Selling a property may be hard in this market cycle, many home owners who are not in need of cash are resorting to refinancing their home loan. Read more to find out why.

Although Singapore runs a surplus almost every election cycle, this surplus does not include Land sales. Hence Singapore runs a much larger “surplus” than reported in the budget.

While IMF treats Land Sales as Revenues, Singapore’s Ministry of finance treats Land sales as Capital Receipts (Reference 1). What this means is, any land sales is added into Singapore’s past reserves as capital gains/losses.

From Jan 2011 to Sep 2015, just Commercial, Hotel, White, Industrial, Residential (Excluding landed housing) and other sites amounted to some $24 billion in land sales (URA). And this has not yet included land sales from HDB for EC, BTO, DBSS sites.

As Singapore maintains a balanced budget, it is puzzling why there is still a need to release so much land parcels considering that the sales proceeds are not even considered Revenues to balance a budget, but are parked away into Singapore’s reserves.

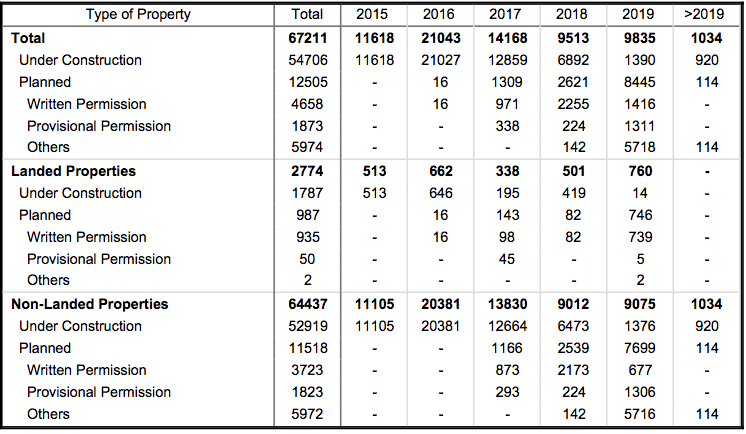

According to URA, there are 64,437 private non-landed units and 2774 Landed Units to be completed between 2H2015 and 2019, based on 2Q 2015 forecast.

Table 1: Pipeline Supply of Private Residential Units, Q2, 2015, Property Market information, URA

Table 1: Pipeline Supply of Private Residential Units, Q2, 2015, Property Market information, URA

On the other hand, actual demand over the past one decade for private non-landed homes averaged only 8,000 units annually, based on the change in occupied stock for non-landed homes.

On a separate note, the pipeline supply is coming on the back of a vacancy rate of 7.9% (25,071 units), 2Q, 2015. Total Stock is 318,524 while Occupied units are 293,453, as at Q2, 2015.

On Sales, between Jan 2014 to Dec 2014, there were only about 8000 units of new sale Private residential units being transacted and subsale of 500 units (including EC).

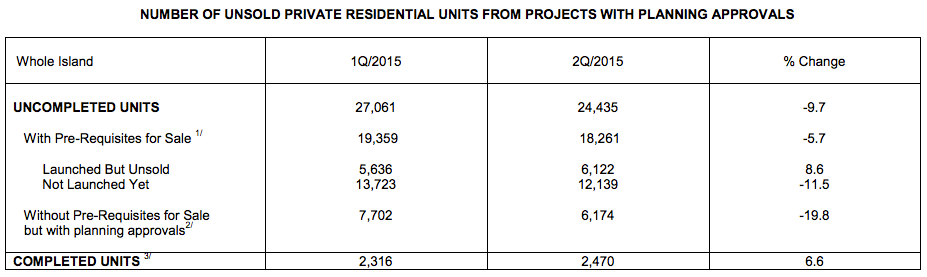

As at 2Q, 2015, there were some 24,435 units of unsold uncompleted residential units versus 64,437 (Non-landed Private residential – Excluding EC), this means there are 40,002 of unsold private non-landed private residential units in the pipeline.

Table 2: Number of Unsold Private Residential Units from Projects with Planning Approvals, URA, 2Q 2015, URA Annex B-1

Table 2: Number of Unsold Private Residential Units from Projects with Planning Approvals, URA, 2Q 2015, URA Annex B-1

In short, there are 40,002 unsold uncompleted residential units (Excl EC) competing to be sold.

