The total property investment volume increased to $16.74 billion in 3Q2019, a 150 per cent jump from the $6.7 billion in 2Q 2019 and it is 49 per cent more than the volume of $11.24 billion for 1Q2019 and 2Q2019 combined. The commercial sector led the way with $6.27 billion worth of investment sales.

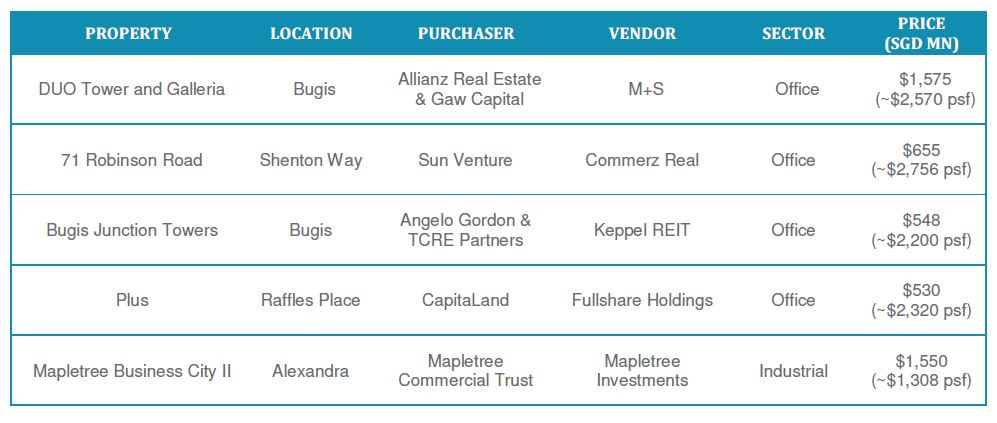

Cushman & Wakefield’s Q3 2019 Capital Markets Report said Allianz Real Estate and Gaw Capital Partners acquired DUO Tower and Galleria from M+S for $1.58 billion or $2,570 psf. With the property performing above expectations, the deal was a record price for the Bugis submarket, enabling M+S to unlock capital and maximize the returns for shareholders.

The C&W report on property investment volume said that another transaction in Bugis involved Angelo Gordon and TCRE Partners purchasing Bugis Junction Towers from Keppel REIT for $547.5 million or $2,200 psf. The selling price was 6.3 per cent above the latest valuation, enabling Keppel REIT to reap a gain of $378.1 million from the acquisition price of $159.5 million paid in 2006 after accounting for capitalized expenditures and divestment cost.

https://www.icompareloan.com/resources/property-investment/

Also, Arch Capital Management bought Anson House from Savills Investment Management for $210.0 million or $2,435 psf. The property recently underwent a revamp which spruced up the common areas and converted some car park space to office space. Other office transactions include 71 Robinson Road and Plus (former GSH Plaza).

Commerz Real divested 71 Robinson Road to Sun Venture for $655.0 million or $2,756 psf. This was lower than the price of $743.8 million or $3,125 psf paid by Commerz Real for its purchase near the peak of the market in 2008. Fullshare Holdings divested Plus for around $530.0 million or $2,320 psf to an associated company of CapitaLand. According to media reports, the selling price was lower than the effective price of approximately $2,600 psf which Fullshare acquired the building for in 2017 as demand for the small strata units had been lower than expected.

However, the deal is structured in a way which enables the seller to benefit from a share of the upside if CapitaLand sells the property for a profit in the future. There was also activity in the retail sector with Lendlease injecting 313@Somerset into its REIT for $1.00 billion. Lendlease Global Commercial REIT’s IPO has been well received by the market, with its share price rising by 4.5 per cent on the first day.

Transactions in the industrial sector in the third quarter of 2019 totalled $4.07 billion. The residential sector accounted for $3.03 billion while the hospitality sector also had a strong showing of $2.92 billion.

REITs drove industrial property investment volume during the quarter. Mapletree Investments committed to pursuing an asset-light strategy by injecting Mapletree Business City II into Mapletree Commercial Trust for $1.55 billion or $1,308 psf.

The data centre segment is in vogue, with Keppel DC REIT continuing to grow its portfolio by purchasing 1-Net North Data Centre for $201.8 million and a 99 per cent stake in Keppel DC Singapore 4 for $384.9 million.

Property investment volume surge as investors seek safe havens amidst regional unrest

“The 2019 YTD volume currently amounts to $27.98 billion due to the robust Q3 contribution, and it is increasingly likely that the 2019 full-year volume will surpass 2018’s volume of $33.96 billion. The Grade A CBD office capital value recorded a marginal increase to $2,930 psf, while yields remained stable at 3.20%. Slight yield compression could occur in 2020 if investor demand for assets in safe havens like Singapore increases amidst greater unrest in Hong Kong and the escalation of the US-China trade war. However, gains in capital value could be mild as rents are expected to peak in 2019 in view of the subdued economic outlook.”

The hospitality sector is also heating up with higher property investment volume

The hospitality sector is also heating up with higher property investment volumes said the report. Royal Group sold Darby Park Executive Suites for $160.0 million to Indonesian tycoon Bachtiar Karim, after its initial purchase from Sime Darby Group last year. This garnered Royal Group a 72 per cent profit after the site was re-zoned from residential to hotel use. Meanwhile, PAM Holdings and Datapulse Technology bought Bay Hotel Singapore for $235.0 million.

A joint venture by Hong Kong financial services firm AMTD Group and Far East Consortium International acquired Oakwood Premier OUE Singapore for $287.1 million. This came after OUE Hospitality Trust declined to exercise its right of first refusal as the deal would not be DPU-accretive for its unitholders.

Christine Li, C&W’s Head of Research for Singapore and Southeast Asia, said “Year-to-date, investment sales volume currently tracks at $27.98 billion, bumped up by the robust Q3 contribution. It is increasingly likely that the 2019 full-year volume will surpass 2018’s volume of $33.96 billion. Grade A CBD office capital values recorded a marginal increase to $2,930 psf, while yields remained stable at 3.20 per cent. Slight yield compression could occur in 2020 if investor demand for assets in safe havens like Singapore increases amidst greater unrest in Hong Kong and the escalation of the US-China trade war. However, any gains in capital value could be mild as rents are expected to peak in 2019 in view of the subdued economic outlook.

Shaun Poh, Executive Director of Capital Markets at C&W, said “In a tight commercial supply market such as Singapore’s, it is tempting for assets to chase price gains. That is where the market is headed now, creating a gap between sellers and buyers’ expectations. Still, Singapore’s gateway city status and its stable fundamentals make it an attractive destination for foreign funds.”

Significant Private Investment Transactions in 3Q 2019: