“The real estate market sentiment has been at the all-time high after showing 10 consecutive quarters of increases since 4Q 2015,” said Dr Sing Tien Foo. Dr Sing who is the Associate Professor at the National University of Singapore and . Deputy Head of the Department of Real Estate at the university added that, “the improvements in the performance were broad-based and found in all sectors of the property markets.”

Dr Sing was commenting on the 1Q 2018 Real Estate Sentiment Index Report which was jointly developed by the Real Estate Developers’ Association of Singapore (REDAS) and the Department of Real Estate (DRE), National University of Singapore. The real estate market sentiment suggeted that prime and suburban residential markets showed the most robust performance in 1Q18 supported by the strong take up in new launches.

The report showed that the current real estate market sentiment index went up to 7.2 in 1Q18 from 6.9 in 4Q17.

Table of Contents

The future sentiment score increased to 7.0 in 1Q18 from 6.9 in 4Q17, which show that the market outlooks continue to strengthen in the next six months. The overall real estate market sentiment stood at 7.1 in 1Q18 up from 6.9 in 4Q17. Developers’ real estate market sentiment have experienced ten consecutive quarters of increases since the trough in 4Q15. The report noted that the rate of increase of the sentiment index is positive but the upturn momentum appears to be slowing down quarter over quarter.

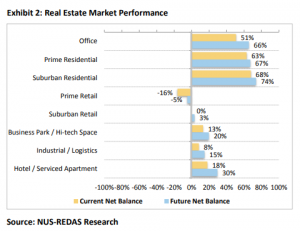

The current and future net balances show improvements in all sectors in 1Q18. Prime residential and suburban residential sectors are the two best performing sectors in 1Q18. The current net balances of 63% and 68%, and the future net balances of 67% and 74% reflect optimism in the two residential sectors.

The office sector’s performance is also robust, with the current net balance and future net balance increasing to 51% and 66%, respectively.

Compared with other submarkets, the prime retail sector is the only sector still showing negative current and future net balances of -16% and -5% in 1Q18, respectively. However, the sector shows improvements relative to the current and future balance of -31% and -10% in 4Q17, respectively.

In 1Q18, the respondents viewed rising inflation / interest rates, excessive supply of new property launches, and government intervention in the market as the top three potential risks that may adversely impact market real estate market sentiment in the next six months.

In 1Q18, the respondents viewed rising inflation / interest rates, excessive supply of new property launches, and government intervention in the market as the top three potential risks that may adversely impact market real estate market sentiment in the next six months.

87.3% of the respondents were concerned about rising inflation and interest rates in the next 6 months, increased from 74.2% in 4Q17 and 50.8% in 3Q17.

In view of new launches in the pipeline, 50.8% of the respondents were worried about excessive supply of new properties. Compared to 59.7% in last quarter, 49.2% of the respondents were still concerned about unexpected government interventions into the market.

In 1Q18, 26.5% and 55.9% of the developers indicated that they would substantially increase or moderately increase their new launches, respectively. Only 14.7% of them would hold the new launches at the same level in the next 6 months.

In terms of unit price change, 88.2% of the developers anticipated the residential property prices to increase in the next six months. Only 5.9% of them expected the residential property prices to hold at the same level, and 5.9% expected a drop in the prices.

52% of the respondents and 62% of the developers indicated that the latest DC rate revision for non-landed residential properties (increased by 22.8% on average) is unusually high. Despite the unexpectedly high DC rate hike, 65.1% of respondents indicated that there would not be significant cutback in collective sales activities in the next 6 to 9 months. 52% and 16% of all the respondents felt the DC rate hike only has minimal impact or no impact on land acquisition volume.

The respondents generally agreed that the residential property prices would continue to increase in 2018. 31.7%, 15.9% and 15.9% of the respondents indicated that residential property prices would increase by 5%, 8% and 10%, respectively. 60.3% of all the respondents and 64.7% of the developers expected the residential property prices to increase by between 5 and 8%, whereas 25.4% of all the respondents and 29.4% of the developers expected the property prices to increase by 10% and more.

The quarterly structured questionnaire survey is conducted among senior executives of REDAS member firms. RESI measures the perceptions and expectations of real estate development and market conditions in Singapore. RESI comprises a Current Sentiment Index and a Future Sentiment Index, tracking changes in sentiments over the past and the next 6 months respectively, and a Composite Sentiment Index which is the derived indicator for the current overall market sentiment.

The real estate market sentiment has broadly improved over the last 6 months but it remains to be seen if the impact of stronger Singapore Dollar and the higher interest rates will have any meaningful impact going forward, id sime survey respondents.

https://www.icompareloan.com/resources/property-prices-increase-income-gap/

Others felt that the “property market is generally in a buoyant mood in view of the rather healthy economy which boosts the office sector. There are pent-up demand for residential properties from those waiting on the sidelines and those who are selling their existing properties in en bloc transactions.”

Some other survey respondents added: “Recovery in office take up, residential sales (enbloc) and economic positivity have helped lift the market in recent quarters. However, the uncertainty over trade war and interest rate movement continue to weigh down sentiments. Net effect is an improvement in condition and pace of improvement likely to remain steady, unlike the exuberance in prices of high end residential segment during 2005-2007, which was spurred by the influx of foreign buyers and limited policy intervention.”

https://www.icompareloan.com/resources/en-bloc-mania-trade-war/

Survey respondents however felt that keen competition is driving steep increase in land prices, but home price might not rise fast due to cooling measures still in place. Developers’ margin might be squeezed. Most local developers are competing for land to remain their development pipeline and keep their businesses intact. While many have ventured into other markets, they would still compete for land stock here to maintain their market presence.

—

To read up more on property buying in Singapore to know what is noise and what is real. Or click here for the Ultimate Guide on Property Buying in Singapore.

Read about the En bloc sales process here: