This article has also been featured on The Edge Property

In order to go into the topic of where mortgage interest rates in Singapore are headed, it is important to review the root cause.

Analyst and economist have lamented for years that printing money (also known as Quantitative easing QE) leads to low interest rate and that in turn leads to high inflation.They have been wrong for 7 years in a row. Many newspapers that give headlines after headlines of sensational news of low interest rates leads to inflation have fallen flat for 7 years in a row.

Chart 1: US Inflation rate versus US Fed Funds Rate, (Source: Trading economics)

If you look at the chart of US Inflation rate versus US Fed funds rate, you will see that low interest rates since 2008 till now in 2015 have not led to inflation. In fact, inflation has dropped to almost zero. Therefore low interest rates do not necessarily lead to inflation, it depends on context.

Chart 2: Singapore Core Inflation rate versus Sibor Overnight Rate,

(Source: Trading economics, iCompareloan.com)

In the case of Singapore (Chart 2), apart from the recent spike in January 2015, the low interest rates persisted since 2009 and inflation spiked at about 3.5% and then dropped to almost 0 recently. And instead of rising inflation rate, inflation was in fact falling.

For a country with a large domestic economy such as USA (Chart 3), one of the key leading indicators for inflation is unemployment rate and disposable income growth. A low unemployment rate usually leads to strong income growth and hence inflation. Hence it is income growth that eventually leads to inflation.

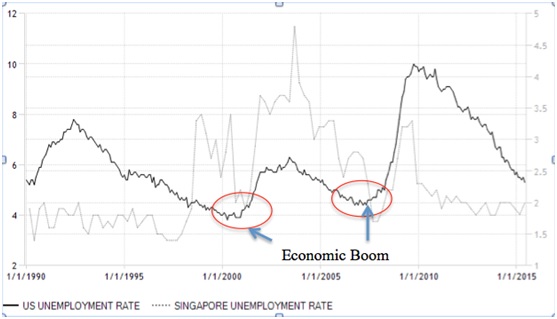

Chart 3: US Unemployment Rate versus Singapore Unemployment Rate,

(Source: Trading Economics, iCompareLoan.com)

The US unemployment rate is now 5.3% (Note: Part of US full employment figures could potentially be skewed by election spending in the USA). The past economic booms correspond to unemployment rates of around 4% to 4.5%. Hence the US is approaching “full employment”. However income growth has been soft, coupled by softer crude oil prices, inflation remains soft.

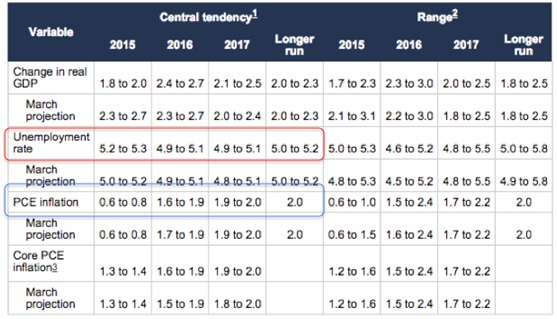

The Fed adopts a policy stance of Maximum employment and medium range inflation target of 2% (Reference 1).

Weak global growth is evident when China further reduced its interest rates to 4.85% to stimulate growth. So the real issue is really one of deflation or low inflation, not inflation.

Why are we talking about other countries when we talk about Singapore mortgage interest rate trends?

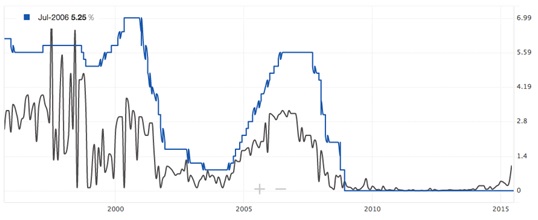

Singapore’s Sibor overnight rate closely corresponds to the US Fed funds rate. An increase in the Fed overnight funds rate will likely be follow suit by Singapore.

Chart 4: US Fed Funds Rate versus Sibor Overnight rate,

(Source: ieconomics, iCompareLoan.com)

Federal Reserve Forecast

Table of Contents

Table 1: Federal Reserve, 16-17 Jun 2015, Minutes of FOMC

Based on Table 1, Federal Reserve’s unemployment figures for 2015 is achieved. Their view is balanced between generating further employment and maintaining inflation.

Exchange Rates Movement

Singapore is a small economy with a large external trade, so it makes sense to control exchange rates against its major trading partners to moderate imported inflation.

• SGD is weakening against the USD

• SGD is strengthening against the EURO

• SGD is strengthening against the YEN

Volatile exchange rates often leads to loss of confidence and leads to exodus of funds.

If you are a hedge fund manager holding a currency that is expected to weaken 5% in a year, while only earning 1% deposit interest rate, would you be tempted to switch out of this currency? Would you be less likely to move your money if interest rateis higher?

