Should You Avoid Frivolous And Multiple AIP Home Loan Applications?

By PAUL HO

Gone are the days when applying for a bank loan is a breeze, thanks to the MAS rules regarding Total Debt Servicing Ratio (TDSR) and stricter lending criteria, especially that clause pertaining to “Proof of Debt”.

What do you mean “Proof of Debt”?

Table of Contents

With TDSR set at 60%, which includes housing loan servicing as well as that of other debt, banks are required to enforce these rules set out by MAS.

The burden of proof of debt is on the banks to make sure that they impose these “Proof of Debt” on potential borrowers. As a result, if your credit report shows that you have several credit cards and if one of the cards shows that payment is not made in full, banks will then require you to print out your credit card statements to ascertain the outstanding loan amount. The banks will then use this amount to impute the minimum sum required by the credit card companies to work out the required monthly servicing amount. This monthly servicing amount affects your TDSR score, and, hence, your total borrowing amount.

How to make sure I have a property loan at hand?

If you are buying a new property, you have to make sure that you have a home loan or commercial loan in hand prior to purchase, just before you make your property buying decisions. This is all the more important especially under the TDSR criteria as many people may not be aware of their financial commitments. These property buyers could easily pay their 1% Option to Purchase (OTP) and then fail to obtain a property loan.

Should you apply for an Approval-in-Principle?

Home loan or commercial loan approval-in-principle (AIP) or some call it In-Principle-Approvals (IPA) are a necessary safe guard prior to committing to a property purchase. They are by no means 100% guaranteed, but they do provide a good indication of borrowing ability.

Why do bad mortgage brokers encourage you to apply for multiple loan applications?

Some mortgage brokers suggest that you should apply for one AIP from one bank first. And sometimes even to many banks at the same time. Generally up to three is considered okay. Anything beyond that is bad in our opinion.

These brokers then suggest that once you have the AIP in hand, you can then try to apply for another few bank loans when you make the property buying decision.

This, on the surface, sounds like a fair statement to protect the consumers. But is it really so?

BAD Mortgage brokers use this technique to lock you into the home loan or commercial loan to protect their interests. We will tell you why this is bad for you.

What will abuse of the Approval-in-Principle process lead to?

Let’s put it bluntly, AIP takes away valuable resources from the banks as it involves huge amount of paperwork. By applying for multiple AIPs, this piles on extra workload on bankers, banks, and, especially more so, credit officers in the banks. Credit officers hold a thankless job, which is both stressful and time-pressing. They are also on the receiving-end of abuses and curses from customers (even though they do not meet them, and, in most cases, are not even allowed to meet with front-end bankers).

By abusing the system created to give you some form of safety by wantonly applying to as many banks as possible for AIP, and subsequently not take up loans from the banks is not simply a matter of fairness. This abuse has led banks to reduce or scrap AIP outright. Some banks have even imposed or considered imposing a fee for AIP.

Credit officers are overworked and hold a thankless job and the bank cannot easily find sufficient credit officers to do all the extra workload.

In the end, such irresponsible behaviour will lead to higher cost for consumers.

What do multiple and excessive AIP and home loan applications lead to?

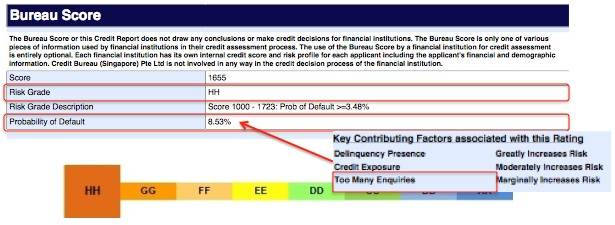

When you make multiple and excessive AIP or home loan applications, each of these applications invoke a “Credit Enquiry”.

According to credit bureau, “Too Many Enquiries” leads to “Marginally Increases Risk” and degrade your credit score.

In Summary

A bad mortgage broker invokes your greediness to take advantage of the system to protect their own commission. They abuse the goodwill of banks, leading to increased costs for consumers.

And worst still, by blatantly making “Too Many Enquiries”, bad mortgage brokers make your credit score worse, demonstrating complete ignorance of credit risks and disregard for your well-being.

You should only apply for an AIP to the top one or two banks that you intend to take up a home loan with after a TDSR analysis.

For advice on a new home loan.

For refinancing advice.

Download this article here.