Queensway Shopping Centre and its adjoining apartment, Queensway Tower, have started the process for en bloc sale. Berita Harian which reported on the en bloc attempt of Queensway Shopping Centre and Queensway Tower noted that the en bloc sales process was started after the property cooling measures introduced by the Government in July last year. Many en bloc sales attempt failed after the property cooling measures were introduced.

Queensway Shopping Centre is one of Singapore’s first multi-purpose shopping complexes and comprises 4 levels with a 1-storey basement car park. The mall is also a mixed development which includes a 13-storey apartment tower with 78 units. Established in 1976, it is one of the oldest malls in Singapore.

According to Berita Harian owners of Queensway Tower and Queensway Shopping Centre attended an extraordinary general meeting last weekend, and a Collective Sales Committee (CSC) was formed.

Table of Contents

Members of the CSC did not speak to the media, but one shop owner who did said that he supports the en bloc attempt as his business declined over the years due to a reduced number of visitors.

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

Built in 1975, Queensway Shopping Centre was opened in 1976 to provide shopping and recreational options for residents residing in Queenstown and in Brickworks, Bukit Merah. Dubbed by locals as “Singapore’s Sports Mall”, the mall is a popular spot for sporting items since its establishment.

Designed in modern architecture style, the mall is characterised by its octagonal facade and sunken central concourse. Units which are located near the concourse features display windows across 2 levels. The layout of the mall is made up of a series of concentric circles radiating outwards, which makes it look like an octagon.

With its unique trigram shape layout, many shoppers get lost within the mall. The mall comprises 150 shops with a tenant mix of sporting goods, apparels, spectacles, printing services and tailor services. The mall is designed to house over 200 shops and features a large emporium, an exhibition hall, a coffee house and a night club. It also features the first public escalators installed in Singapore.

Paul Ho, chief mortgage officer of iCompareLoan, said “subsidiary proprietors (SP) and strata apartment unit owners of Queensway Shopping Centre should get involved and understand the deal that is being put together.”

https://www.icompareloan.com/resources/mortgage-broker-best-home-loan-reasons/

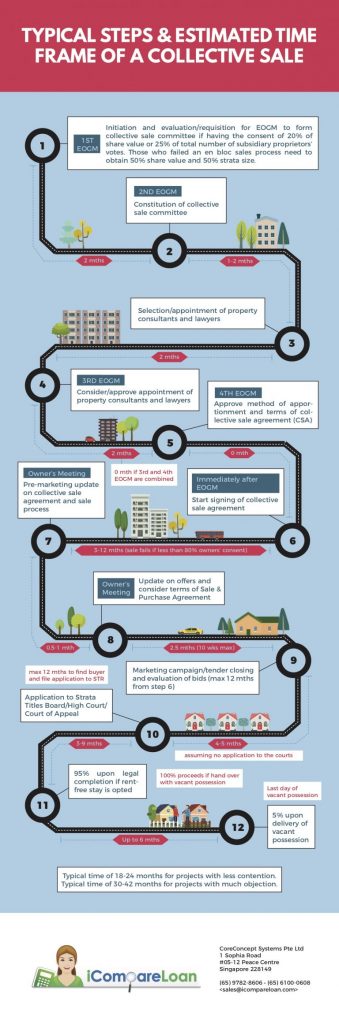

KEEPING TRACK OF MILESTONES

As an SP, you should always keep track of all the milestones leading to the conclusion of your en bloc sales- milestones like when your Sales Committee (SC) was formed, Extra-Ordinary General Meetings, Updates from SC, etc. Most importantly don’t rely on any knowledge or information you may have gleaned from your en bloc experience in the past.

The en bloc regulations have been more firmly tightened, and the process strictly regulated in the past few years. The tighter laws we now have means the responsibilities of the SC, the property consultants, and the lawyers, are all well defined, which provides for better transparency of the en bloc processes.

IT’S NOT OVER TILL IT IS OVER

Don’t think that just because a qualified developer has made a bid at or above the reserve price, and just because the SC has agreed to accept the bid on behalf of the SP, the transaction is considered done. Some SP may still raise objection to the en bloc sales and if they do, the Strata Title Board (STB) is obliged to hear their case. The entire en bloc transaction can be stopped from proceeding further if the dissenters can prove that the SC did not abide by correct procedures.

TIME TO MOVE OUT

Once the STB gives the stamp of approval for the en bloc sales, the winning developer will have to give you at least 6 months for you to move out of your property. The funds from the en bloc sales would also have been transferred to you by this time, but a significant portion of your proceeds will go towards offsetting any existing loans you may have with the bank, as well as any CPF funds used for purchase of your previous unit. The 6-month period may be sufficient time for most SP to arrange sufficient finances to find another suitable home.

CONSIDER ALL OPTIONS

Whether you are considering to rent or to downgrade to a smaller apartment, consider all options carefully. Everybody’s needs and comfort-levels are different. Just because one housing option works for someone, it doesn’t mean that the same option will work for you and your family. As soon as you are sure that your en bloc sales will conclude without any hassle, you should be speaking to a trusted property advisor. The advisor would be best placed to guide you through your next housing option.

How to Secure a Commercial Loan Quickly

Are you planning to purchase an office space site but unsure of funding? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner.

Alternatively you can read more about the Best Commercial Loans in Singapore before deciding on your purchase. Our brokers have close links with the best lenders in town and can help you compare Singapore commercial loans and settle for a package that best suits your commercial purchase needs. Our services are also very personalised and tailored to the unique needs of the buyers.

Whether you are looking for a new commercial loan or to refinance and existing one, our brokers can help you get everything right from calculating mortgage repayments, comparing interest rates, all through to securing the final loan. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us for your next purchase.

If you need advice on a new commercial loan or Personal Finance advice.

If you want to speak to our trusted Panel of Property agents.

If you need refinancing advice.