The Federal Reserve is likely to raise interest rates in 2H, 2015. Therefore smart money has already moved into the USD in anticipation of both the US economic recovery as well as the better yield (deposit rates). In order to prevent exodus of funds to the US market, Singapore’s regulators may have to act preemptively themselves or via proxy to raise interest rates. (Although they are not known to intervene in rates)

Deposit Rates already higher than Sibor

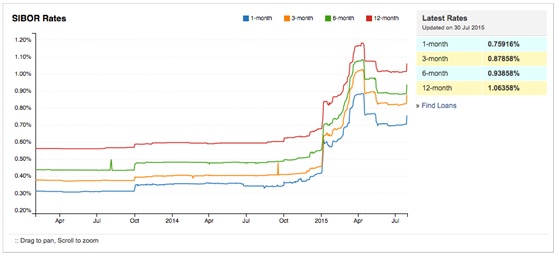

Several banks are offering fixed deposit rates (24 months) at 1.8 to 1.95% and 10 month fixed deposits at around 1.5% while Sibor (12 month) is only about 1.06%.

Chart 5: Sibor Rates, iCompareLoan.com

There is a discrepancy in rates between Sibor (12 month) and Fixed Deposit rates. Even though these are promotional deposit rates, what this means is that the banks see interest rates rising and are starting to lock in deposits in anticipation of rising interest rates.

Singapore Savings Bond – Singapore Heavily in Debt

The Singapore Savings Bond is schedule for release in 2H, 2015. The initial tranches are for 1 to 2 billion dollars. The offered interest rate is about 2.5% (if held to maturity of 10 years). The amount being raised is still insignificant relative to the overall deposits. Nonetheless it is worrying that Singapore is borrowing so much despite being one of the world’s most indebted nations at Debt-to-GDP ratio of 382% (Reference 2). A large part of Singapore’s debt is owed to the CPF (Reference 3). Savings Bond is unlikely to affect Singapore’s interest rates in the short term due to the small tranche. This is nonetheless a worrying trend in the longer term when the tranches gets bigger, sucking up more funds and impacts interest rates, regardless of Singapore’s government’s strong asset balance sheet and ability to pay.

Chart 6: McKinsey, Debt and Not Much Deleveraging, http://www.mckinsey.com/insights/economic_studies/debt_and_not_much_deleveraging

Summary

We expect benign inflation and moderate growth in Singapore coupled with near “full employment” in the USA at 5.3% while inflation is close to 0% (due in part to low crude oil prices).

Global weak growth and a deflationary environment lead many countries such as China to reduce interest rates.

The Federal Reserve policy stance is for “Maximum employment” and 2% inflation target rate, hence it can wait a while before raising rates as long as inflation stays low. At a rate of ~0.1% drop in unemployment a month, by November it should fall below 5% at current trajectory and the Fed may be tempted to raise Fed Funds target rate by 0.25% to 0.5% as a precautionary measure.

Singapore’s interest rates should also start to rise considering the weakening Singapore dollar and correlation to the US Fed Funds rate. Singapore’s deposit rates being higher than Sibor also point to an increasing interest rate environment.

While many factors are at play, we foresee a moderate increase of 0.20% (lower range) to 0.75% (top range) in Sibor rates. Currently Sibor (1m) is at 0.76%, at the end of the year we estimate that it could end up at between 0.95% to 1.5%.

References: –

1. Federal Reserve Policy Stance, http://www.federalreserve.gov/newsevents/press/monetary/20150729a.htm)

2. McKinsey, Debt and (Not much) Deleveraging, http://www.mckinsey.com/insights/economic_studies/debt_and_not_much_deleveraging

3. Ministry of Finance, Excerpt; “CPF monies are invested by the CPF Board (CPFB) in Special Singapore Government Securities (SSGS11) that are issued and guaranteed by the Singapore Government.”

http://www.mof.gov.sg/Policies/Our-Nations-Reserves/Section-IV-Is-our-CPF-money-safe-Can-the-Government-pay-all-its-debt-obligations

What does iCompareLoan.com do?

www.iCompareLoan.com is a Loan Portal and a Mortgage & Loan broker, helping property buyers and home owners to get the best fit home loan and business owners obtain Business loans for business expansion.

Home Loan Report ™ is Singapore’s first Cloud based Home Loan Report ™ platform to be used by Property agents, financial advisors as well as other Mortgage brokers to prepare reports for their customers.

Home Loan Report ™ – Enterprise allows a property agent’s website to immediately add a loan section. Improve your Google Ranking, let’s viewers increase Time-on-site. Property or Finance sites that deployed Home Loan Report ™ – Enterprise loan section sees viewers stay on their site longer by between 30% to 350% after 4 to 8 weeks of installing the Embedded Loan Plugins.

About PAUL HO:

Paul holds an a B.Eng(Hons) Aberdeen University (UK) and a Masters of Business Administration (MBA) from a Macquarie Graduate School of Business (MGSM) Australia. He also serves as current President of Macquarie University Alumni Association of Singapore and Hon. Secretary of British Alumni.

He is founder of www.iCompareLoan.com, his articles have been syndicated/featured on STproperty, iProperty, BTInvest, TheEdgeProperty, Propwise, Propquest, Yahoo and TheOnlineCitizen amongst many other sites.

He has also given speeches, guest speeches, trainings and/or seminars at NUH Lunch time talk, iProperty, David Poh and Associates, Getty Goh’s Ascendant Asset property, NTU (Guest Lecture on SEO), Panel discussions at GPS Alliance, C&H, Skillup just to name a few.

He is passionate about helping people enhance their wealth and in making money work harder for them.

Copyright © – www.iCompareLoan.com

For advice on a new home loan.

For refinancing advice.

For advice on a personal loan.

Download this article here.