Singapore Banks hurry to Raise Mortgage Rates

Paul HO (iCompareLoan.com) 15th Dec 2016

Singapore Banks are urgently reviewing Fixed Rate Home loan packages and responding to the Federal Reserve announcement.

As we have discussed previously the close relationship between Interest Rates and capital flow and how that affects Singapore mortgage rates.

Federal reserve raises overnight target rate by 0.25% on 14 Dec 2016 to 0.75% , this causes funds to flow to a higher yielding currency. Hence capital flow or loss of capital from Singapore to the United States or simply USD parked outside of USA.

Loss of funds causes rates to go up, and hence this impacts Singapore’s Sibor rate. Sibor is the market benchmark rate for cost of funds for interbank borrowings.

The rates are moving as we speak.

Why is Fixed Rate cheaper than Sibor Rate home loans?

Anomalies can happen when the market moves while the banks review of packages stay static or irresponsive.

Fixed rate home loans are almost always more expensive by about 0.3 to 0.5% for home loans (residential) and 0.3 to 0.7% more expensive for commercial and industrial properties.

As fixed rate involves the bank’s product department committing to a fixed rate into the future, namely 1 or 2 or 3 or even 5 years into the future, hence there are cost for treasury operations such as hedging costs to lock-in these rates. Read more about Fixed Rate mortgages.

As an illustration: –

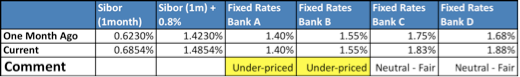

Compared to one-month Sibor + 0.8%, the fixed rates are under-priced one month ago. If the current rate has gone up, this makes the Fixed Rates even more under-priced.

Figure 1: Fixed Rates compared to 1-month Sibor Packages one month ago and current

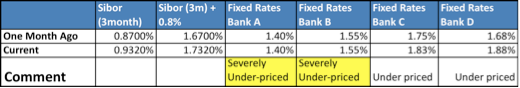

Figure 2: Fixed Rates compared to 3-month Sibor Packages one month ago and current

Fixed rate packages compared to 3-month Sibor packages even appear much cheaper.

There are more than 10 banks in Singapore offering more than 150 home loan packages in Singapore and at least another 50 to 100 commercial and industrial property loan packages.

Often the bank’s management wants to see a clear signal or trend of the interest rate direction before adjustment of packages, such as a major event like a Federal Reserve Rate Hike.

How much time do I have before Fixed Rates are Raised?

The banks normally announce a cut-off date for the package to receive its last application forms. So you only have a few days to act and the savings are in the thousands.

Anomalies happen from time-to-time but they are not very frequent. Just like when you go to the supermarket and see a super good deal for a product and you rub your eyes and could not believe it. Hesitate and someone would just take the last one from the shelve.

If you agree that the Fixed Home Loan Rates being lower than Sibor-package rates, then you only have limited time to secure a Refinance from a Mortgage Broker.

Get an Affordable refinance PROMOTION package, while stocks lasts: –

- 1.5% (Throughout) – Pegged to Fixed Deposit. (More resilient against Rate Hike)

- Legal subsidy of 0.4% of Loan amount (For refinancing)

- Valuation Subsidy (Only in DEC 2016) – Min loan size 750k. (For refinancing)

- Enquire NOW www.iCompareLoan.com/contact