionally valued. This includes proximity to amenities, accessibility to mrt stations and other factors. However, the conventional valuation might not be aligned to your definition of value.

For example, you might prefer a property that is located to your workplace in Jurong Industrial Estate to reduce your daily commute time. According to conventional valuation, such properties are not as pricey as the ones that are nearer to Jurong East Mrt. But does that mean you should go for the pricier ones at Jurong East Mrt? And do they really prove to be more “valuable”? At least not to you if you have to spend twice the amount of time to travel to and from work.

Read also: HOW BIG WILL SINGAPOREAN HOMES GET?

-

Relying On Someone Else’s Wisdom, Instead Of Doing Your Own Research

Whenever your phone plan is up for a change, do you look up for the best deals available among the telcos? Most of us would, wouldn’t we? But yet, for something that we are committing to for the next 20-25 years, it is surprising how little research some of us are doing.

Do you really bother to research on what it means for a property to be considered a good bargain? Have you studied whether the current property cycle is suitable for investing in a property? Do you analyse past property transactions to determine whether you have over or underpaid for the property you are eyeing? Sadly, some of us might succumb to conventional wisdom and even opinions that are not backed by facts.

To really make a sound property purchase decision, time, effort and patience have to be committed to do all the necessary legwork. Do not just rely on someone else, or worse, relying on anyone who has an opinion.

Related: WHAT TO LOOK FOR WHEN BUYING UNDER-CONSTRUCTION CONDOS

-

Not Understanding How It Is Like To Live There

When we buy a property, our motive is to live and settle down there with our loved ones. However, how likely do we go and understand what it is like to live there? When viewing the property with your property agent, many of us forget about the trivial but yet critical stuff.

Do you bring your compass to see if your home is affected by the morning or evening sun? Did you take a good walk around the neighbourhood to learn more about the food options in the vicinity? Have you had a casual chat with your potential neighbours to see if you and your family can get along with them? Do you try traveling to and from your workplace to the property’s location to understand your future work travel time? For those of you living with your parents, are there neighbours of similar demographics to mingle with them? Is a market available for them to visit?

Also, most of the time, you view the showroom or property when it is comfortably air-conditioned, have you ever wondered what it might feel if you turn off the air con?

These might sound trivial, but they are crucial in adding to your quality of life when you move in with your loved ones.

Ultimately, you may really need to know also how costly it is to live there. You may want to know what is your share value and maintenance fees.