Renew COE or buy new car – how to choose?

Paul HO (iCompareLoan.com)

Should I renew COE when my car reaches 10 years old or should I buy a new car? COE is a uniquely Singapore phenomenon. COE stands for Certificate of Entitlement, it is a license that you need to bid for, and it allows you to use a new car on the road in Singapore for 10 years. Without this COE, you cannot register a car to use on the road. This COE cost is on top of Excise duties, Additional registration fees (ARF) and many other fees to use a car in Singapore.

How to Renew COE for my car?

At the end of your 10-year COE, you will have to deregister your car. Alternatively, you can renew your COE for another 5 years or 10 years by paying the COE Prevailing Quota Premium (PQP).

What is a COE Prevailing Quota Premium (PQP)?

It is the moving average of the last 3-months of the COE prices. There are 2 COE bids per month, hence a COE prevailing Quota Premium (PQP) is the average of the latest 6 COE bids.

If recent COE hovers around $50,000, hence COE PQP will also around this figure.

Is it better to Buy a New Car or Renew COE?

We consider the buying of cars into 3 categories: –

• Mass market

• Executive

• Luxury.

Just using COE at $50,000 as a guide, a Mass Market car would fall neatly into $90,000 to $110,000 range while an Executive car would fall within $140,000 to $160,000 range and Luxury cars will fall within $190,000 to $210,000.

Mass market cars around $90,000 to $110,000: –

Picture 1: Honda Vezel

Honda Vezel, Honda City, Toyota Corolla Altis, Toyota Prius, Nissan Alverra, Nissan Juke, Toyota Wish, Chevrolet Cruze, Mazda 3 and several more.

Executive Cars around $140,000 to $160,000 are: –

Picture 2: Toyota Camry

Toyota Harrier, Toyota Camry, Audi A4, Honda Accord, Honda Odyssey, Nissan Teana, Lexus CT Hybrid, Mini cooper convertible, Volkswagen Passat 1.8TSI, Volvo S60 T2, Volvo S60 Diesel and several more.

Luxury cars around $190,000 to $210,000 are: –

Picture 3: Mercedes C-Class

BMW 325, Audi Q5, Lexus E250, Mercedes E200d, C200A, Jaguar XE and many more.

Whether you are buying a New Car or Renewing your COE depends on what is your current car.

For the sake of simplicity, let us compare renewing COE versus buying a new car in the current classification of Mass Market, Executive and Luxury.

So what is the estimated New Car Cost per Year in Singapore?

As the more expensive cars comes with heavier down-payment. Your ARF rebate will not be able to fund your down-payment. Extra cash is needed.

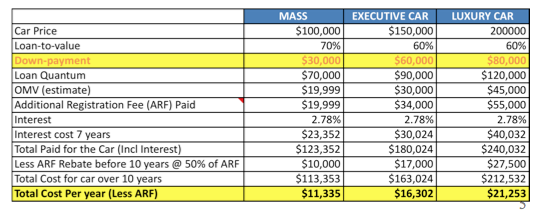

Table 1: Estimated Annual cost of a New Car in Singapore, iCompareLoan.com

Assuming that the down-payment is not an issue, then you are looking at the Total Cost Per Year of: –

• Mass Market at $11,335 per year

• Executive segment at $16,302 per year

• Luxury Car segment at $21,253 per year.

What is the Annual Cost of my Car for renewing COE?

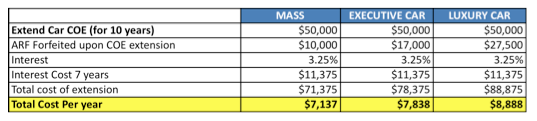

If you renew your COE, assuming COE is $50,000.

Table 2: Annual Cost for Renewing your Car’s COE for 10 years, iCompareLoan.com

The annual cost for renewing the COE for Luxury car is only slightly more than that of a Mass Market Car, whereas when you buy a new car, the Luxury car annual cost is almost double that of the Mass Market car.

What other things to consider whether to renew my Car’s COE?

It makes more sense to renew a luxury car’s COE as the annual cost would be less than half of buying a new one.

The down-payment is one inhibiting factor for many people whether to buy a new car as the ARF rebate is insufficient for the down-payment, this means that the buyer has to fork out cash for buying a new car.

If they extend their COE, 100% COE loan can be obtained.

You should also look at whether a car has been a high maintenance car. If it is high maintenance, then you could look at scrapping it and getting back your ARF for a new car.

Also, check what is your car insurance cost too even if you are not due for COE extension. You could save money by changing insurer.

If you feel that the car loans are too expensive, you could obtain an equity term home loan from your home to pay cash for your car.

Image Credits: Wikicommons