Table 3: Population Change versus housing stock change (URA, Singstat, Century21, iCompareLoan.com)

Table 3: Population Change versus housing stock change (URA, Singstat, Century21, iCompareLoan.com)

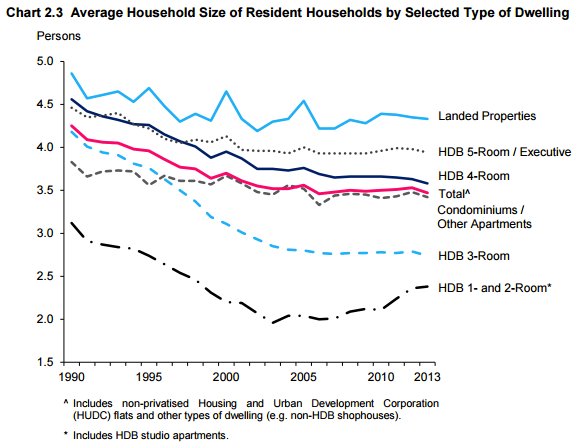

From 2005 to 2014, Singapore’s population increased by 1.3m and housing stock increased by 171,870 units. This indicates 7.58 people per household. This is more than double the average Singaporean’s household size of 3.5 to 3.6 where part of the reason could be attributed to workers staying in dormitories, domestic helpers staying with their employers or room rentals.

Chart 1: Average Household size of Singaporeans and PR households (Singstat)

If we are working on 64,437 units becoming ready from 2H 2015 through 2019. That means an average 15,000 units a year while our current new unit sales trend is about 8000 to 10,000 units. This indicates a possible build-up of unsold units to the tune of 25,000 to 30,000 units in 4 years time. This adds to the already elevated private residential unsold rate.

How many foreigners do we need to fill these units?

Based on 7.58 people per household, 30,000 vacant units will need about 227,000 in population growth (with the same foreigner mix) within the next 3 to 4 years to fill them up, either to rent and stay or simply to buy and stay.

Foreigners will find it costly as Additional Buyer Stamp Duty (ABSD) is punitive at 15% as this will mean substantial cash upfront for a property purchase. Except for the ultra high-income expatriates, the likelihood to save up about ~18% in ABSD and BSD would amount to about $180,000 for a $1m property. It will still take several years of aggressive savings.

Many foreigners will most likely end up renting a place in Singapore, in support of the rental market.

Will Housing Reach Negative Equity levels in 5 years?

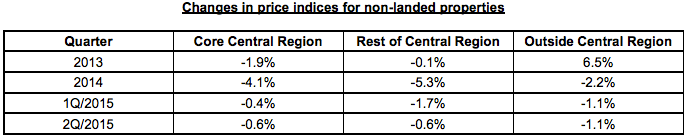

Singapore’s housing prices are gradually dropping at around 3 to 5% a year (Reference 7). Core Central region seems to be holding out quite well compared to Outside Central Region.

Table 4: Price Change in Non-landed Properties, URA (Reference 8)

Assuming an annual price drop of 4% per year and a price drop of 20% in 5 years.

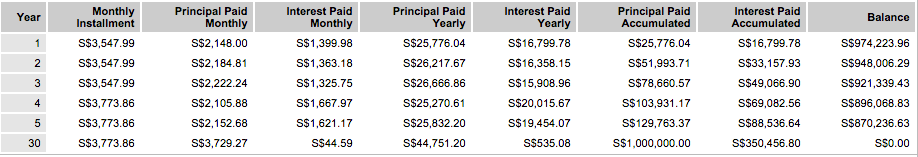

Table 5: Amortisation using 1.7% interest rates for first 3 years. (Assumption: Interest rates is static)

Table 5: Amortisation using 1.7% interest rates for first 3 years. (Assumption: Interest rates is static)

A property bought at $1.25m with a loan of $1m (@ 80% LTV) would be $1m in valuation in 5 years. The loan balance will be ~$870,000 if interest rates stay at the same level. We would have a property valued at $1m and loan outstanding of $870,000. Loan to Value has increased to 87%, but is still not in the dangerous negative equity zone, as long as the economy is not severely impacted and interest rate increases moderately.

Why help the property developers?

While we could argue that developers have themselves to blame for bidding high prices for land only to be stuck with unsold stock. Developers are merely proxy “tax” or “Capital receipts” collectors on behalf of the government who is the largest landlord and controls immigration policies. Perhaps the root cause is the over-eagerness of the Singapore government to release as much land supplies as possible during attractive pricing to fill the reserves while constricting supply at low land prices, when what was needed was a constant and measured supply to smooth out market volatility.

