Colliers Research reports a strong momentum in the second half of the last year suggesting Singapore property investment recovery to pre-pandemic levels in 2021

- Singapore property investment sales’ volumes to recover to pre-pandemic levels in 2021

- Commercial assets’ volumes grew 8.8%, making up 52% of 2020 transactions

- Shophouses are the only other sector to grow in COVID-struck 2020

- Residential investment sales to recover in 2021 as GLS and en bloc sales reboot

- Positive long-term growth for Industrial investment sales despite a 9.3% fall QOQ

Colliers International has published its latest market research report which examines the performance of Singapore property investment in Q4 2020 and its prospects ahead.

Colliers Research reports a strong momentum in the second half of the last year showing resilience with Singapore property investment sales in Q4 2020 trebling quarter-on-quarter (QOQ) and doubling year-on-year (YOY) to S$14.4 billion mainly on a REIT merger.

Mr Jerome Wright, Senior Director of Capital Markets at Colliers International, said, “2020 is the year of two-halves as we see investment sales at SGD18.6 billion in the second half, making up three-quarters of the full year of S$24.7 billion, signalling strong momentum going into 2021.”

Q4 2020 has seen a strong rebound, and Colliers expects 2021 volumes for Singapore property investment to recover to pre-pandemic levels, supported by Singapore’s safe-haven status, pro-business environment and economic growth.

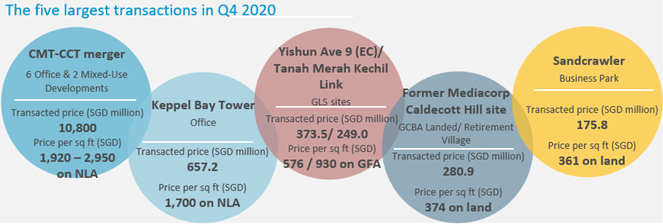

The largest commercial deal during Q4 was CapitaLand Mall Trust acquiring CapitaLand Commercial Trust’s six offices and two mixed-use developments for SGD10.8 billion in a merger of equals. Keppel REIT also acquired Keppel Bay Tower for S$657 million.

Ms Tricia Song, Head of Research for Singapore at Colliers International, said, “Residential also saw more activity after a pause in Government Land Sales (GLS) due to COVID-19, with two sites awarded in Q4.“

COMMERCIAL

According to Colliers, commercial investment sales in Q4 surged 228% QOQ and 509% YOY to SGD8.69 billion, mainly due to CMT acquiring CCT’s six office and two mixed-use developments on their merger.

Mr Wright added, “According to our recent Colliers Global Capital Markets 2021 Investor outlook, Offices in key regional centres, including Singapore, are a key area of focus for regional investors, with the pandemic seen as likely to accelerate a shift towards higher-quality assets that meet rising demand for health and sustainability.”

RESIDENTIAL

Residential investment sales in Q4 jumped 92.6% QOQ and 94.2% YOY to SGD1.97 billion, mainly on the revival of public and private land sales, including two collective sales said Colliers. It noted that FY 2020 volume fell 23.6% to SGD5.25 billion on fewer public land sales awarded and luxury apartments sold due to COVID delays.

Steven Tan, Senior Director of Investment Services at Colliers International, said: “With strong developer sales and a depleting pipeline, we expect private land sales via en bloc and collective sales to recover in 2021.”

INDUSTRIAL

Colliers obsered that industrial investment sales fell 9.3% QOQ in Q4, supported by two major business park transactions – Sandcrawler and former Big Box. FY 2020 transactions fell 43.3% YOY to SGD2.3 billion, as 2019 saw larger REIT acquisitions such as Mapletree Business City II.

Mr Tan added, “We see positive long-term growth as investors seek warehouses, data centres and hi-specs space to leverage growing e-commerce and technology trends.”

Another report by CBRE Research Singapore Real Estate Market Outlook 2021 says Singapore property investment recovery will gain momentum in 2021. According to CBRE’s research, the Singapore real estate market recovery is expected this year, albeit uneven across sectors, as the city emerges from the pandemic-induced disruption of 2020.

The gradual Singapore real estate market recovery over the next 12 months is underpinned by a possibly extended low interest rate environment, as well as the government’s continuous efforts to reinforce its status as a regional trade hub.

Mr Desmond Sim, CBRE’s Head of Research, Southeast Asia, says, “With the pandemic contained locally and access to vaccination secured, brighter prospects are expected for the local economy towards the latter half of 2021, led by the service and construction sectors. Nonetheless, as the global COVID-19 situation remains volatile, recovery is likely to be bumpy and uneven.”

Mr Sim continues, “To facilitate Singapore’s economic recovery, the Monetary Authority of Singapore is likely to retain its accommodative policy stance in 2021, keeping interest rates low. The extended low interest rate environment will increase the attractiveness of commercial real estate in Singapore, especially those that can provide stable returns. What’s more, as Singapore continues to establish itself as an aviation and distribution hub, logistics demand is expected to remain healthy.”

The CBRE Research noted that investors will realign strategies:

- While investors remain cautious, with ample liquidity in the currently low interest rate environment, they will be in search for investments that can provide them with higher returns, but now with stability and value also top of mind.

- Investors prefer asset types that have been less affected by the pandemic, such as office, industrial and residential; sectors which have been proven to provide dependable and durable income streams.

- Healthy demand for homes expected in 2021 would reduce unsold inventory, which could revive developers’ appetite for land, starting with smaller sites, and drive a nascent recovery for the residential collective sales market in 2021.

- Barring any unforeseen circumstances, CBRE forecasts that investment sales volume in 2021 is likely to rebound by 30% from S$11.299 billion recorded in 2020.

CBRE Research added that residential will resume momentum:

- Encouraged by 2020’s sales performance, developers are likely to capitalize on the sales momentum to clear remaining project inventory this year.

- The market continues to be driven by units at an affordable quantum. CBRE Research expects the quantum size for new sales transactions to continue to widen, as price sensitivity is likely to decrease with the aid of low interest rates.

- CBRE Research forecasts that the Private Residential Property Index will continue to edge up and may achieve a 0% to 2% growth in 2021.