Hence, the priority should be to help Singaporean developers where Singaporeans hold majority shares.

Allow developers to delay their completion of the development without incurring penalty so as to shift some of these property supply to later years in 2017, 2018, 2019 and beyond. Or allow developers to return the land to the government, indefinitely shelf the building plans with a penalty payable based on the number of years delayed or simply cancel the contract outright with a penalty. This would enable developers to cut loss and move out of this difficult situation.

Summary

As the property prices are gradually dropping and rentals are also weakening at the same time due to the choices of properties available, there will be a need to solve the vacancy challenge.

The Singapore government is keen to bring in higher population to solve many problems, but with the weakening economy, employment growth may be muted for foreigners as well as Singaporeans and PR.

At the very least the ABSD needs to be reduced for foreigner as well as for Singaporeans and PR buying 2nd or more property as long as their TDSR meets the guidelines.

As negative equity will not happen in an orderly decline of prices, there is now increased incentive to help the developers to clear some of their unsold stocks via reduction in ABSD for foreigners.

TDSR is a good policy and should stay to ensure financial prudence. However TDSR is artificially reducing demand for property not due to its total debt limitation nature, but due to the huge amount of paperwork submission burden on the property buyer just for the bank to check and comply to TDSR. Such as obtaining car loan statements, credit card statements, etc. Banks and financial institutions do not necessarily print and deliver monthly statements and calling their hotline will set you back by 30mins, printing a statement will cost you $20.

Financial institutions are not helping to provide timely release of statements required for housing loan applications.

Perhaps MAS could coordinate a bureau where such information are shared in a better manner so that banks can check with a central bureau to obtain the information they need instead of burdening the buyers to fulfill onerous paperwork submission. A suggestion could be that a Buyer simply sign an authorization form to a bank to allow a bank to seek the information from the other banks to retrieve the statements, freeing up the burden on the home buyer.

Else MAS could also mandate all financial services providers to provide monthly statements 3 days upon request by customers who require this for bank financing purposes.

TDSR could potentially be relaxed for people with high income or small business owners so as to allow them greater flexibility in leveraging and having access to funds to create employment.

Developers need help too. Going forward, the government could perhaps make known it’s plans in immigration and regulation pertaining any piece of land. By providing more transparency of land parcels to be released 5 years ahead of schedule, the developers will then know the 5 years land supply forecast and bid responsibly. The end consumers will also likely end up with property prices that do not swing so wildly. The government has the Reserves to do it and should not simply constrict land supplies to hold out for the highest prices only to release massive parcels of land when it hit the price sweet spot, as this simply becomes a land tax which ripples across the industries raising business cost and makes Singapore uncompetitive and cost of living unbearable.

The likelihood of selling a property at the price sellers wanted is now remote, perhaps it is better to quickly refinance to a fixed rate packages despite the paperwork.

References: –

- Sale of land is capital receipt, Ministry of Finance

http://www.singaporebudget.gov.sg/data/budget_2014/download/4%20Government%20Revenue%202014.pdf - Stock and Vacancy and Supply in the Pipeline, 4th Quarter 2014

https://www.ura.gov.sg/uol/media-room/news/2015/jan/~/media/User%20Defined/URA%20Online/media-room/2015/jan/pr15-03e1.ashx - Supply in the pipeline, Q2, 2015

https://www.ura.gov.sg/uol/media-room/news/2015/jul/~/media/User%20Defined/URA%20Online/media-room/2015/jul/pr15-39e2.ashx - Supply in the pipeline, Q1, 2015

https://www.ura.gov.sg/uol/media-room/news/2015/apr/~/media/User%20Defined/URA%20Online/media-room/2015/apr/pr15-18e2.ashx - Supply in the pipeline, Q4, 2014

https://www.ura.gov.sg/uol/media-room/news/2015/jan/~/media/User%20Defined/URA%20Online/media-room/2015/jan/pr15-03e2.ashx - HDB land sales

http://www.hdb.gov.sg/fi10/fi10330p.nsf/w/LandDevMangSitesForSale?OpenDocument - Average Household size of Singaporeans and PR households (Singstat)

https://www.singstat.gov.sg/docs/default-source/default-document-library/publications/publications_and_papers/population_and_population_structure/population2014.pdf) - Price Index – Release of 2nd Quarter 2015 real estate statistics

https://www.ura.gov.sg/uol/media-room/news/2015/jul/pr15-39.aspx